Ethos Life Insurance Review

Table of Contents

About Ethos Life Insurance

So, maybe you’ve just reached a new milestone in your life. Daily life can be stressful itself, and big transition periods can come with lots of responsibility and challenges. However, something you shouldn’t slack on is life insurance, and getting started doesn’t have to be complicated. Ethos is here to make life insurance plans simple, accessible, and affordable.

The brand believes in providing people with honest and transparent life insurance plans, along with educational resources, to protect their loved ones in case anything happens to them. The brand has captured the attention of notable outlets such as PR News Wire, Tech Crunch, and Bloomberg. They also boast a strong 11.1k followers on Instagram.

Are you curious about life insurance, and whether you should get it? You’re not alone. This Ethos Life Insurance review will give you everything you need to know about this brand including an overview of their plans, customer reviews and ratings, and frequently asked questions.

Overview of Ethos

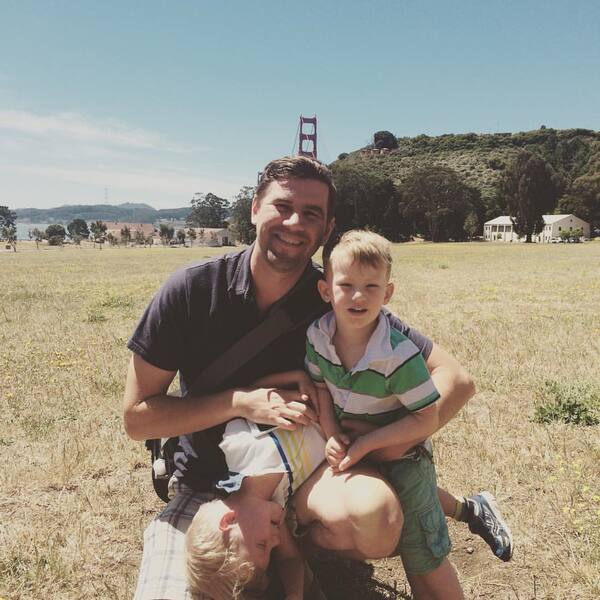

Ethos Life was founded in 2016 by Peter Colis and Lingke Wang who were both pursuing graduate degrees at Stanford University. The inspiration for the company came from Wang’s personal experience with a traditional life insurance company. When Wang was only 22, he was sold life insurance that ended up costing him more than he expected.

Wang talked with his roommate at the time, Colis, and through their conversation realized that he wasn’t the only one who misunderstood life insurance policies and payments. It wasn’t an individual failing, but a much larger issue. So the pair decided to tackle the issue head-on.

The brand focuses on making sure applicants know what they’re getting into when they sign up for life insurance. With lots of resources, a blog, and clear plans, making sure your family is covered is super simple.

Ethos Life best states the company’s driving force: “We’re here to help millions protect their families with access to simple, affordable life insurance.”

Now that you know a little more about how the brand started, this Ethos Life Insurance review will take you through its key features:

Highlights

- Ethical and charitable company

- Easy online application process

- Transparent life insurance plans

- Industry-leading partners

- Low monthly cost

- Flexible options

- Lots of useful and informative resources

- High customer ratings on Trustpilot, Google, and BBB

If you haven’t thought about life insurance before, it may be time to start. Ethos Life Insurance offers term and whole life insurance plans for people in the US between the ages of 20 and 85.

Whether you’re a student with tuition debt, homeowner, caretaker, or partner, having a suitable life insurance plan will allow you to have peace of mind knowing your family is protected. In the next section of this Ethos Life Insurance Review, we’ll explore the brand’s options while seeing how they operate and what to expect during the application process.

Ethos Life Insurance Review

Not sure where to start when applying for life insurance? Before getting overwhelmed we suggest taking a deep breath. Ethos Life Insurance plans are straightforward.

First, we recommend using their estimation calculator to find out a quote for your plan. You’ll receive a rate depending on your age, credit score, and health information you provide.

This feature is free to access and use at your leisure. All you have to do is answer a few questions and get your results right away. However, it’s good to note that this is only an estimation cost.

If the price seems like something that can work for you, you’ll have to answer some additional questions and apply for the insurance plan which only takes about 10 minutes. After you apply, you can make adjustments at any point, or withdraw your application at no cost.

