LoanDepot Mortgage Review

Table of Contents

About LoanDepot Mortgage

Purchasing a home shouldn’t cause any anxiety. It’s an exciting venture, especially if you’re upgrading from a small city apartment to a suburban mansion. However, the asking price can cause some tension. Mortgages can be a great way to quickly move into your dream home, but the question is, what company should you opt for?

If you value convenience, flexibility, and overall support, LoanDepot Mortgage can help soften the blow after closing on a house. Available in the U.S., this company is a trusted source among thousands of American homeowners. They’re also featured in a few media outlets, including HousingWire, Time, and Forbes.

Ready to say yes to the duplex? If so, perhaps this company can help you settle in much faster. Keep reading, as in my LoanDepot Mortgage review, I’ll take an in-depth look at the brand, its products, customer ratings, promotions, and more to help you decide if they’re worth checking out.

There’s no sob story with LoanDepot Mortgage. Its story mainly sticks to the facts. People need homes and with homes come mortgages.

Founded by Anthony Hsieh in 2010, this Californian-based company is considered a popular pick within the industry. They’ve got some impressive stats to show off, as they’ve funded over $275 billion since the brand’s debut and have helped over 27k clients each month.

LoanDepot Mortgage is committed to helping customers at every step of the process: “Our goal is to provide you with an exceptional level of care as we assist you in achieving your financial goals. To achieve that, we’ve assembled one of the best teams in the industry, who will provide you with the expert guidance you seek throughout your mortgage journey.”

Before I continue further in my LoanDepot Mortgage review, let’s go over some initial highlights.

Highlights

- Home mortgage lender

- Available in over 200+ locations

- Offers informational resources about mortgages

- Provides multiple loan options including FHA, fixed-rate, and VA

- An entirely digital process compared to manual paperwork

- Official mortgage provider for the MLB

- Positive customer reviews

That 2,500 sq ft property you’ve had your eye on features a marble-covered kitchen, a vintage wine cellar, a massive master bedroom, and a gorgeous backyard overlooking the lake.

Such a dreamy villa obviously calls for a hefty fee but if it’s in an agreeable range, paying it off shouldn’t be too much of a hassle. Unless you’re a billionaire, most homeowners opt for mortgages to help speed up the move-in day.

Is it your first time buying a house? If so, you’ll be glad to know that LoanDepot Mortgage offers a comprehensive list of resources concerning equities, refinancing, and loan types. If you’re wondering how their services work, I’ll provide a quick overview here in my LoanDepot Mortgage review.

Why You Should Trust Us

Our mission is to help you make better, more informed purchase decisions. Our team spends hours researching, consulting with medical experts, gathering insight from expert professionals, reviewing customer feedback, and analyzing products to provide you with the information you need.

