Thimble Insurance Review

Table of Contents

About Thimble Insurance

Covering more than 300 professions, empowering over 60k businesses, holding more than 1k followers on Instagram, and appearing in publications like Fast Company, Money, and CBInsights, Thimble Insurances have assembled quite the portfolio since their foundation in 2016.

However, you may be wondering whether they’re just another big, faceless, and daunting insurance company that is out here to take your money. Or, perhaps you’ve already heard a bit about them and want a concise yet informed take on what they’re all about.

Regardless of which camp you’ll fall into, you’ll find the answer you’re looking for in this Thimble Insurance review. I’ve included all the information you need to know about the company’s history, their offerings, their fees, what the sign-up process is like, and what customers have to say about them.

This article should provide you with everything essential so that you can decide whether they’re worth your time and money.

Overview of Thimble Insurance

Thimble Insurance has an interesting backstory. Jay Bregman and Eugene Hertz established the company to provide insurance for drone operators who only needed coverage for a day. Their original plan was to stick with drones, but enough people kept bugging them to expand their coverage so, being the nice guys that they are, they did.

They turned their original vision into a small-business-focused insurance company. Their plan reflects their desire to help those who need it most. It breaks down into three key components; simplicity, scalability, and flexibility. They want to provide clients with the means to cover themselves as they see fit, even if they grow over time.

To find out some of the ways in which they implement that framework, read through the list of highlights of this Thimble Insurance review.

Highlights

- Fast service

- Can upgrade service as your business expands

- Option to adjust policy on the fly

- Over 100k policies sold

- Caters to small and large businesses

- Better Business Bureau Accredited

- Available on iTunes Store and Google Play Store

These are the types of coverage that Thimble Insurance provides for businesses:

- General liability

- Professional liability

- Business equipment protection

- Business owners policy

- Commercial property insurance

- Cyber insurance

Thimble Insurance Business Review

Thimble Insurance offers a robust net of coverage options that you can scale up or down to meet the size of your business. You can also change the length of time with which you’ll need insurance.

Here’s the entire list of businesses that can earn coverage under Thimble Insurance:

- Construction + Contractors

- Landscaping

- Cleaning Services

- Crafters + Makers

- Sports + Fitness

- Event Professionals

- Photo + Video

- Hair + Beauty

- Pet Services

- Professional Services

- Retail Stores

- Restaurants

How Does Thimble Insurance Work?

Thimble Insurance is all about simplicity. The people behind the brand know how annoying it can be to sign up for insurance on top of all your other daily tasks. It’s hard to plan for the future when it’s so stressful to sign up for insurance and there are more pressing issues at hand.

As such, Thimble Insurance makes the process of speaking with someone, purchasing a policy, and getting back to work as quick as buying a burger from McDonald’s.

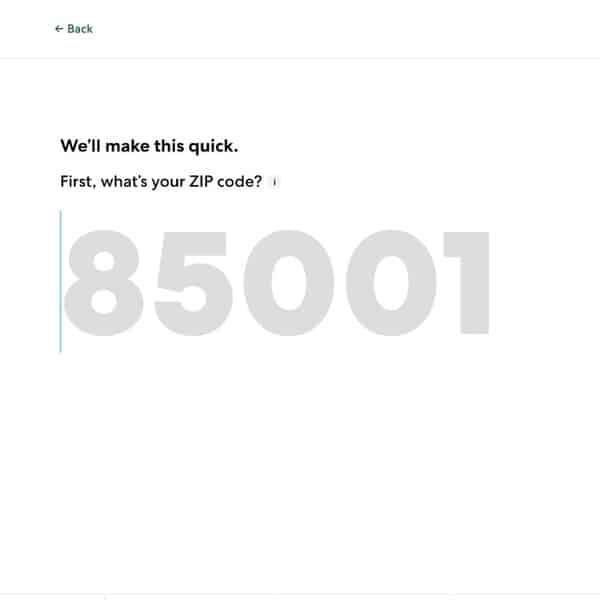

The first thing you’ll enter when signing up for Thimble Insurance is your zip code.

