Klarna Review

Table of Contents

About Klarna

Have you ever fallen in love with a product, whether it was a piece of furniture, makeup, or device, only to discover that the price was a little more than you were looking to spend at that moment?

Designed to make shopping experiences smooth and simple, Klarna offers users the ability to buy what they love now and pay for it later. There are three ways to use the benefits this brand has to offer: the app, browser extension, or credit card.

Offering a convenient and accessible way to shop, Klarna has amassed an impressive following of 529k on Instagram and 196k likes on Facebook. It has also been featured on popular media outlets like Forbes Advisor and GQ Magazine.

Interested in finding out more about all the different ways you can finance your purchases? Stay tuned to my Klarna review. I’ll be your guide through the brand, its methods, how it works, and the different perks to help you decide if it’s worth the try.

Overview of Klarna

Klarna Bank AB, known as Klarna, is a Swedish company that provides financing services such as payments for online and in-person purchases, direct payments, and post-purchase payments.

The brand was launched in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson, who had a vision for “making online payments easier and safer, both for consumers and retailers.”

Today, the company is based in Columbus, Ohio, with offices in New York City and worldwide availability. It boasts 147 million active customers and 2 million daily purchases, demonstrating that it is a trusted payment platform.

While it began as a browser extension for certain brands, Klarna is now also available as a credit card and app, making every purchase simpler and streamlined. But we’ll get into those details later.

Now that we know a little more about the brand and its origins, my Klarna review will delve into some of the key highlights to keep in mind.

Highlights

- Buy now, pay later with Klarna payment plans

- Available as a browser extension, app, or credit card

- It can be used at any store, in person or online

- Multiple different payment plans available

- Extra perks like order tracking and notifications of in-stock items

- No interest

- Hassle-free returns

- Rewards program

- Available worldwide

- For users 18+

Klarna offers one simple thing: an easy way to finance your purchases, interest-free. But, there are a number of different ways to shop to suit your specific needs, including an app, credit card, and browser extension.

Below in this Klarna review, I’ll spill the beans on how all the different methods work, what perks they offer, and what may be the best option for you.

Klarna App Review

The Klarna App makes shopping easy. When you’re looking to purchase a few items online, you can split your purchase into 4 interest-free payments.

Here’s an example: if your purchase costs $200, you will pay $50 at checkout. The three remaining $50 payments would each be billed to your debit or credit card, depending on the option you chose, every two weeks until you have paid the complete $200.