LoanDepot Mortgage Features Review

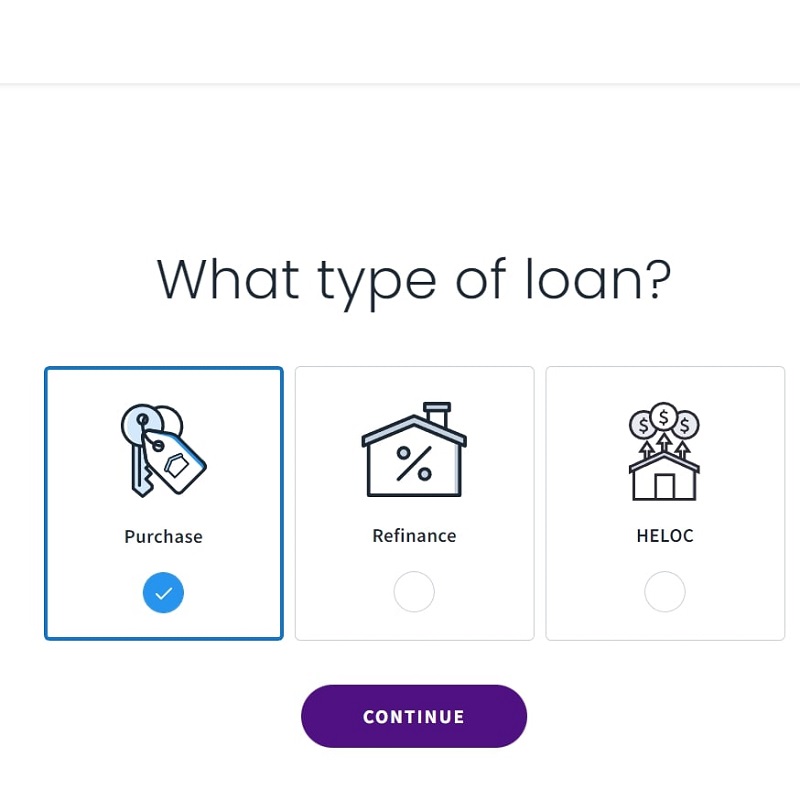

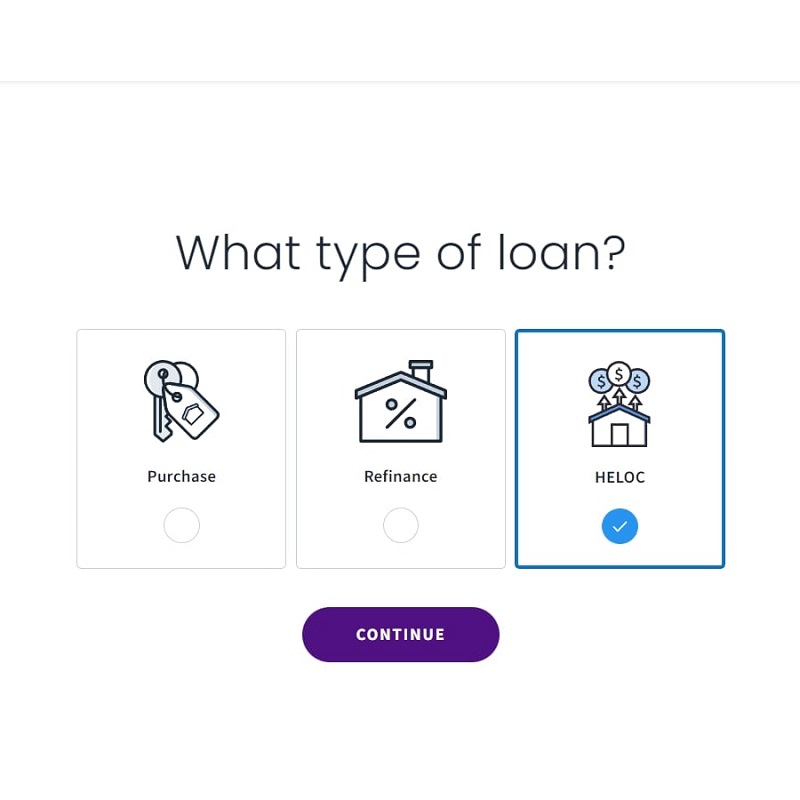

Simply put, LoanDepot Mortgage offers loans for homeowners to use in buying a new property. They offer a wide selection of options to choose from, including 203k, VA, FHA, Jumbo, fixed rate, and more. Customers can also apply for refinancing and HELOCs on their website.