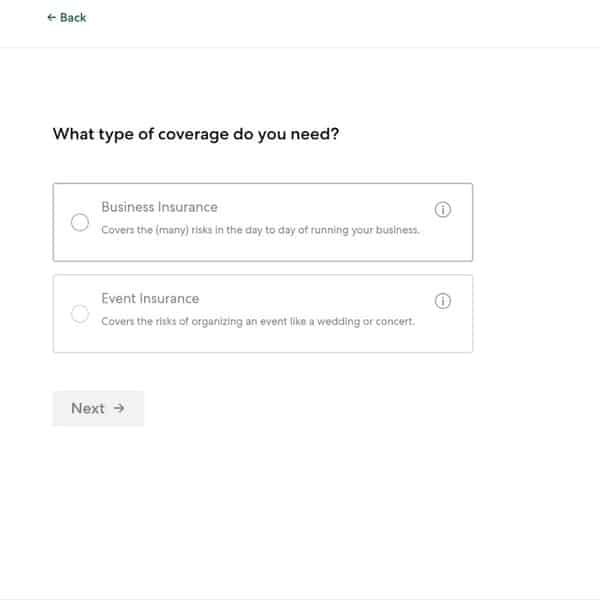

Next, you’ll select the insurance type you’re looking for. You can choose either business insurance or event insurance. The former covers routine risks that can often cut a small business’ legs if they crop up while the latter accounts for the risks that could ruin something like a wedding, a concert, or gender reveal parties (which should have the highest levels of insurance possible, based on the numerous accidents that seem to afflict them).

The available business coverages are

- General liability

- Professional liability

- Commercial properties

- Business owner’s property

- Business equipment protection

- Customer property protection

- Cyber insurance

Meanwhile, event insurance can cover event liabilities and liquor liabilities.

If you choose business insurance then you’ll need to inform Thimble which type of work you’re doing. Some of the examples they have include handyman, landscaper, and DJ (who knew DJs could incur damages).

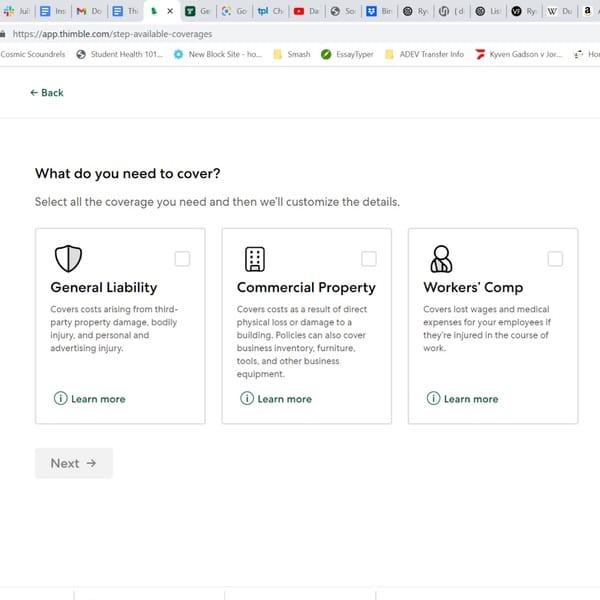

For the purposes of this Thimble Insurance review, I choose “landscaper” as my profession because I’ve never done a day of physical labor in my life but like to pretend my back pains are caused by work. In any case, you’ll next decide what it is that you want to cover. For my would-be role as a landscaper, I could choose between three options:

- General liability

- Commercial property

- Worker’s compensation

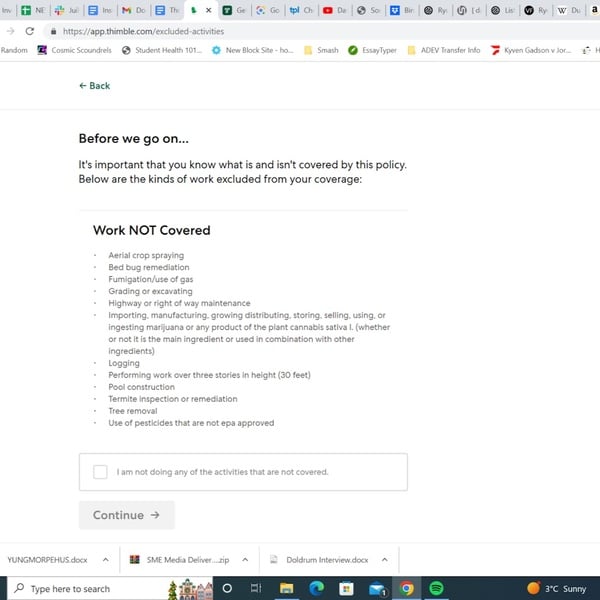

You can choose as many of these as you need. After you choose, you’ll find a screen that tells you everything that Thimble Insurance doesn’t cover. Some of the jobs that cannot use their coverage include:

