Current Bank Review

Table of Contents

About Current Bank

Imagine a world without ATM fees, where your checking and crypto accounts live harmoniously, and you can dip into overdraft without getting punished. Now imagine all of that is available on your phone. That’s the reality that Current Bank presents.

This company provides those services through support from Choice Financial Group and Metropolitan Commercial Bank, entities that handle all of the back-end work.

What matters for you, dear reader, is that the service has more than 4 million members and 73k Instagram followers. So you know they are a customer favorite.

In my Current Bank review, I will fill you in on what attracted these users to the service, what the card’s fees are like, and what actual users have to say about it.

The fully digital Current Bank provides services that connect many of the disparate elements that complicate modern finances.

Crypto, cashback rewards, speedy paychecks, and overdraft protections combine in a paperless bank account that caters to the modern investor’s whims.

For a better idea of what that means, check out the highlights section of my Current Bank review.

Highlights

- Covered by FDIC insurance for up to $250k

- Overdraft up to $200 with no fees

- 4% APY

- Available on the App Store and Google Play

- Direct deposits can enter your bank account more quickly

- Cashback rates up to 15 times more at over 14k stores

- More than 40k fee-free ATMs

- Buy and sell crypto without fees

Current Bank offers two types of accounts: the Current Bank Basic Plan and the Current Bank Teen Plan. I’ll cover what each of those entails up next.

Why You Should Trust Us

Our mission is to help you make better, more informed purchase decisions. Our team spends hours researching, consulting with medical experts, gathering insight from expert professionals, reviewing customer feedback, and analyzing products to provide you with the information you need.

Current Bank Bank Review

Current Bank offers users a wide variety of features that traditional banks simply can’t match. This includes:

- Savings of up to 15 times at thousands of retailers including popular stores like Burger King.

- Saving pods with a 4.00% APY.

- Three different savings pods each with a $2,000 upper limit.

- The ability to deposit cash into your account at retailers like Walmart and CVS.

- Removal of all gas station holds.

- The ability to buy and sell over 27 cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

The other account type Current Bank offers, the Teen Plan, is an excellent option for parents who want to teach their children to be financially responsible. It’s best to view it as a set of training wheels since parents still have plenty of control over their child’s finances.

With the Current Bank Teen Plan, parents can block certain retailers, receive notifications from all their child’s transactions, set spending limits, instantly transfer funds, automate allowances, and set chores.

Current Card Review

The Current Bank Card is your gateway to savings, cashback, and earlier paychecks. With it, you can receive paychecks up to two days earlier as they won’t be sitting in purgatory, stuck between bank accounts.

Additionally, you can use the Current Bank Card to deposit cash at retailers or earn cashback rewards that you can turn into discounts. This modern card is filled with ways to help you save and make your life easier.

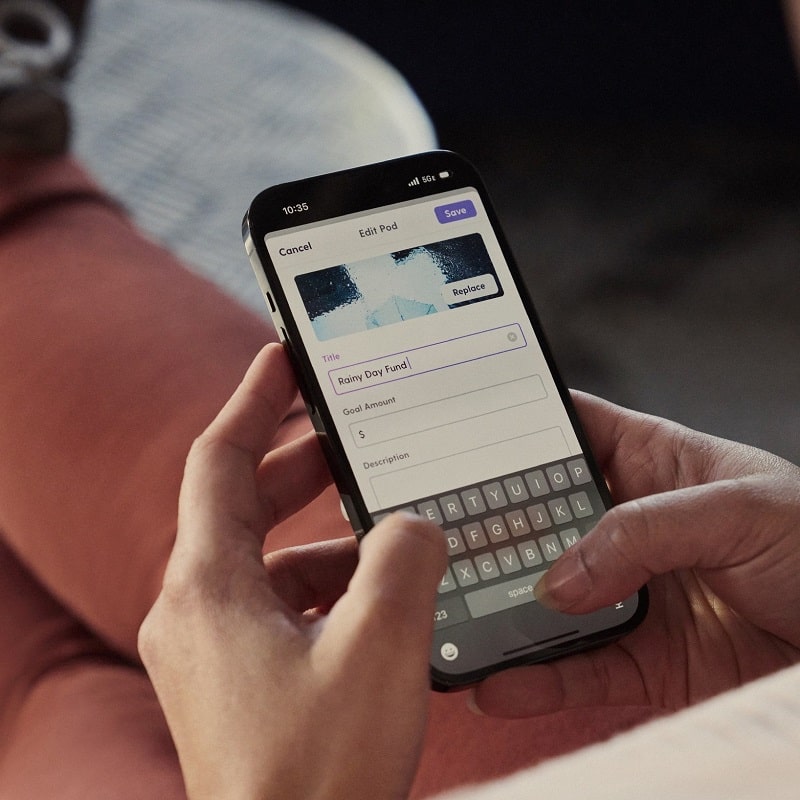

Current App Review

While the Current Card is important, the Current app is the crux of the operation here. As I mentioned earlier in my Current Bank review, the service is digital-only, meaning everything is conducted through the Current App.

Customers say they love using this app because there are no subscription fees and it provides a list of ATMs you can use for no additional fee. In addition to providing you with resources on how to save and invest your money, this app allows you to manage all of your finances in one easy-to-use interface.

