Rocket Money Review

Table of Contents

About Rocket Money

Rocket Money is a budgeting app with over 5 million downloads on the Google Play Store and stellar customer reviews across the board. It’s been heralded by outlets such as Money, Forbes, The Wall Street Journal, and more.

Dating back to 2015, Rocket Money’s team was made of everyday individuals who experienced the same financial challenges as you and me. They set out to create an app that would help people track their expenses, save for the future, and identify opportunities to reduce unnecessary subscriptions.

So far, Rocket Money has saved customers more than $245 million and helped them cancel more than $155 million worth of fluffy subscriptions.

Up ahead in this Rocket Money review, I’ll break down the key components of the app that distinguish it from other similar options on the market.

Highlights

- Comprehensive budget-balancing tools

- Identifies your active subscriptions and suggests cancellations

- Free sign-up

- Flexible payment options

- Exceptionally positive customer reviews

Features

Let’s talk about the features that Rocket Money promotes that can keep more money in your wallet. The app’s main functions are:

- Subscription management

- Automatic savings

- Information on spending habits

- Credit scores surveillance

- Negotiating bills and payments

- Budgeting tools

- Net worth calculation

The first tool, subscription management, involves Rocket Money locating your active bills and subscriptions. In a world where it’s becoming tougher and tougher to know what you’re subscribed to, this comes in handy.

The automated savings tool can help you put away money towards a goal amount that you set for yourself. Rocket Money can provide you with an ideal rate so that you can save exactly as much as you want.

The Rocket Money app can also keep track of what you’re spending your money on based on categories like bills, utilities, and eating out. They’ll let you know about upcoming important payments so that you can stay on top of your business.

Additionally, Rocket Money’s credit score system helps you keep an eye on your credit score so that you’re never blindsided.

The app’s bill-negotiating tool is remarkable. Rocket Money scans through your bills (cell phone, cable, and insurance payments), to find the optimal time for you to pay them. This can prevent you from paying overdraft or late fees.

Another important feature is the budget-setting tool, which allows you to impose an overhead on yourself to stay within the green zone. This isn’t just a universal budget. You can segment it into different categories so that you can allocate more funds to them.

Lastly, Rocket Money offers a comprehensive financial overview by seamlessly linking all your accounts. This sets it apart from typical banking apps because it not only consolidates your accounts but also incorporates insights from the app’s AI to inform you about how your spending patterns might impact your future.

Rocket Money App

All of the key features I detailed in the previous section of this Rocket Money review can be accessed through the company’s app. The app combines them into a sleek interface that’s easy to comprehend. You can download it from either the App Store or the Google Play Store.

This is how one buyer described the Rocket Money App: “I have never commented on an app before in my life. That was because I’ve never felt genuine value in my life from an app. I’ve had apps I’ve liked and thought were fun, but Rocket has influenced my day to day life more than any other. I have saved over $50 a month from their unsubscription service.”

How Does Rocket Money Work?

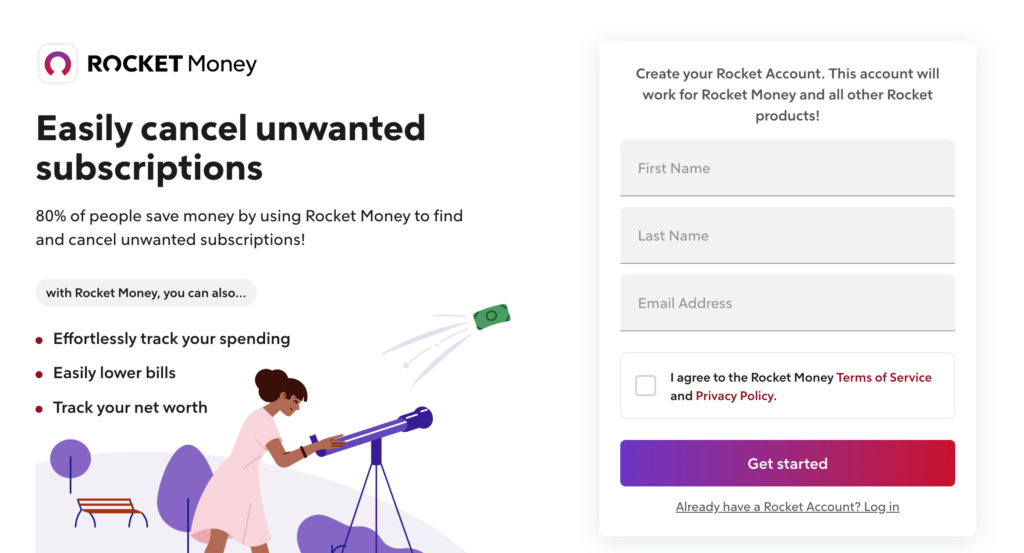

The following section of my Rocket Money review will take you through the sign-up process. After clicking on the “Sign Up” button, you’ll come to a page that asks you to create an account. You’ll fill in basic information such as your name and email address.