- Bed bug remediation

- Excavating

- Highway maintenance

- Logging

- Pool construction

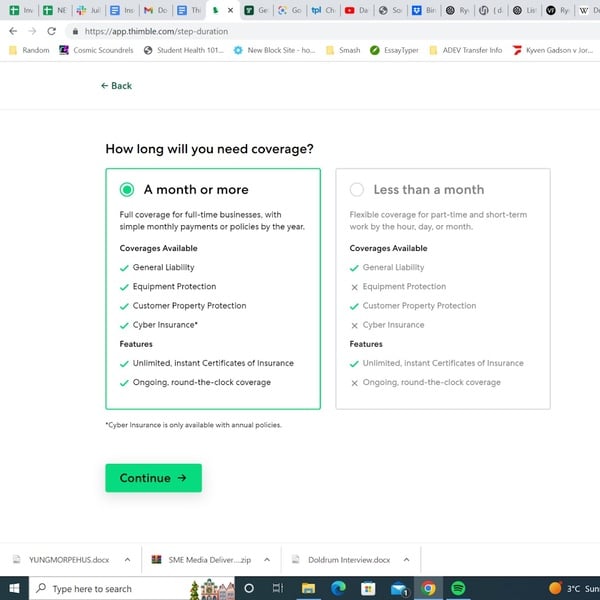

After signing that your work doesn’t involve any of these tasks, you’ll then select how long you’ll require coverage for. You get two options; periods lasting at least one month, and ones that are less than a month. Each option is better for certain types of work.

For example, hourly workers completing a single project would benefit more from a coverage that lasts less than a month while registered workers who have been with a company for a long time would want to choose the option that lasts longer than a month.

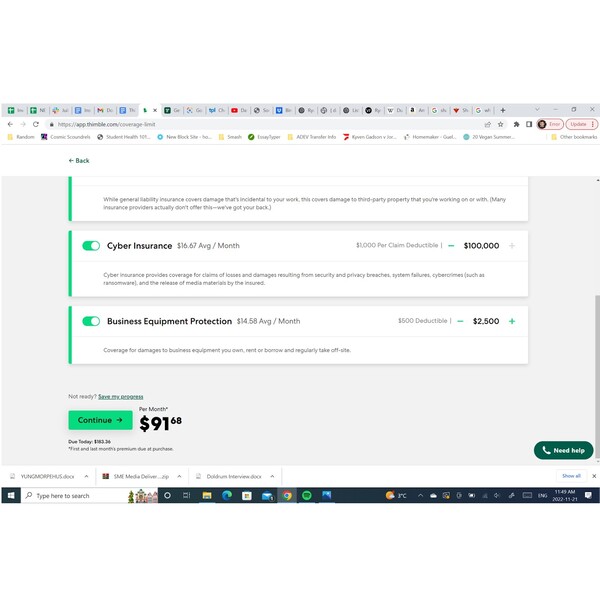

Note that only coverages that cover more than a month can provide equipment protection and cyber coverage.

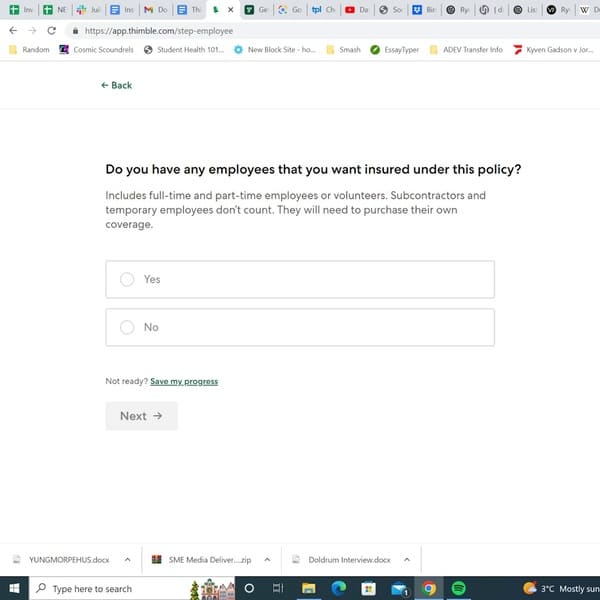

After that, you’ll inform Thimble Insurance whether you have any employees that you want to cover with the selected policy. The policy cannot extend to temporary workers or subcontractors as they must purchase their own protection.