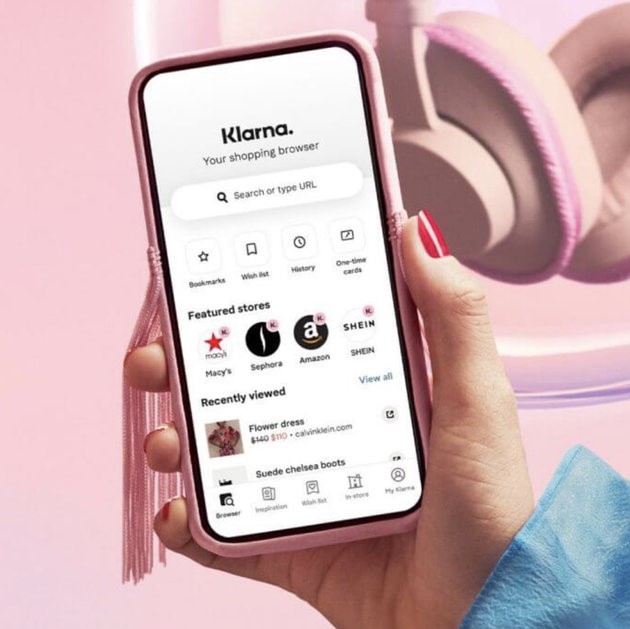

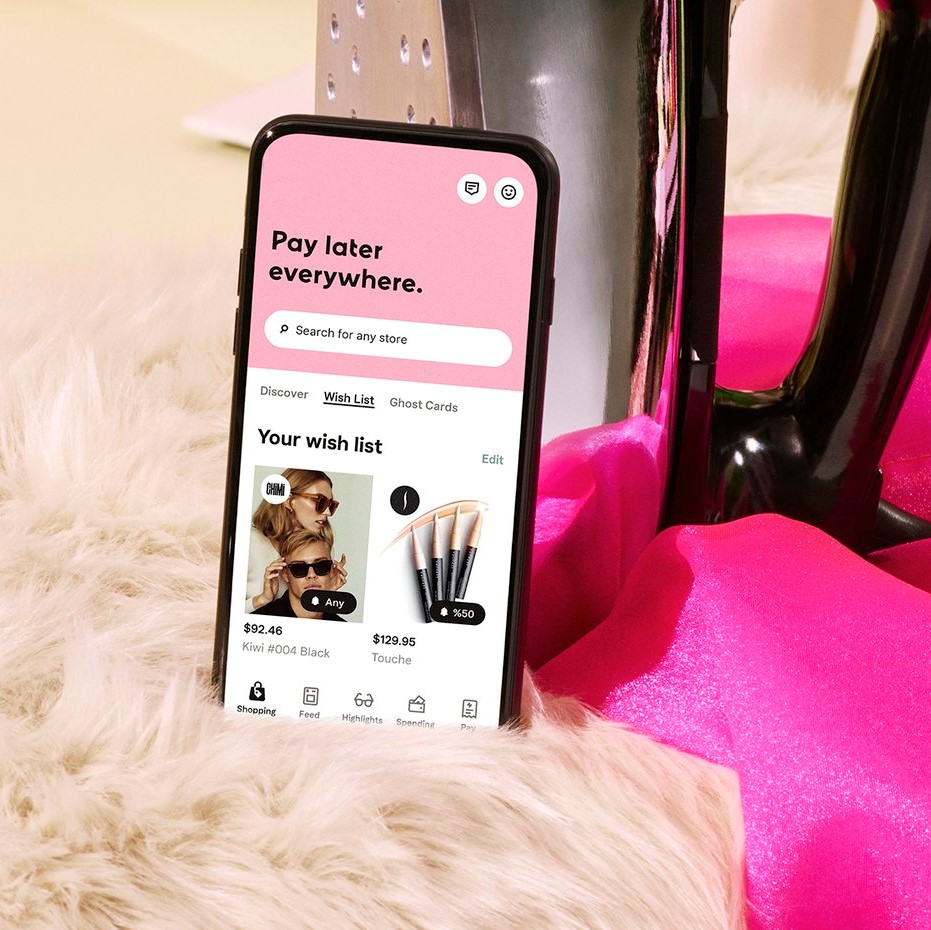

Essentially, users can log into the app, browse for brands and products they like in the Klarna stores section, and add them to their cart. On top of that, the app will alert you of price drops, discounts, and even when items are back in stock.

On top of that, the Klarna app will take note of what you’re interested in and begin developing a list of curated recommendations, so you’ll always find pieces you love.

The Klarna app also helps you get more value from every dollar you spend. With the rewards program, you can earn points and gain access to exclusive deals to save on your favorite brands.

Plus, you’ll get a $5 welcome reward as soon as you complete your first purchase as a member. After that, with every dollar you spend, you’ll earn points that you’ll be able to redeem for discounts and products.

You can also use the app to track orders so you can keep all the important info in one place. And if you need to make a return? No problem–simply log into the app, click “report a return,” and your payment will be halted and refunded.

The best part of the Klarna App? It’s completely free to use! You can break up your payments, find ways to save, and organize your purchases, all at no cost to you!

How Does Klarna Work?

With all that being said, you may still be wondering, “how does Klarna work?” The “buy now, pay later” motto is appealing, but it helps to know what you’re signing up for.

Essentially, you can pay later in 4 interest-free payments across all Klarna stores (brand partnerships) using the app. This means that your purchase will be split up into three smaller payments across six weeks without any interest or damage to your credit.