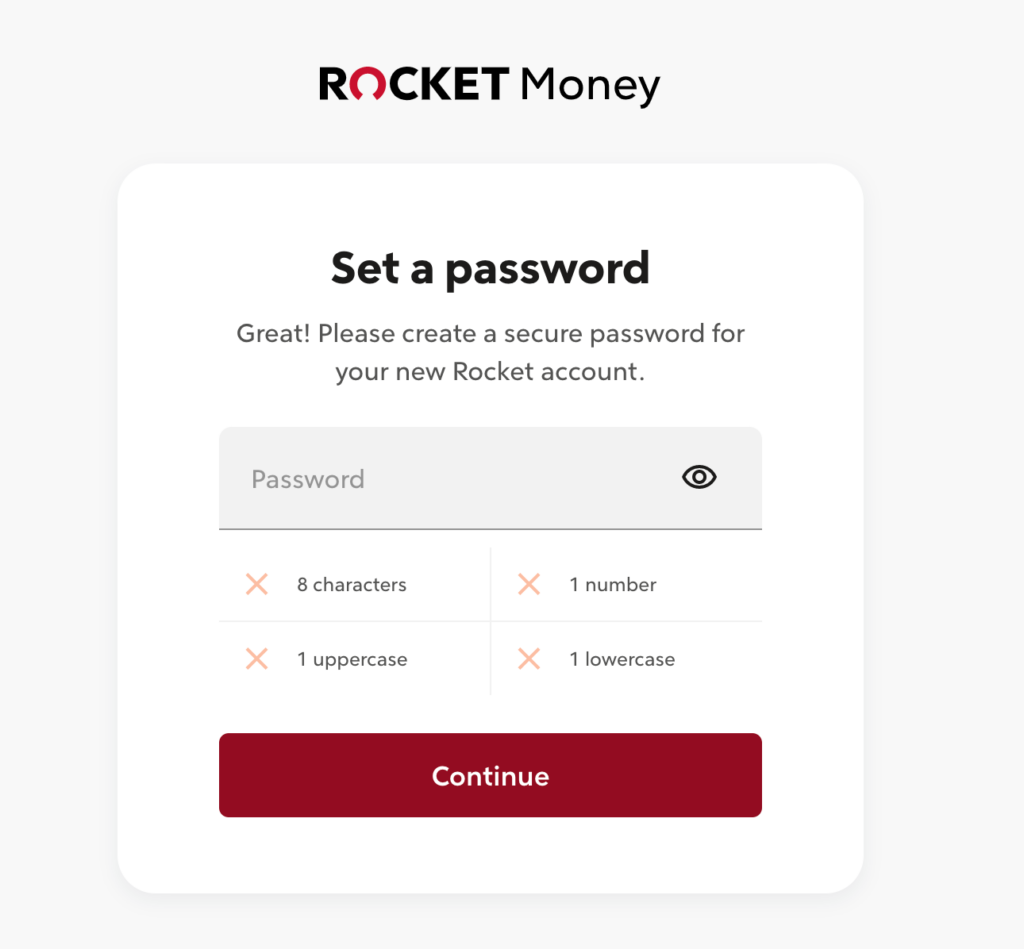

Once you’ve filled that in, you’ll create a password.

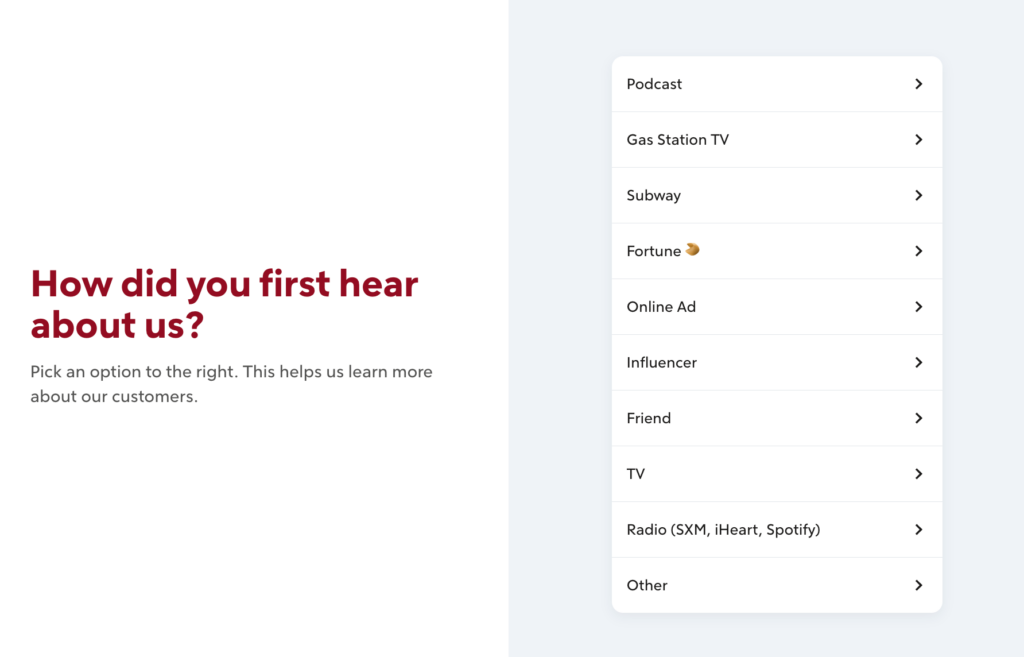

Following that, you’ll reach a page where you need to tell Rocket Money how you found out about the company. The options listed range from podcast adverts and television ads to word-of-mouth.