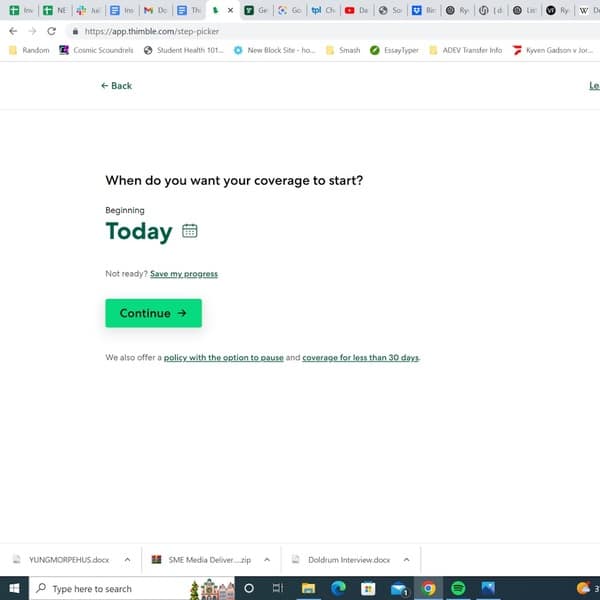

The next step is to choose a start date for your Thimble Insurance. You can start your insurance the very same day that you sign up, or you can put it off until a later date.

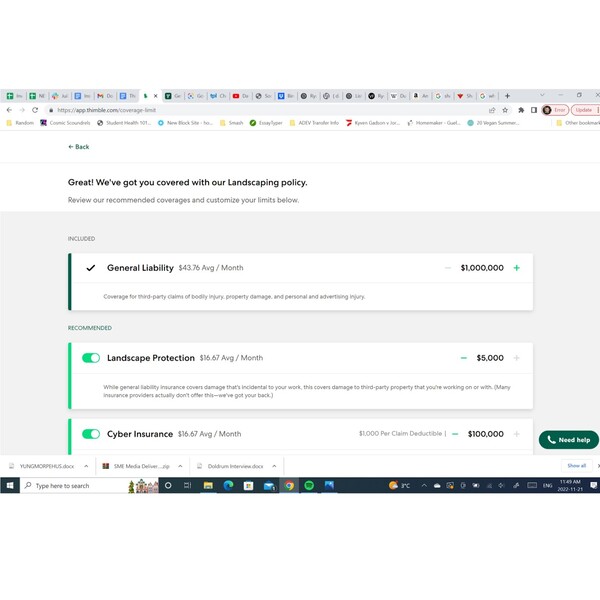

Finally, you get the opportunity to sift through the options that Thimble Insurance presents to you based on your needs. You can customize the limits of each if you feel like the numbers are too high or low for you.

If at any time during this process, you feel overwhelmed or want to consult someone else for their opinion you’re free to save your progress and return at another time. Thimble Insurance will keep track of everything you’ve entered thus far so you can return to it at a later date. As such, there’s no pressure on you to make a decision as soon as you’re there.

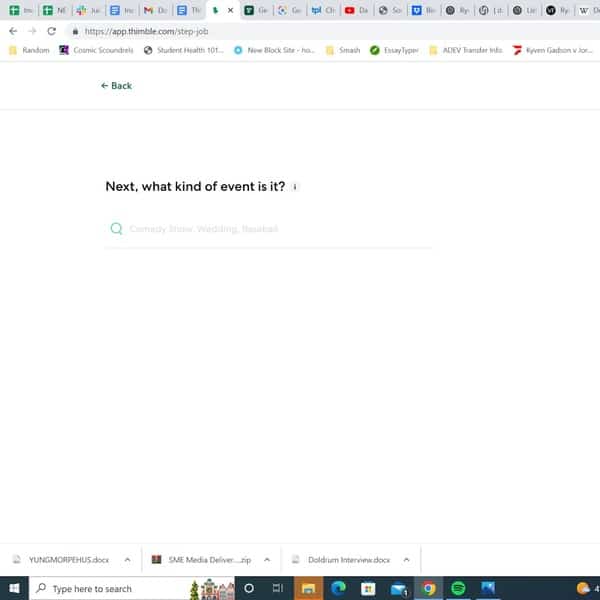

I also want to use this Thimble Insurance review to cover what the event insurance sign-up process looks like. Let’s turn back to that first path between business insurance and event insurance. If you select event insurance, you’ll have to tell Thimble what event you’re trying to insure (wedding, concert, party, etc.)

