KOHO Review

In partnership with KOHO

Table of Contents

About KOHO

We all hear about how important it is to spend if we want to keep the economy afloat. The problem is that sometimes we don’t have the money to spend to support the economy, which leads to a chicken and egg problem: a better economy promotes more spending, but more spending strengthens the economy. Oh, what are we to do?

Here’s an option. You can pick up a KOHO card and earn unlimited instant cash back. It’s an account made by Canadians for Canadians to help them spend and save with more freedom and security. More than 800k Canadians already hold one, and the brand has more than 21k Instagram followers.

But what does KOHO do that’s earned them praise from Bloomberg, Forbes, and Global News, among other publications? Allow my KOHO review to tell you all that. You’ll find out about how the card works, what benefits it comes with, what customers have to say about it, and more.

Why You Should Trust Us

Our mission is to help you make better, more informed purchase decisions. Our team spends hours researching, consulting with medical experts, gathering insight from expert professionals, reviewing customer feedback, and analyzing products to provide you with the information you need.

Overview of Kokoon

To put it simply, KOHO is an account that’s free to make that grants you unlimited instant cash back and the opportunity to earn interest.

There are a bunch of benefits that come with KOHO, many of which young people will find attractive as they can help you plan for a better future.

A KOHO account can help you rebuild your credit score, generate interest on your spending and savings, and get cash back on regular purchases.

I’ll cover more of those details later in my KOHO review after presenting you with some of the highlights that come with the service.

Highlights

- Pre-paid Mastercard with perks

- Can be used anywhere that Mastercard is accepted

- Monthly interest payments

- Users don’t pay monthly credit card surcharges

- Unlimited instant cash back that can be cashed out at anytime

- Uses money you already have rather than credit loans

- Trusted by almost a million Canadians

KOHO Account Review

The KOHO account is the main hub. It’s where you store your money to spend or save to earn cash back or to accrue interest that you can later collect.

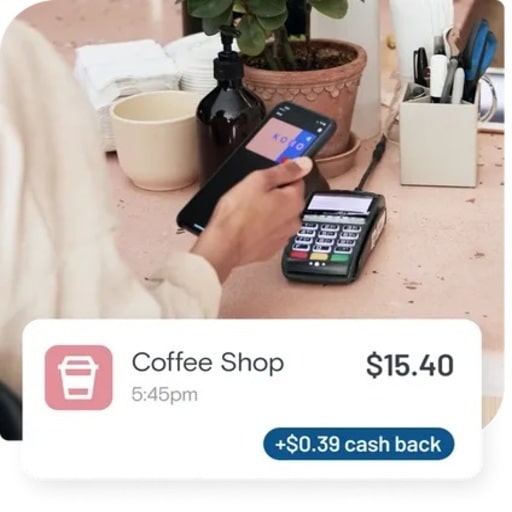

One main advantage of the service that everyone reading this KOHO review must’ve picked up by now is that users can earn unlimited instant cash back on all of their purchases.

In fact, for free account KOHO Easy, they earn 1% cash back on groceries, billing, and services, which may not seem like much, but it stacks up quickly if you use it regularly.

Additionally, you can receive up to 5% extra cash back if you shop with one of the brand’s partners.

All the money in your account is stored by Peoples Trust and can generate a minimum of 0.5% saving interest. This protects your money if something unfortunate were to happen to KOHO.

KOHO App Review

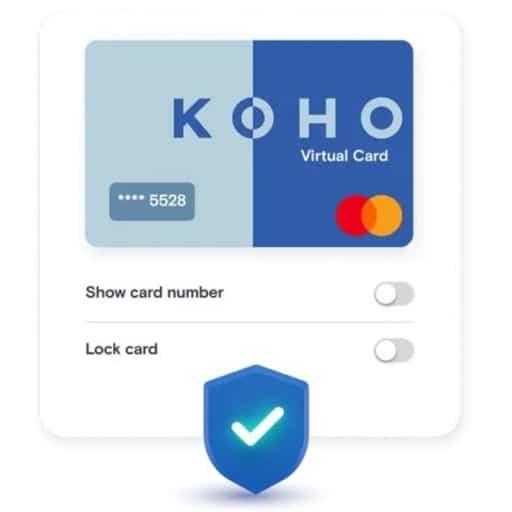

The KOHO app is the perfect companion to your KOHO account. While your account is based around earning you money and keeping it safe, the app is a budgeting tool that measures your spending, allows you to instantly cash out, locks your card to prevent more purchases, and more.

The app makes it so much easier to keep track of your spending and fully take advantage of the card’s perks.

How Does KOHO Work?