You won’t start paying until your application is approved and you accept your coverage plan. Unlike many life insurance companies, with Ethos, you will have ample time to decide and support when you need it.

Curious about your options? Next, this Ethos Life Insurance Review will go through the brand’s main life insurance plans. When it comes to your plan, it’s completely personal and will vary depending on different personal factors.

Ethos Term Life Insurance Review

Want to take baby steps into the world of life insurance? There’s no need to commit to a lifelong insurance plan if you don’t want to or if it’s not within your budget.

Term Life Insurance is designed to cover you within a set period of your life, usually ranging from about 10 to 30 years. If you pass away during this time, then your family or beneficiaries will receive financial support in the form of a cash payment.

Term insurance is ideal for people who have student or credit card debt as it’s the most affordable option. You don’t have to pour loads of money into your plan, you can reap the benefits of life insurance by contributing a little bit each month.

You have the option of applying for a simplified issue or fully underwritten. What’s the difference?

The simplified issue is a less tedious process and provides people who are typically ineligible for life insurance, due to health or age, to apply. Your application is processed using third-party data only. Most term life insurance plans use the simplified issue.

Alternatively, if you’re in good health and want a more beneficial plan in case of death, then Ethos offers fully underwritten term policies. This process takes a bit longer and includes health questions within the application.

When your term ends, you have the option of extending your current term, applying for a new term, or canceling your policy altogether. The cost of the Term Life Insurance will be based on different factors that vary between individuals. For the most part, it will cost about the price of a dinner per month.

Ethos Whole Life Insurance Review

If you’re ready to commit fully to life insurance, Whole Life Insurance is the plan to go for. This type of insurance will cover you for the rest of your life.

Over time, you can invest in your policy to grow your savings. Your beneficiaries will be completely covered once you pass.

If you’re between the ages of 66 and 85, you are guaranteed to be approved, regardless of your health condition. No medical exams are necessary for the application, and you can apply online within minutes.

Once you accept your plan and make your first payment, coverage will start instantly and will last a lifetime. Your payment plan is secure meaning it will never increase in cost.

The Whole Life Insurance policies range from $1,000 to $30,000. Ethos licensed agents will work with you to create a suitable plan if you need external support.

How Does Ethos Work?

The brand prides itself on offering a simple and fast online application process. Compared to its competitors, Ethos Life Insurance does not require mountains of paperwork and lengthy calls with agents.

Depending on whether you are applying for Term Life Insurance or Whole Life Insurance, the process will differ slightly.

Before starting your application, it’s handy to have the following information with you:

- Driver’s license

- SIN number

- Medical history

- Prescription information

For Term Life Insurance:

- Choose a term policy that works for you

- Fill out the online application

- Once approved, you can activate your coverage

For Whole Life Insurance:

- Fill out the online application

- Select your coverage level (up to $30,000)

- Make your first payment and receive instant coverage

Once you pass away, your beneficiaries can file a claim and will receive an untaxed lump-sum payment. It’s important to be completely truthful in your application as any misinformation or fraudulent claims can result in the denial of your beneficiary’s claim. As with almost anything, certain exclusions apply so make sure to read the fine details on the brand’s website.

Applying for Ethos Life Insurance is seriously as simple as following the steps listed above. The entire process takes is quick and efficient so that you have more time to focus on other areas of your life, rather than menial (but necessary) tasks.

Who Is Ethos Life Insurance For?

Ethos Life Insurance is for anyone and everyone. The brand offers plans for people of all ages. If you are getting married, having children, starting a business, buying a home, taking out student loans, or planning for retirement, it may be the perfect time to start investing in life insurance (or at least thinking about it).

This Ethos Life Insurance Review believes it’s never too early or too late to apply for life insurance. However, the earlier you apply, the more you will save and will be able to provide for your family once you pass. Another thing to keep in mind is that rates increase the older you get, so to receive the best value you’ll want to start contributing to life insurance young.

Ethos Life Insurance Reviews: What Do Customers Think?

If you’re interested in applying for life insurance with Ethos, we encourage you to stick with this Ethos Life Insurance review as we will find out what customers think about the brand. We were genuinely shocked to see such high ratings from popular third-party sites such as Trustpilot, Better Business Bureau, and Google.