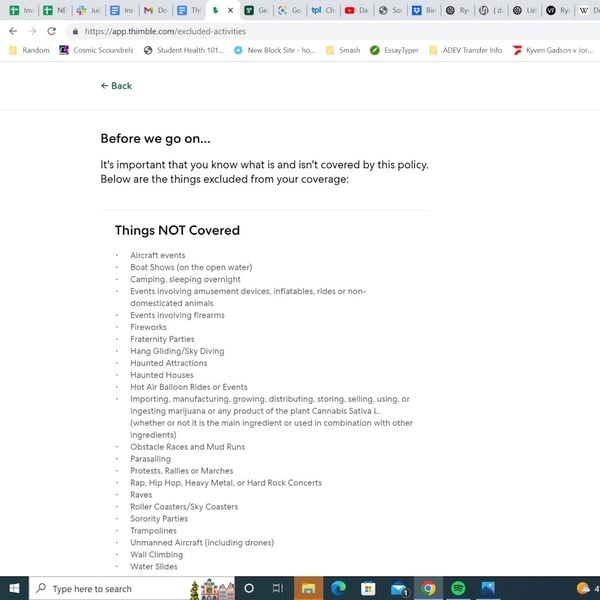

As with business insurance, there are some events that Thimble Insurance cannot cover. These include

- Fraternity or sorority parties

- Rap, hip hop, heavy metal, and hard rock concerts

- Raves

- Fireworks

And other events that you’d assume would either be any fun or exhilarating. Thankfully, they can cover your monthly book meeting with the ladies to talk about Kristin Hannah’s latest book.

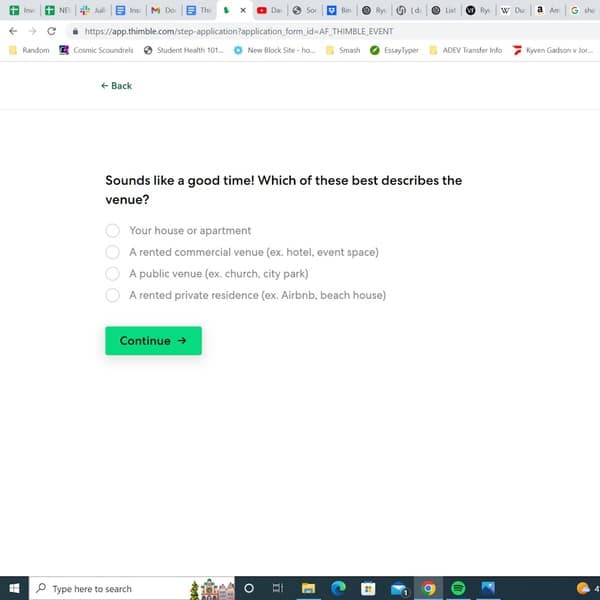

After that, you’ll choose which option best describes the venue for your event from a drop-down list.

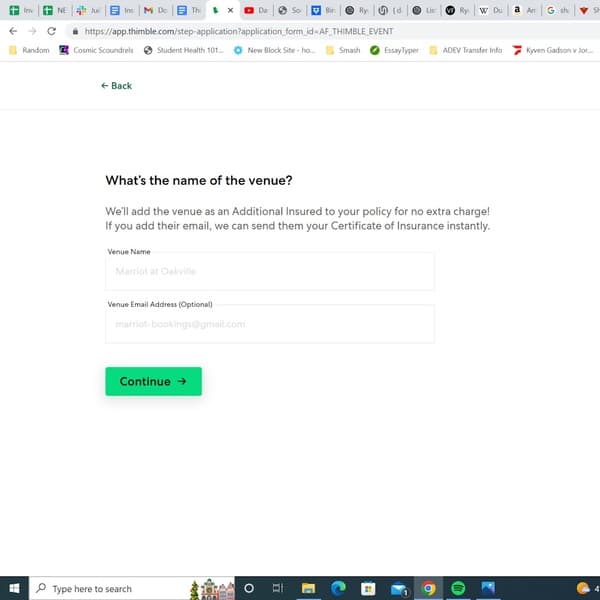

You’ll then enter the address and/or name of the venue for the event. I chose to hold my hypothetical gathering at a public venue which is why the attached photo asks for the name of the hosting location.

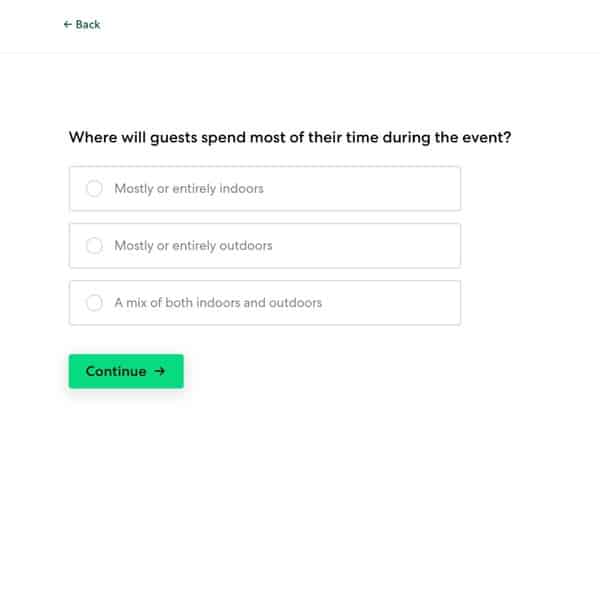

Next, you’ll tell Thimble Insurance where your guests are going to be for the majority of the event. There are three options you can pick from; mostly inside, mostly outside, or a healthy mix between the two.

