Lemonade Insurance Review

Table of Contents

About Lemonade Insurance

The New York-based Lemonade Insurance seems like a lemon-scented breath of fresh air in the stale insurance industry. The basic premise behind their business model is that they withdraw a flat fee and repay your claims quickly. If there’s any money remaining then they donate it to charities and causes that you select.

So, with Lemonade, you’re not only reducing the mental stress of paying for insurance but you’re using what’s left to support what’s important to you. There’s a reason why the company holds over 43k Instagram followers and is particularly popular among young folks.

Intrigued by this brand? If you’re ready to learn more, keep reading my Lemonade Insurance review. Here, I’ll explain all the information you need to know to decide whether the brand is worth your while. It’ll look at how their systems work, what types of insurance they offer, how they give back to charity, and more.

Overview of Lemonade Insurance

The old adage goes, “When life gives you lemons, you make lemonade.” That’s very the much idea that Lemonade Insurance adopted when it was founded in 2015. They recognized that one of life’s most sour lemons is insurance and that most people don’t own juicers, so to speak. That’s why they decided to make their own juicers in the form of insurance premiums.

Their system is reportedly as fast as lighting, with customers getting insurance in as little as 90 seconds and receiving payment in 3 minutes flat.

Beyond their speed, Lemonade Insurance operates with a transparent mindset. They don’t want to obscure information or confuse their customers, instead, they aim to provide them with as much information about their money and how they’re using it as possible. The company actually treats your money like it’s your money.

They flip the traditional insurance company model where corporations profit off of cash overflow. Lemonade works by withdrawing a flat fee from your premium which they take as profit. The rest of the money is split between claims and donating to charities.

Don’t worry if you’re confused by that, I’ll tell you all the details later in my Lemonade Insurance review. But before I get to that, let me tell you about some of the brand’s highlights.

Highlights

- Socially-driven insurance company

- Insurance for renters, homeowners, cars, pets, and life

- Quick and easy process

- Flat fees

- Available on both iOS and Android devices

- High customer reviews across the board

- Run in nearly 40 US states

- Also available in France, the UK, Germany, and the Netherlands

Lemonade Insurance Review

In this section of my Lemonade Insurance review, I’ll give you the breakdown of each type of insurance the brand offers and how they differ.

Lemonade Pet Insurance Review

Lemonade’s pet insurance covers both cats and dogs. It’s been developed alongside expert vets to cover the most common issues that pets deal with that could potentially bite into your wallet.

These include diagnostic tests, outpatient procedures, hospitalizations, emergency care, surgery, and medications. On top of that, their preventative care program can save you big time on routine procedures like fecal tests, wellness exams, bloodwork, vaccines, and dental cleaning.

Lemonade Renters Insurance Review

The next type of insurance I want to cover in my Lemonade Insurance review is their renter’s protection, which starts for as little as $5 a month and can protect the goods in your house and on your property. Vandalism and destruction costs can be covered alongside water damage and fires.

The Lemonade Renters insurance can also provide you with accident protection, so if somebody slips and falls on the banana peels you love to leave on your floor then Lemonade can hire a lawyer on your behalf.

Lemonade Homeowners Insurance Review

Now let’s move from the renters to the homeowners. This type of Lemonade Insurance is accepted by nearly all American lenders, including Wells Fargo, J.P. Morgan, Quicken Loans, and Bank of America. You can either pay it through them or by using your credit card.

If you’re switching over, Lemonade Insurance can cancel your previous home insurance for you and then manage the escrow payments for a painless transition.

Speaking of painlessness, their home insurance can keep your wallet free from financial pay by protecting you from unexpected emergencies (like a tree falling onto your roof). They can also cover claims if your possessions get stolen or you need to go to court for liability.