Surprisingly, this may be the most straightforward segment of my KOHO review. KOHO is an account you add money into through direct deposit via work paychecks, transferring money through your Mastercard debit, or e-transferring from your bank account. From there, you just spend as you normally would and reap the rewards.

The other nice thing is that KOHO cards run like regular credit card transactions because they run on the Mastercard network.

Who Is KOHO For?

KOHO is for Canadians who want more control over their money and want to be rewarded for their smart spending.

KOHO Reviews: What Do Customers Think?

What do customers have to say about KOHO after using the card for a while? Here are some overall KOHO review scores I found from various websites:

- Apple App Store: 4.8/5 stars based on more than 60k reviews

- Google Play Store: 4.6/5 stars based on more than 49k reviews

- Google Reviews: 4.2/5 stars based on more than 990 reviews

- Facebook: 3.3/5 stars based on more than 330 reviews

The majority of KOHO reviews came from folks who enjoyed the security that came from KOHO’s lack of fees. One user wrote:

“This bank has offered me so much financial comfort and has helped reduce the stress of having to stretch finances between paycheques. And with setting up direct deposit I noticed that GST and child tax deposit an entire day (or sometimes DAYS) earlier than the official cheque issue dates, which is a total lifesaver for lower-income families.”

Others enjoyed the money they earned through making purchases with their KOHO card because it made them feel a bit safer when buying goods. As one KOHO reviewer said:

“KOHO is amazing!! In the year I’ve had this account, I’ve earned more cashback than I’ve ever earned with a traditional bank. I love the fact they offer early payroll and do not charge you for early access to the money. And another bonus is you don’t have a charge every month like banks charge every month. No more banking fees with KOHO.”

On CreditCardGenius, KOHO was awarded 4.3/5 stars by 14 users. One said, “Perfect, it’s a secure credit card but it’s perfect for saving.”

While some customers were disappointed that certain retailers in Canada don’t accept KOHO cards (thus preventing them from earning benefits of the cash back features) overall, there’s a great response from users who feel that their cards are beneficial, safe, and convenient.

And speaking of convenient, that’s how one Facebook user described KOHO’s customer service. Their review read:

“The customer service chat is pretty quick at responding, and always super friendly and informative.” Others aren’t big fans of the fact that KOHO’s main line of communication is through a chatbot, but based on the abundance of positive reviews, it’s apparent that so many more feel differently.

Is KOHO Legit?

KOHO is definitely legit. They are also partners with Mastercard which means they are trustworthy.

Is KOHO Worth It?

Judging from the thousands of positive ratings I found during this KOHO review, it’s clear that the company is loved by users. Offering advanced features that enhance safety, help you build credit, and earn you money, it’s so much more than just another card in your wallet, it’s a smart financial tool.

KOHO Credit Building

For the low cost of $10 a month (that’s as much as I spent on coffee while writing this KOHO review for context of how low it is), you can subscribe to the KOHO Credit Building program. It follows a three-step process to help you get your credit score back in order:

- After signing up, KOHO opens a credit line dedicated to helping you improve your score.

- You make monthly payments.

- Payments that you make on time will help you improve your credit score.

“After years of bad financial dealings along came KOHO… now I am finally rebuilding my credit. Thank you for doing what others can but have not. Giving individuals like myself a second chance.” wrote one customer.

KOHO Careers

Currently, there are more than 20 positions available at KOHO. They are all remote but the company’s base is in Toronto. They offer a clear purpose to improve finances for all Canadians as well as a competitive salary, training allowances, and a strong value-based mindset.

That’s likely why they’ve been listed as one of the best places to work in Canada for the past two years and as one of the best-start-up companies on LinkedIn.

Where to Create your KOHO Account

You can sign up for a KOHO account for free on their website, www.koho.ca.

FAQ

Who owns KOHO?

KOHO’s founder Daniel Eberhard owns the company to this day.

How old do I need to be to use KOHO?

To be eligible to use KOHO, you must the age of majority at the very least in whichever province you reside. For the most part, this is either 18 or 19 years old.

What type of account is this? When is Interest Paid?

The KOHO account is a cash brokerage account. As soon as you place money into the account it begins to accumulate interest, meaning it grows as soon as you water it (if it were a plant).

Although KOHO calculates interest daily, it only pays it out once a month. All payments are made on the 5th of the month and will deposit your interest for the previous month. That means that, for example, the interest you receive on February 5th will be from what you generated in January.

Can I use my KOHO card in the United States?

Thankfully, you can use your KOHO card in the United States.

How to Contact KOHO

You can either chat with KOHO in their app or send them an email at [email protected]

Check out some of our recently published articles you might enjoy:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review