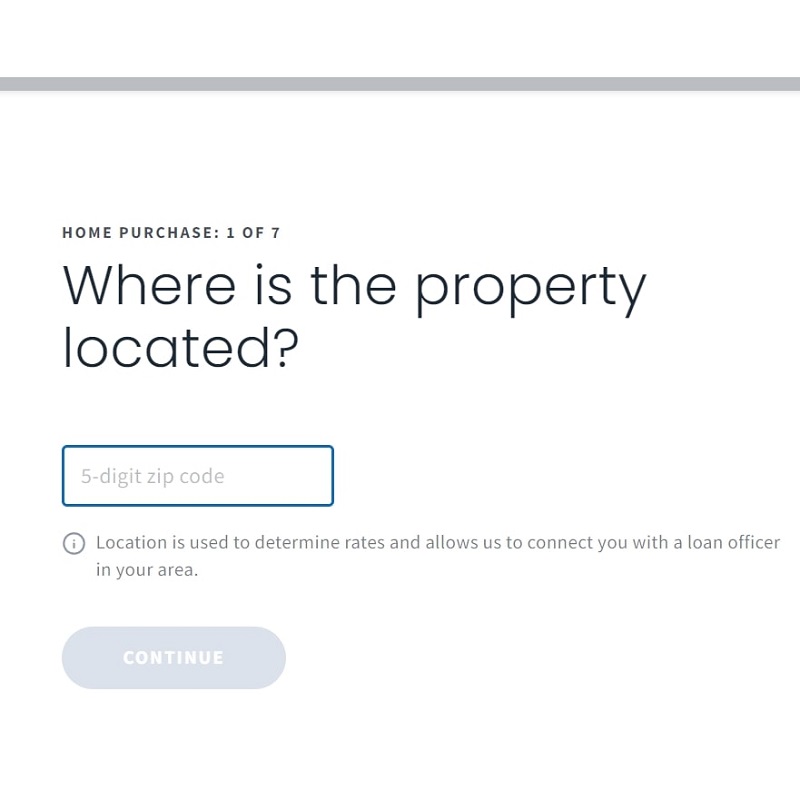

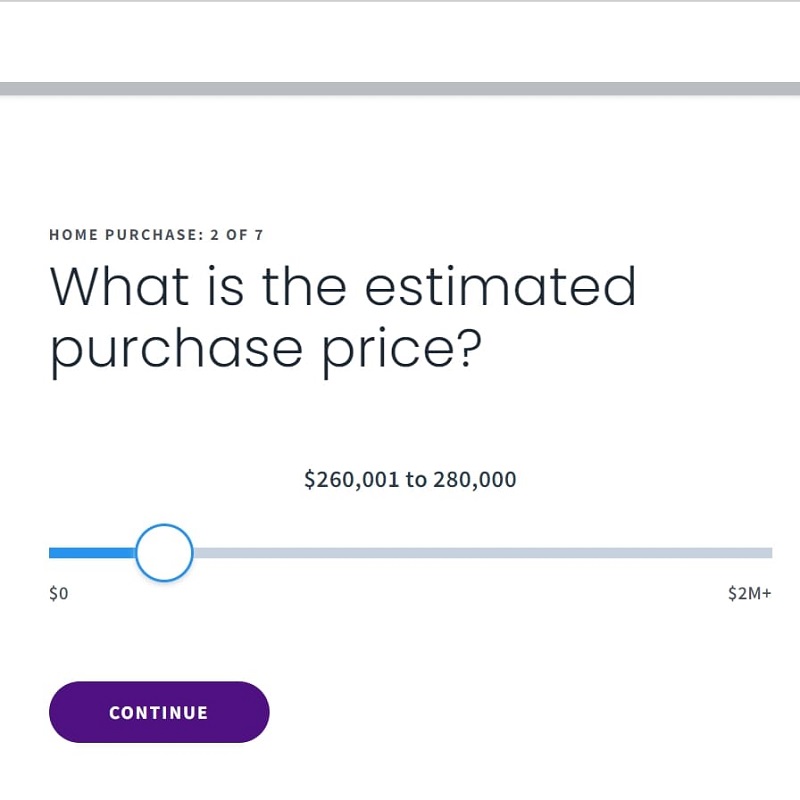

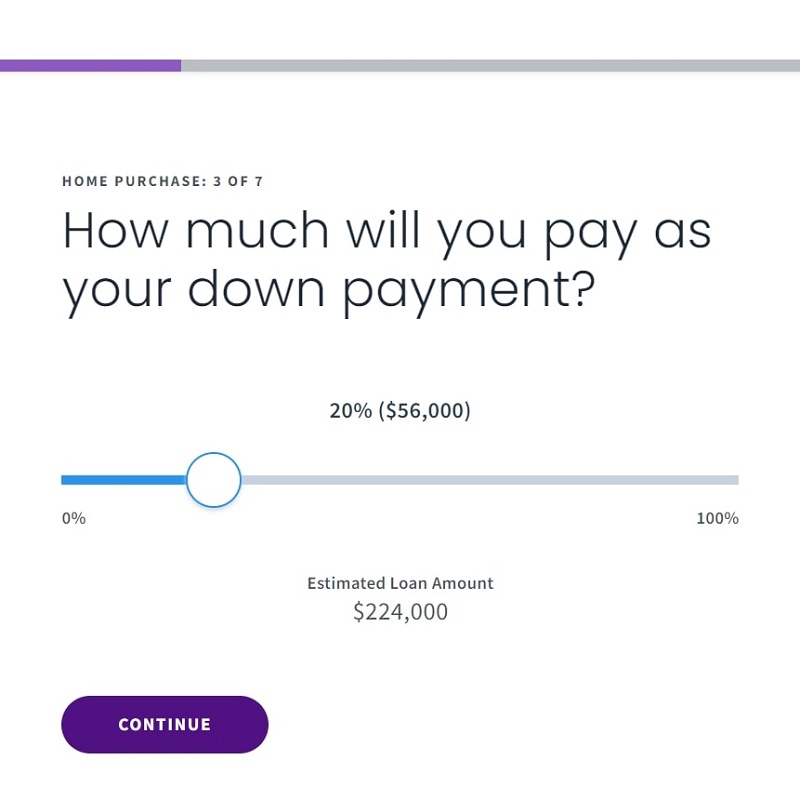

To get started, you’ll need to provide some information about your property address, estimated purchase price, how much you’re willing to pay for your down payment, and other crucial details in order to consolidate a plan.