You can scroll through your favorite shops like Sephora, Adidas, and H&M. Alternatively, you can browse through different sections, such as home, makeup, or clothing.

But Klarna offers more than just an app! There is also a browser extension that allows you to do the same thing. You can either download it onto your computer/browser or click the “checkout with Klarna” button at participating stores.

This way, you don’t just have to browse through the list of Klarna stores, but you’ll also be able to “pay in 4” at any online store. Plus, you can still log in and keep track of your payments and purchases in the app.

While Klarna is an alternative to credit, it also offers a credit card. Essentially, you can shop anywhere Visa is accepted–online, in-store, at home, or abroad–regardless of whether a retailer offers Klarna.

You can add the card to your Apple Pay and Google Pay in order to make contactless payments in-store. Each card has a specific payment plan to help you keep track of your expenses. Interested in the Klarna card? Join the waitlist here.

There are also different financing options available so you can make larger purchases. Whether you’d like to pay sooner or later, organizing your payments is easy. Here are the options:

- Pay in 4: pay four equal installments, due every two weeks, with no interest

- Pay in 30: pay nothing for 30 days, then pay the entire balance with no interest

- Financing: pay with a loan for up to 36 months with interest rates between 0%-24.99%

Klarna does not approve 100% of all orders in order to reinforce responsible, ethical, and sensible spending habits. It’s also worth noting that while there is no interest, fees may accrue if you do not make your payments on time.

Here are a few things to keep in mind about how Klarna works:

- With the pay in 4 option, Klarna runs a soft credit check which does not affect your credit

- With financing options, Klarna may run a hard credit check which will be reported to the credit bureaus

- There is never any interest if you pay in 4

- You may be charged a late fee of up to $7 if you miss a payment

- It can be used online or in-store

Overall, Klarna is quite simple in terms of operations and payments. The three different methods ensure there’s something that is convenient and works with your personal needs.

Who Is Klarna For?

If you’ve ever fallen in love with a piece but not the price, Klarna makes it easy to set up a payment plan that works with your budget but still allows you to purchase items you love. It makes shopping easy and flexible, helping you develop sensible spending habits and feel good about what you buy.

Contrary to what you might think, Klarna can also be used for those large in-store purchases, too. So if you want to purchase something and be able to use it right away, you can use your Klarna credit card!

In other words, you’ll be able to break up the payment and experience the joy of having the product immediately.

Also, Klarna is ideal if you’re waiting for payday to purchase something. You can simply buy it now, set up a payment plan, and then pay in full once you receive your funds!

Klarna Reviews: What Do Customers Think?

So far, we’ve covered a lot of ground, detailing Klarna’s financing methods, how they work, and how they can benefit you. The brand boasts an impressive following and a vast number of users, not to mention the fact that it’s available worldwide at virtually every and any store.

But is it really worth all the hype? For this Klarna review, I turned to what its users have to say to find out. So, we sourced comments from Trustpilot, NerdWallet, and Better Business Bureau.

Starting off strong, Klarna earns an impressive rating of 4.4/5 stars out of a whopping 148,272 reviews on Trustpilot. One customer shares that the company is a great option around the holidays, helping them make good purchasing decisions and buy their loved ones a few special presents:

“Klarna has been there for me when I’m tight on money during Christmas. Words can’t express how thankful I am especially being a single parent.”

Another shopper notes that Klarna helped with their stress levels, and they also admired that it was easy to use anywhere, as well as convenient and accommodating:

“When there’s a problem or just simple questions it gets handled quickly. I recommend everyone to take full advantage of this gift we were blessed with because the 4 payments gives more than enough time to definitely get it paid with smaller payment I know my stress level went down!”

Klarna helped another customer through hard times, ensuring their credit wouldn’t be impacted, and they could have access to things they needed:

“Klarna understood that I’m having a financial hardship due to medical reasons. My agent was very caring and understanding. Quickly found the best options for me to ensure I dont fall in a bad standing.”