Once you’ve completed that, you’ll then tell Rocket Money why you want to use the app by selecting from the features that most appeal to you. You can select more than one goal. The goals listed include:

- Canceling subscriptions

- Lowering bills

- Tracking spending

- Budgeting

- Tracking net worth

- Growing savings

- Improving credit score

Rocket Money will then ask you to connect your checking accounts and credit card info.

Once that is all wrapped up, all that’s left is to become a member and download the Rocket Money app. Alternatively, you can complete this entire process through the app.

Rocket Money Fees

The app itself is free, but you can sign up for the premium membership for around $12 per month depending on how many services you wish to use. Rocket Money charges a 40% annual fee if you sign up for their bill-lowering service.

Who Is Rocket Money For?

Anyone who is absolutely swamped with subscriptions or struggles with creating regular budgets would benefit the most from Rocket Money. Nowadays, it’s hard to know where our money is going, so if you’re balancing tons of subscription-based services or can’t seem to keep track of your money, then this app would be right for you.

Rocket Money Reviews: What Do Customers Think?

Here are a few aggregate Rocket Money review scores from various websites:

- Trust Pilot: 4.8/5 stars based on more than 3,600 pieces of customer feedback

- iOS App Store: 4.4/5 stars based on more than 46,000 pieces of customer feedback

- Google Play Store: 4.3/5 stars based on more than 36,000 pieces of customer feedback

- Better Business Bureau: 3.4/5 stars based on more than 115 pieces of customer feedback

As you can see, most people enjoyed their time on the app. Customers said that Rocket Money lived up to its claim to help buyers balance their budgets. Here’s what one user wrote on Better Business Bureau.

“Their app interface is extremely user friendly and I find it easier to use than previous budgeting apps I’ve tried. Rocket Money really does all the work for you and is even helping me automatically put away money to save up for a car. They are slightly more expensive than Quicken’s budgeting app which I used previously, but it’s completely worth the extra charge in my opinion.”

Other Rocket Money reviews said that the service’s deep and robust features gave them a better understanding of their money. They learned their spending habits more quickly than if they would’ve calculated them themselves.

“I am amazed at the comprehensiveness of the application. The application has helped me in many ways to save money and lower my overall cost of day-to-day living. The application has pointed out to me some costly subscriptions that I didn’t realize I had. I recommend this application for everyone as a help to enhance their monetary budget,” wrote another customer.

Some negative Rocket Money reviews came from customers who had problems canceling their subscriptions or who didn’t know that they were being subject to monthly fees. This wasn’t the case with all customers. In fact, it was mostly in the minority of customer reviews. However, it seems that Rocket Money could be more straightforward with their payment and cancellation policies.

I want to wrap up this section of my Rocket Money review with one final customer testimonial.

“I started using this app about 8 months ago, and it changed my whole financial situation. I’m finally able to set a budget and track all my spendings. I love the feature where you split big payments and give them a future date to be part of the coming months.”

This reviewer went on to say that Rocket Money isn’t a magic bullet; you’ll have to do some work yourself. Ultimately, they decided that the work was worth it in the end. “Keep in mind that you need to spend some time organizing and labeling your past spending, setting rules, reviewing and editing until it’s all set, after doing that, it’s the best financial managing experience you’ll have.”

Is Rocket Money Legit?

Despite the negative comments I mentioned that cropped up in some Rocket Money reviews, I don’t think there’s anything that makes this app seem sketchy.

Is Rocket Money Worth It?

I’ll be honest with you; I’ve been paying for Apple TV for the past six months without using it once. I’m just too lazy to cancel it myself. Keeping that in mind, Rocket Money seems like a solid app to help rid my life of those annoying payments, and I doubt I’m the only person who would benefit from it!

Rocket Money Promotions & Discounts

I couldn’t find any promotions or discounts running at the time of this Rocket Money review.

How To Get Started On Rocket Money

Download the Rocket Money app on the Apple App Store or the Google Play Store. Alternatively, you can create your account on the brand’s website at www.rocketmoney.com.

FAQ

Who owns Rocket Money?

Rocket Companies owns Rocket Money.

What is Rocket Money’s Privacy Policy?

You can read through Rocket Money’s entire privacy policy on their website as it’s quite lengthy. In short, they won’t sell your information to third parties but your information may be passed through to credit card companies.

How is Rocket Money’s Customer Service?

Based on what users wrote in their Rocket Money reviews, the brand’s customer service is quite friendly and knowledgeable.

How to Contact Rocket Money

You can fill out a customer contact form on their website.

Next, check out some similar reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review