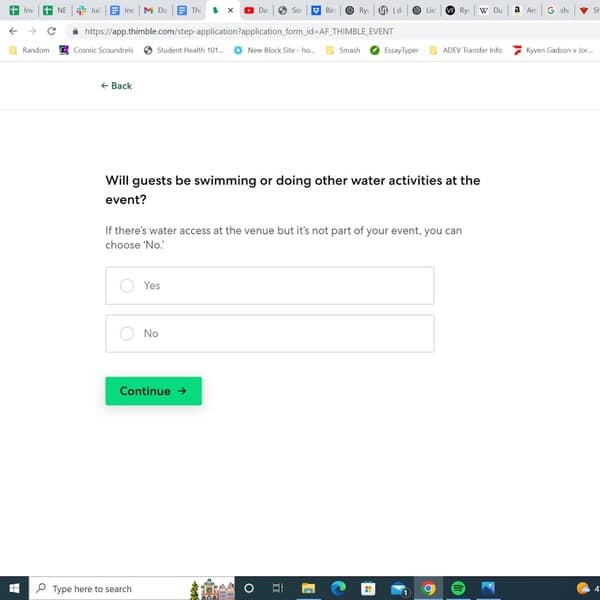

There’s then a quick question about whether or not your guests will be swimming. If you want people to actually attend your party, then you’ll have a pool, but if you want to keep things tame so that your blood sugar doesn’t spike then you can skip the swimming.

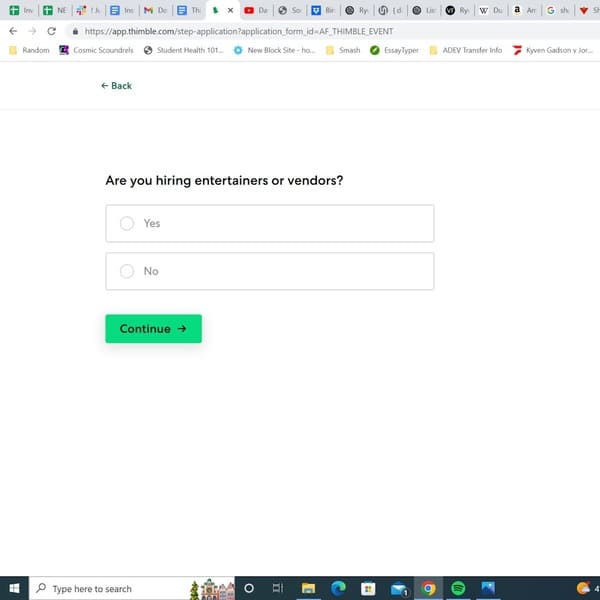

You’ll then have to let Thimble Insurance know whether or not you plan on hiring entertainers.

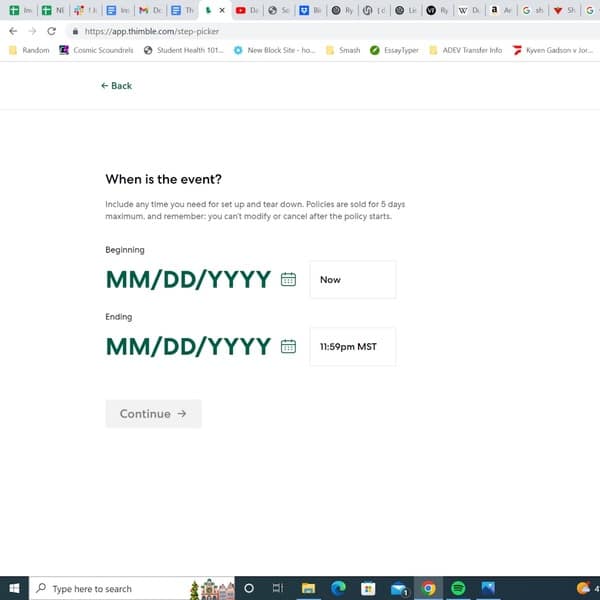

Next, you’ll be responsible for entering the date at which your event is going to occur.