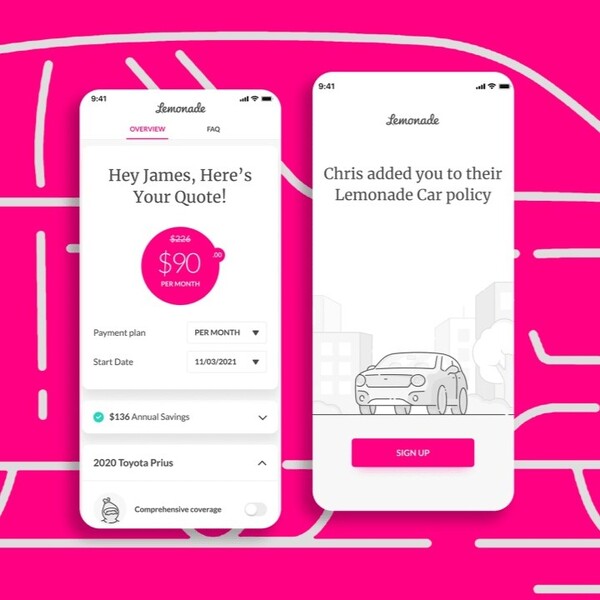

Lemonade Car Insurance Review

The penultimate insurance that I’m going to tell you about today is Lemonade’s unique take on car insurance. They adopt tech-friendly practices like GPS to save you money when you drive well. You can earn a lower premium when you have a better driving record, and you can even chip away at that over time. The more you improve your driving, the more money you can save.

While they don’t go into detail about this next feature, it’s nonetheless worth noting. Lemonade Insurance will plant trees when you sign up for their auto insurance plans as a way to put their money where their mouth is and help clean up the environment.

They can cover common auto incidents like accidents, broken glass, stolen cars, or vandalism. Additionally, they can provide roadside assistance if you’re caught upstream without a paddle.

The pricing model works by measuring how much you actually drive. If you drive less, emitting fewer carbon gasses, then your insurance can be much lower. They also provide lower premiums for EVs and hybrid vehicles.

Lemonade Life Insurance Review

Lastly, let’s talk about Lemonade Life Insurance. Starting at $9 per month, their sign-up process is done virtually without the need for medical exams. You can get a quote in as little as 5 minutes.

One major difference with Lemonade is that they only offer term life insurance, which is fixed for 10-30 years, rather than covering you for your entire life. The advantage of this is that term insurance plans are less pricey. With Lemonade, your premium charge won’t change over your term!

The brand prides itself on making its coverage as simple as possible. They even have a “life insurance explained” section on their website to help clear up any confusion.

How Does Lemonade Insurance Work?

Lemon Insurance charges users a flat fee alongside the cost of their insurance. That’s simple enough to follow as that’s how most insurance companies work. What Lemonade Insurance does after that is what makes them an anomaly in the market.

They use your funds to pay claims you submit to them, but in the event that you don’t issue any claims (or if you have some money leftover) then they’ll donate that money to charity.

I’m not talking about sketchy charities or self-interested parties, like when billionaires donate to charity so they can list it as a tax write-off and pay fewer taxes. No, Lemon Insurance allows you to select from charities that work in over 100 sectors. These charities exist in spheres like environmental awareness, the LGBTQ+ community, and everything in between.

Some of the charities they’ve donated to since their inception include:

- Teach For America

- UNICEF

- The Trevor Project

- ACLU

- New Story

- To Write Love on Her Arms

- Code to Inspire

In total, Lemonade has donated more than $6 million to charities.

The actual donation process works like this: once you sign up and receive your Lemonade Insurance policy, you can pick which charity or cause you want to donate to. I’m assuming that Lemonade Insurance asks you which cause you’re interested in rather than which specific charity based on the language they use on their website, but I can’t say that for sure.

In any case, they use the money that you have left over from an entire year to donate to your selected cause. So rather than making monthly donations, Lemonade Insurance donates once per year, lumping your contributions alongside other members. They can donate up to 40% of the leftover money in your account that you haven’t claimed yet.

Lemonade Insurance Cost

It’s difficult to give you a concrete answer in this section of my Lemonade Insurance review because there are so many factors that will affect how much your insurance costs. What I’ll do instead is tell you the minimums you can expect to pay for each of their insurance policies.

- Lemonade Renters Insurance: starts at $5 per month

- Lemonade Homeowners Insurance: starts at $25 per month

- Lemonade Car Insurance: starts at $30 per month

- Lemonade Pet Insurance: starts at $10 per month

- Lemonade Life Insurance: starts at $9 per month

Lemonade Insurance States Coverage

Sadly, not every Lemonade Insurance option is available in every state. Car insurance is only offered in three states: Ohio, Illinois, and Tennessee. Meanwhile, the rest of their insurance packages are available in many more states.

Who Is Lemonade Insurance For?

It’d be silly of me to suggest that everyone could benefit from switching over to a Lemonade Insurance account. Although their rates and premiums can be lower than the competition, those numbers can change depending on your individual factors.

As such, I think that Lemonade is for people who can get favorable returns or better rates from switching their insurance over to them.

On the other hand, I think Lemonade Insurance is a great option for people who want to adopt a more active role with charities but don’t know where to begin. Since Lemonade vets all the charities themselves, you don’t have to do investigative work to find out if an organization is suspicious or not.