And they’re not the only ones. Check out this testimonial from someone who fell on hard times during the pandemic:

“I had a financial difficulties due to being ill and the person I chatted with was soooo helpful and nice and solved the problem was Soo worried about I would recommend klarna to anyone.”

Another user describes Klarna as accommodating and easy to use, writing:

One shopper also says that returns are hassle-free, stating, “I really like that I can split payments, also unlike similar companies, I’ve never had an issue with my refund when regarding returns or cancellations.”

Another patron, a self-professed “loyal customer,” had nothing but good things to say, noting the perk of the rewards program:

“I really like that I can split payments, also unlike similar companies, I’ve never had a issue with my refund when regarding returns or cancellations. Please keep up the great work.”

On NerdWallet, the reviewer shares that Klarna is an ideal option for “anyone who needs to buy a big ticket item, is new to credit and does not qualify for a credit card, has a credit card without a high credit limit, or wants a BPNL plan that earns rewards.”

On Better Business Bureau, the brand receives an A+, showing off its excellent customer service skills. There are a fair number of complaints on the BBB, but Klarna has shown to be very responsive and making sure everyone goes home happy.

That being said, a couple of shoppers report an issue with the fact that Klarna offers small loan amounts. But the company does this for one simple reason: to help you make purchases that are within your means, and therefore inspire you to develop healthier spending habits while still being able to enjoy things you love.

Overall, Klarna is known for making bigger purchases feel more manageable, offering an ideal alternative to credit. And with many different financing options and ways to pay, there’s something for everyone to feel comfortable using,

Is Klarna Worth It?

With Klarna, there is no catch. You won’t have to pay any extra fees, stress about overspending, or pay a huge bill all at once. It’s the ideal way to finance, budget, and develop spending habits that are easy to keep track of.

The company also offers a rewards program for extra savings, an app that helps you track orders and notifies you when items on your wishlist are back in stock, as well as hassle-free returns. Plus, it’s completely free to use. So, it’s really all perks.

With all that being said, it is always important to be mindful of how purchases can add up and that budgeting is still essential.

And Klarna supports this, demonstrating a commitment to helping customers make ethical and sustainable purchases, as well as develop healthier spending habits, which is something we can stand behind.

Knowing that this brand makes it easy to understand what you’re spending while taking the stress out of making a larger purchase, I have one last thing to say in this Klarna review: this app, credit card, and browser extension are worth the try.

Klarna Promotions & Discounts

Klarna focuses on making pricey products more accessible, but it’s more of a way to spread out costs rather than receive discounts. So at the time of this Klarna review, I couldn’t find any promo codes for the company itself—you’ll have to check out the website of the brand you’re shopping from!

With that being said, Klarna does have a rewards program in the app that allows you to save, which we outlined in detail earlier.

Where to Buy Klarna

This one is easy! Klarna is an entirely online platform, available in the app store or as a browser extension. Plus, it’s completely free.

The Klarna app and browser extension allow consumers to pay later across all online stores. Are you looking to shop in person? With the Klarna credit card, you can shop anywhere Visa is accepted (online, in-store, at home, or abroad), regardless of whether a retailer offers Klarna.

FAQ

Who owns Klarna?

At the time of this Klarna review, the company is privately held, though CEO Sebastian Siemiatkowski and board member Michael Moritz are at the helm of operations.

Does Klarna ship internationally?

No matter where you are in the world, Klarna is an amazing solution. Shoppers worldwide can use Klarna to break up payments.

What is Klarna’s Shipping Policy?

Since Klarna is more focused on payment plans, it doesn’t have a shipping policy. For details on shipping costs, timeframes, and delivery arrangements, check out the deets offered by the brand you’re shopping from.

What is Klarna’s Return Policy?

If you need to make a return, simply follow the store’s instructions. Then, follow these simple steps:

- Log into your Klarna account or app

- Select “Report a Return”

- Then the payment will be paused and refunded

How to Contact Klarna

I hope you enjoyed this Klarna review! If you have any further questions about the brand or its products, you can contact them by filling out the email form.

Check out some our recently published reviews:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review