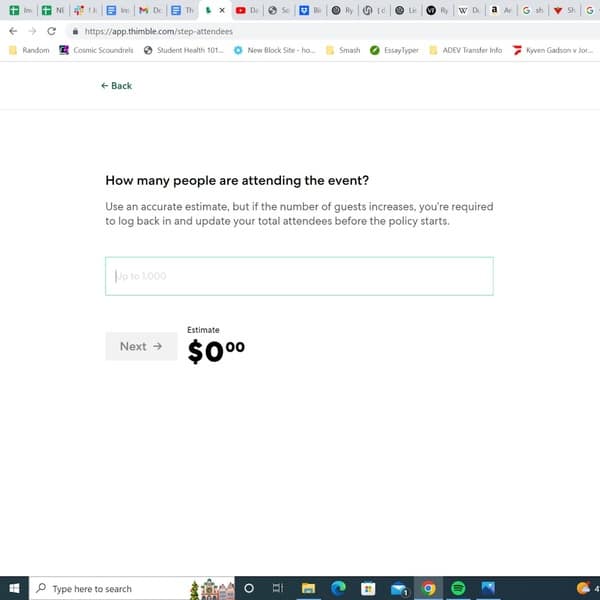

You’ve then got to tell Thimble how many people you’re expecting at your event. A rough estimate should be fine. However, note that if the number increases, you’re liable to go back and update that number so that Thimble Insurance can adequately cover everyone there. You must do this before the policy begins.

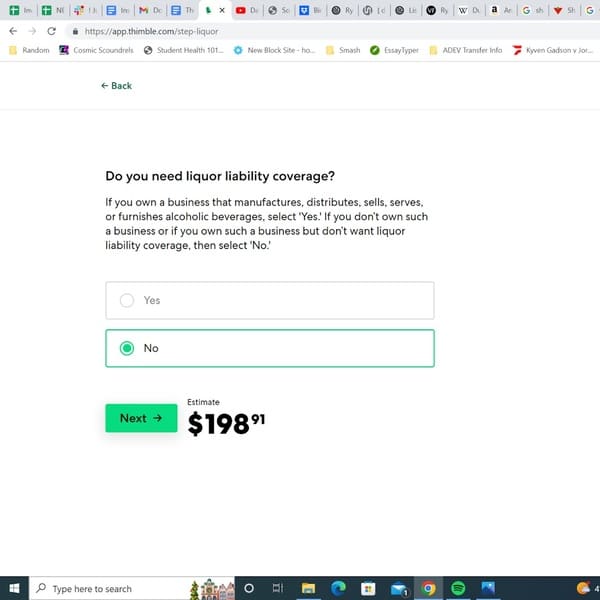

After that, you’ll reach the most important part of any party-planning process – the alcohol! You can choose whether or not you need liquor liability coverage. You should select “yes” if your business or venue will be distributing or serving alcohol or if there will be any drinks available during the event.

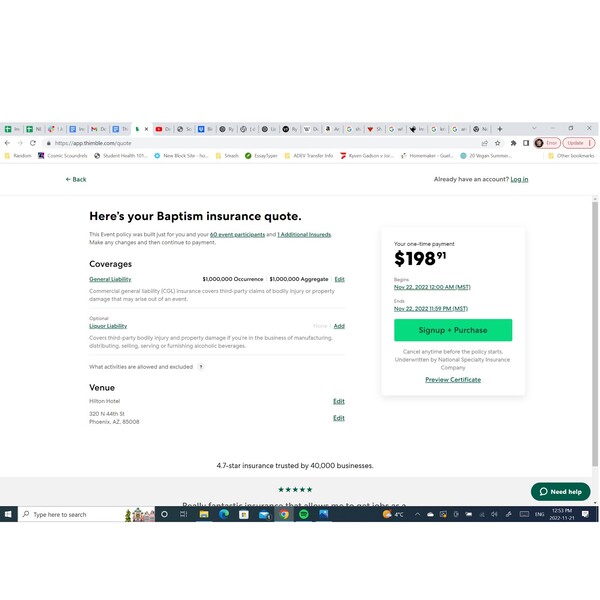

After all that, you’ll finally get the chance to preview the total cost of your event. For reference, here’s a photo of the coverage that Thimble Insurance recommends for my hypothetical baptism at an Arizona Hilton Hotel (I’d invite you, but that’d betray the ethical boundaries of this Thimble Insurance review).

Thimble Insurance Fees

I can’t give you a definitive answer as to the company’s fees in this Thimble Insurance review because each quote will be different. The company relies on multiple factors to generate the fees and give you adequate coverage. For smaller businesses, this includes variables like location, team size, occupation, and coverage limits. On top of that, there are also factors like state class codes and business claims history.