How Does Current Bank Work?

You might be interested in signing up right away after reading about what Current Bank offers. So in this section, I will break down the sign-up process into four easy steps:

- Download the Current Bank app on your Android or iOS device.

- Fill out the required personal information like your name, email address, phone number, and social security number.

- Add funds through your debit card or bank account.

- Wait 7 to 10 business days to receive your Current Bank card in the mail.

And that’s it! Your account is active as soon as you complete the sign-up process, even without the bank card. You can use the virtual card that Current provides you through their app while you wait to receive your physical card in the mail.

Current Bank Fees

The Current Bank Basic Plan and the Current Bank Teen Plan both charge zero monthly fees. Also, there are no overdraft fees, minimum balance requirements, or internal money transfer fees.

However, there are ATM fees for when you use an ATM that’s not in Current’s network. These ATMs charge under $3 per transaction while international ATMs come with a $3 fee. The last fee you’ll face is a fee under $4 for adding cash to your account.

Current Bank Trustworthiness and BBB rating

Current Bank reviews on Better Business Bureau reported that customers faced difficulties transferring money between accounts. Some users also said that their money was stolen from their accounts or that they were locked out of the app.

That said, not all Current Bank reviewers were as disgruntled as those on Better Business Bureau. You’ll read more of what users thought about Current in a bit.

Who Is Current Bank For?

Due to the small limits on savings in the savings pods, I don’t think Current Bank is best for those who want to keep large sums of money at their disposal. Instead, Current Bank is best for folks who like to spend money as soon as they receive it.

Additionally, the service is great for parents who want to teach their teens to be financially responsible while maintaining some control.

Current Bank Reviews: What Do Customers Think?

To get a better understanding of what customers thought about this modern financial service, I gathered some Current Bank review scores I found on various websites:

- App Store: 4.7/5 stars from over 132k reviews

- Google Play: 4.6/5 stars after 140k reviews

- Trustpilot: 3.8/5 stars from over 2.2k reviews

Most Current Bank reviewers praised the banking service’s helpful features like their rewards program and control settings. One user wrote:

“The app is well-designed and easy to navigate. Plus, their actual banking services and debit card are top-notch with a great rewards program. I have yet to have an issue! Plus, the feature to block entire brands from charging your card is something I didn’t know I wanted until I used Current! Highly recommend.”

Current Bank also had longtime customers who swore by the company, saying that the speedy paychecks and customer service kept them loyal to the brand. As one user wrote:

“I’ve been with Current [since] 2019 and it has been such a great experience! I get my paycheck 2 days faster, sometimes 3 days! Customer service has been great and I’ve had no issues. I’ve recommended family and friends and they have enjoyed it as well!”

The final Current Bank review I want to highlight comes from a customer who echoed what many others said: Current was easy to use. Our last reviewer said it’s the best bank they ever had. Here’s why:

“They don’t make you jump through any hoops the app is easy to use and stress-free all the way! I had been looking for a mobile bank app and was frustrated by how many of them just ended up being a huge waste of time just throwing obstacles left and right to make it difficult to do anything you need to do. CURRENT makes it just easy and just hassle-free.”

This is all excellent feedback, but how does Current compare to other brands in the same industry? Let’s take a look.

Current Bank vs. Chime

While there are similarities between Current Bank and Chime, they have enough differences that could swing users towards one side. Current Bank offers 4.00% APY but only on balances up to $6,000. Meanwhile, Chime’s APY rate is 2% without a balance limit.

Chime also features a credit builder function that Current Bank lacks. On the flip side, Chime lacks the teen account plan that Current Bank offers. When it comes down to it, both services seem great depending on your specific needs.

Is Current Bank Legit?

The majority of Current Bank reviews claimed that the service was legit, though some customers felt that the company didn’t do enough to protect their money.

Is Current Bank Worth It?

The lack of fees and robust rewards are attractive enough to convince many people to swap to Current Bank. However, they should be aware that some customers weren’t satisfied with the service, and take their complaints into account.

Current Bank Promotions & Discounts

There were no discounts or promotions at the time of writing my Current Bank review.

How To Get Started On Current Bank

You can either download the Current Bank app or sign up on the company’s website to receive a direct link to the app for your platform.

FAQ

Who owns Current Bank?

Stuart Sopp, the company’s CEO, owns Current Bank.

Is Current Bank a free app?

Yes, Current Bank is free to download and has no monthly fees.

Which ATMs can I use with Current Bank?

There is a feature in the Current Bank app that shows the location of all Allpoint ATMs in your vicinity.

How much can you withdraw from the Current Bank Account?

Current Bank offers a daily withdrawal limit of $500 per day.

What is Current Bank’s Privacy Policy?

Current Bank uses the data you provide them to “facilitate and improve the Current service and communicate with you.”

How is Current Bank’s Customer Service?

According to Current Bank reviews, the brand’s customer service is reliable and helpful, though you may want to speak with them yourself.

How to Contact Current Bank

If you have any questions after reading my Current Bank review, you can submit a customer request form on the company’s website.

Next, check out some similar reviews you might like:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review