Lemonade Insurance Reviews: What Do Customers Think?

To give you an idea of what customers think of Lemonade Insurance, I collected several reviews from across the internet. The average scores I found reflected a very positive reception. Here’s what I found:

- App Store: 4.9/5 stars, 61k reviews

- Clearsurance: 4.85/5 stars, 2.2k reviews

- Consumer Affairs: 4.7/5 stars, 65 reviews

- Google Play Store: 4.5/5 stars, 13k reviews

- Trust Pilot: 4.5/5 stars, 870 reviews

- Better Business Bureau: 2.9/5 stars, 230 reviews

According to many Lemonade Insurance reviews, the company was true to their word when it came to their speed. People mentioned that they signed up and received claims very quickly. As one user wrote on their experience with pet insurance: “Super fast and easy claim refund on vet bills using the Lemonade app. Everything is user-friendly and easy to submit.”

They went on: “Funds were in my bank account within 24 hours after submitting the claim. The prices are competitive and they offer preventative packages. I ended up switching to Lemonade after adopting another family member. The comparable insurance premium price for both cats with Lemonade was the same price as 1 cat with another provider.”

Other shoppers said that Lemonade Insurance’s customer service was also noteworthy. They commended the company’s employees for their efficiency and willingness to help them. Here’s a customer review that spoke to that point: “I had the chance to work with Lemonade Insurance over email and via one phone call when he returned my call to help answer questions I had.”

Speciifclaly about their situation, they shared: “It was a really negative experience getting a prized possession stolen from my own garage and to have to go through this process during an extremely busy week at work. Jose was phenomenal and truly seemed like he was trying his best to make this experience as smooth and seamless as possible.”

I was delighted to read so many Lemonade Insurance reviews that mentioned the brand’s claims process and customer service as those are often the two worst parts of any insurance company. Luckily, it seems that Lemonade stood out from the pack, evidenced by comments like this:

“I’ve used Lemonde for four different places I’ve rented at over the last few years. The app is really well done and it’s always been a smooth experience, through everything down to the claims process. Really appreciate how they aim to make everything dead simple, and a pleasant experience overall. Super friendly and helpful claims team.”

Customers were quite affectionate towards the Lemonade Insurance app as well. One user wrote this about the iOS app: “The Lemonade app is so easy to use as well as having affordable rates! It took me all of 15 minutes to sign-up, pick a coverage, and a deductible. Very nice customer service as well as very informative.”

Meanwhile, users were just as complimentary on the Google Play store. One customer left a glowing Lemonade Insurance review that positively compared the service to other insurance apps, saying that Lemonade left them in the dust! Overall, it seems customers enjoyed the convenience that Lemonade provided compared to other leading insurance companies.

Is Lemonade Insurance Legit?

Though there were some customers with ruffled feathers about Lemonade Insurance, these were rather minimal complaints. They focused on small issues with the app like loading times and crashes, but those comments are to be expected for any app. Applications are routinely improved and updated, so there’s no need to fret over these.

Is Lemonade Insurance Worth It?

Based on everything I’ve read while conducting research for my Lemonade Insurance review, the company seems like a great alternative to modern insurance companies. Their rates are competitive enough that even if you’re not a charitable person, you may like what the company offers.

Lemonade Insurance Promotions & Discounts

There are various discounts associated with some Lemonade Insurance types. For example, you can get a 10% bundle discount, a 5% multi-pet discount, and a 5% annual discount with their pet insurance plan.

How To Get Started On Lemonade Insurance

You can get started with Lemonade Insurance by getting a quote through their website, www.lemonade.com, or by downloading the app on your Android or Apple device.

FAQ

Who owns Lemonade Insurance?

Daniel Schreiber and Shai Wininger are the co-CEOs of Lemonade Insurance.

What is Lemonade Insurance’s Privacy Policy?

The intricacies of Lemonade Insurance’s privacy policy are open to the public on the company’s website, but in short, they do not sell your information except for the purposes of advertising their business.

What is Lemonade Insurance’s Cancellation Policy?

You can cancel your insurance at any time from the Lemonade Insurance app. They’ll send you a refund of the money for the remainder of your agreed-upon membership period.

How to Contact Lemonade Insurance

I’ll wrap up my Lemonade Insurance review by telling you how you can contact the company if you have any questions. You can call them at (844) 733-8666 or send them an email at [email protected] if you want to ask about auto insurance claims.

Next, check out some similar reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review