Even with that in mind, I can’t let you click away from this Thimble Insurance review in a tizzy because you didn’t learn how much you should expect to pay for coverage. Their general coverage begins at $17 per month without any add-ons.

With regard to events, you’re looking at a minimum of $115. There are a host of factors that can increase this price, but your quote will tell you about all that.

In my opinion, it’s a better use of your time to just go through the process of obtaining a free Thimble Insurance quote because it’s so speedy. I got the mock ones I inserted into this Thimble Insurance review in less than two minutes each.

Who Is Thimble Insurance For?

As you read in some Thimble Insurance reviews that customers wrote, the service is particularly great for small businesses or even vendors. Some of these smaller retailers run pop-up shops a few times per year so Thimble’s limited-time coverage is great for them. They can register as a single event and then use the leftover funds to carry over to their next business date.

Thimble Insurance Reviews: What Do Customers Think?

Insurance is notoriously difficult to assess from the outside looking in. There are seedy companies around every corner in the market, so it’s vital to obtain customer insight. As such, I took to a couple of different websites to investigate what those with experience with the brand wrote in their Thimble Insurance reviews.

Before I get into the details, allow me to present you with the scores they gave Thimble.

- Google Reviews: 4.7/5 stars based on more than 160 pieces of customer feedback

- Trust Pilot: 4.6/5 stars based on more than 1,100 pieces of customer feedback

- Insuranks: 4.5/5 stars based on more than 10 pieces of customer feedback

So, overall, people were pleased with the service. The main thing that they appreciated was the speed and simplicity of the process. They obtained a quote, had their questions answered, and signed up for insurance in a heartbeat.

“When our insurance wouldn’t offer the extra coverage we needed for an event, I was happy to see thimble in a quick online search. Creating the policy online was super fast and easy and when I had questions they were quick to provide feedback. Most efficient process, quick and painless. Would use them again,” wrote one customer.

Plenty of Thimble Insurance reviews included positive comments about the low fees and cost. Folks deemed the service to be cheap, especially compared to other insurance companies.

One buyer wrote, “Easy to purchase, specify additional insured. Inexpensive! Appropriate coverage for my event and they even sent a copy to the coordinator for me. I liked the updates as the date of the event approached. And a full copy was available to me for print. I will definitely use Thimble again and I highly recommend it for other vendors.”

Smaller businesses and solo operations specifically loved Thimble Insurance. It was seen as the ideal protection for their business given the flexibility and specificity with which Thimble worked.

“My name is Rico and I’m a caricature artist. I have used thimble on quite a few occasions. It’s great for individual events that I’ve booked where insurance is required. Each time I found it easy to use, quick and efficient. Pricing compared to competition can’t be beat. All the bells and whistles, I dotted T’s crossed. great service and convenience,” said one independent worker on Google reviews.

The last Thimble Insurance review from a fan I’m going to include mentioned a specific instance in which the service outperforms other insurance companies.

“I love Thimble for the needed/required liability insurance for selling my product at a local venue. Thimble is EASY to sign up for..and the best part for me is that you can cancel at any time..I only do 6 separate days a year selling my product, so, with Thimble I can cancel after my last event and get a return of any payment not used. I tell many people about Thimble and they are all very satisfied. Thanks!”

Is Thimble Insurance Legit?

I was expecting to read more negative reviews from customers about Thimble Insurance, but I honestly couldn’t find anything that set off any alarms. Of course, not everyone thought the service was rainbows and puppy dogs, but their complaints paled in comparison to the magnitude of positive Thimble Insurance reviews.

Is Thimble Insurance Worth It?

Due to the way that customers spoke about the service, their low fees, and the speed at which you can obtain a quote, I think that Thimble Insurance is at least worth checking out.

Thimble Insurance Promotions & Discounts

I couldn’t find any promotions or discounts running at the time of writing this review.

How To Get Started On Thimble Insurance

You can get started on Thimble Insurance by checking out their website, www.thimble.com.

FAQ

Who owns Thimble Insurance?

Jay Bregman is the current CEO of Thimble Insurance.

What is Thimble Insurance’s Privacy Policy?

Thimble Insurance’s privacy policy is lengthy and detailed. You can find the entire policy on their website.

How is Thimble Insurance’s Customer Service?

Based on what customers wrote in Thimble Insurance reviews, the team is responsive and willing to answer all questions.

How to Contact Thimble Insurance

You can contact the customer support team behind Thimble Insurance by sending in a contact request on the brand’s website.

Check out some of our recently published articles you might like:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review