Before we get into the meat of the Ethos Life reviews, here’s a breakdown of the ratings from the platforms mentioned above:

- Trustpilot: 4.3/5 stars from 413 reviews

- Better Business Bureau: 4.86/5 stars from 73 reviews

- Google: 4.8/5 stars from 726 reviews

As you can see, generally customers of Ethos Life Insurance were satisfied with the brand’s efficiency, customer service, and cost. Let’s start by taking a closer look at what customers from Trustpilot have to say.

On Trustpilot, one 5-star reviewer said: “We have been putting off purchasing life insurance because it’s time-consuming and the process can be so invasive. Ethos made it simple – the application was straightforward and easy to complete. My agent was super nice and knowledgeable and answered all my questions.”

“I would recommend this company to anyone looking for life insurance without the hassle.”

The ease of the application process and honesty of the company were a selling point for another 5-star reviewer on Trustpilot: “Ethos did exactly what they said they would do, and more. Received a quick quote. After answering a few more questions, they actually offered me a better deal. In addition, the whole process took a couple of days. Very satisfied.”

From the Better Business Bureau, one 5-star reviewer gleefully attests to the brand’s exceptional service and value: “I couldn’t have asked for an easier process. It eliminated the anxiety associated with procuring life insurance. The ease of purchase, cost-to-benefit ratio, and polite and helpful people were all a blessing to be sure. I would highly recommend them… and have!”

Last but not least, we scoped out some reviews on Google for some additional insight into the brand. We were pleased to see an overwhelming amount of positive reviews from customers who were able to get life insurance without unnecessary and time-consuming tasks.

One 5-star reviewer said: “Ethos has the best system for purchasing Life insurance. I was able to get a $100,000 policy in less than 15 minutes & without talking to an agent.”

If there is power in numbers, then this Ethos Life Insurance review thinks the brand is onto something. Many customer reviews were beyond impressed at the service they received and the streamlined application process. At the end of the day, life admin should be as unstressful as possible and Ethos helps take the work out of getting proper life insurance.

Is Ethos Life Insurance Worth It?

This Ethos Life Insurance review can confidently say that the brand is worth a try. After our research, we can confirm that there is nothing to lose when you choose a life insurance plan with the brand. They make it easy and accessible to get the life insurance you need. There are no medical exams and you can choose a plan that works for your budget and lifestyle.

Ethos wants you to be educated and informed when it comes to life insurance plans. They have a wide range of resources on their website to help you learn everything you need to know before committing to a plan. Instead of overcomplicating information and important knowledge, they simplify it. We love to see an inclusive brand that strives to uplift and empower individuals.

Ethos Life Insurance Promotions & Discounts

At the time of this Ethos Life Insurance review, the brand is offering a $10 discount when you refer a friend.

Where to Buy Ethos Life Insurance

Ethos Life Insurance operates entirely online. You can choose and purchase your plan (if approved) entirely online with your credit card.

FAQ

Who owns Ethos?

Peter Colis, one of the founders of Ethos Life Insurance, owns the company. The brand is based in San Francisco, California.

What is Ethos’ Whole Life Insurance Policy?

To sum it up, Ethos’ Whole Life Insurance policy is a lifetime policy aimed toward older citizens between the ages of 66 and 85. Coverage plans range from $1,000 to $30,000, and when you turn 100 you’ll receive full coverage without payment.

What is Ethos’ Term Life Insurance Policy?

Ethos’ Term Life Insurance policy allows you to choose a set amount of time you would like your life insurance to cover. This option is ideal for younger folks as it is more affordable than the whole life insurance and there’s less of a commitment. Once your term is up, you can choose to extend it or opt out altogether. That’s your call.

How to Contact Ethos

Hopefully, this Ethos Life Insurance review covered all the essentials! If you have any extra questions about the brand we highly encourage you to contact one of the brand’s licensed agents. You can get in touch by:

- Email: [email protected]

- Call: 415-915-0665

- Text: 415-702-1844

The brand’s hours of operation are Monday to Friday 8:00 am to 6:00 pm CST.

Check out similar reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review