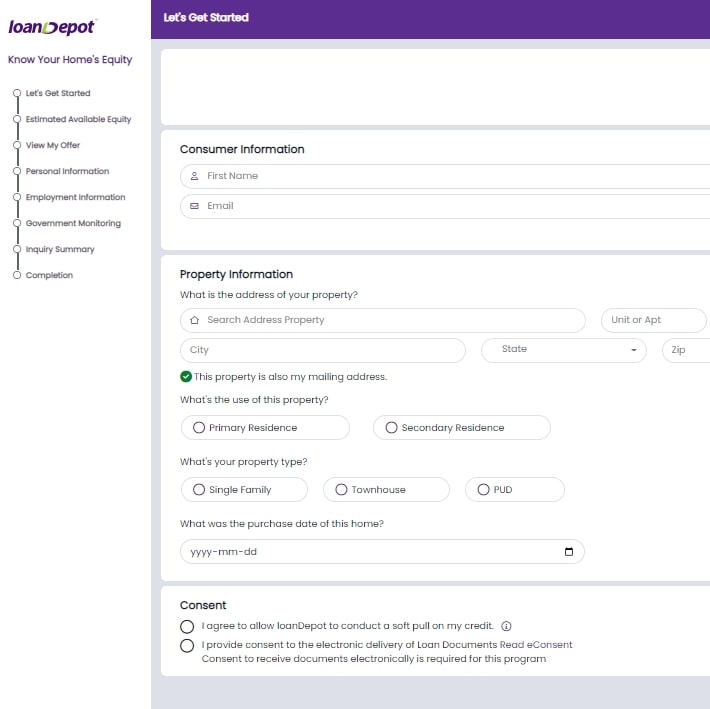

For HELOCs, the process works a bit differently. To apply, you’re required to fill out a quick form in order to get a personalized quote. Again, it’s worth mentioning that LoanDepot Mortgage offers a great list of resources on its website concerning loans, equity, and other related topics if this is your first time purchasing a house.

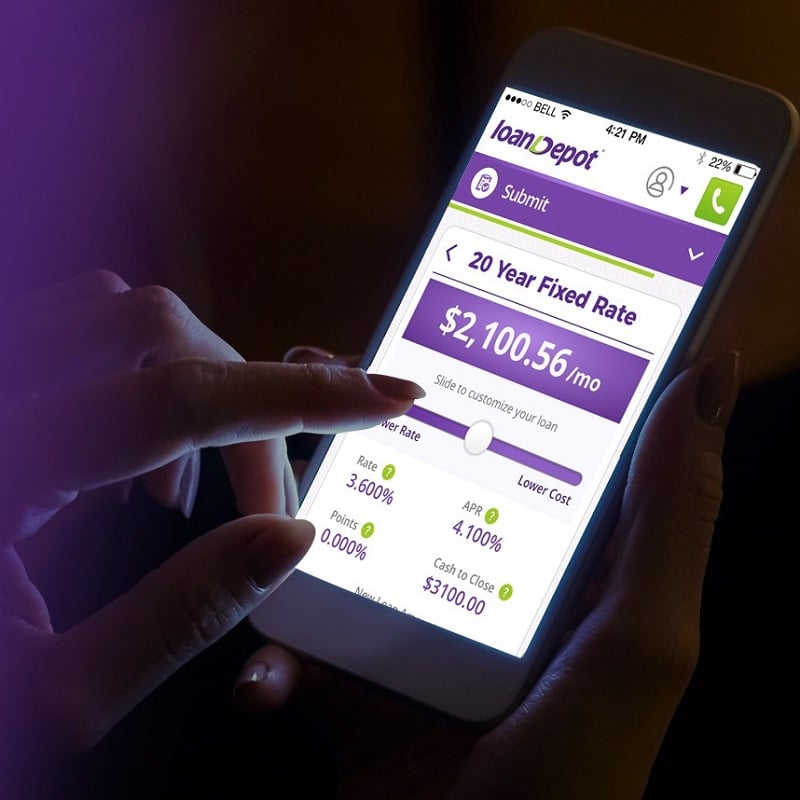

LoanDepot Mortgage App Review

Long gone are the days of messy paperwork. If you’re looking for a more convenient way to access your payments, overall standings, and financing history, the company offers a handy LoanDepot Mortgage App for customers to download. This program is available on both the App Store and Google Play.

Through the application, you can schedule payments, view your loans, and review your billing history. You can also opt for autopay to help make ensure no missed deadlines. Oh, and just a quick note, the brand offers a convenient QR code on its website as an easy way to download the LoanDepot Mortgage app.

How Does LoanDepot Mortgage Work?

One of the main advantages of using LoanDepot Mortgage is that the application is done online. The brand utilizes Mello technology, a software that “powers every transaction.” Designed to be super secure, signing up shouldn’t cause much worry. If you’re looking to join, I’ll give you a quick rundown next.

To sign up for a mortgage or refinancing, simply click on the “apply now” button located in the top right-hand corner of the website. Click either option to get started.

Next, the brand will ask you a series of questions. This will include your property’s zip code, the asking price, how much you’re willing to pay for down payments, your credit score, and other important information.

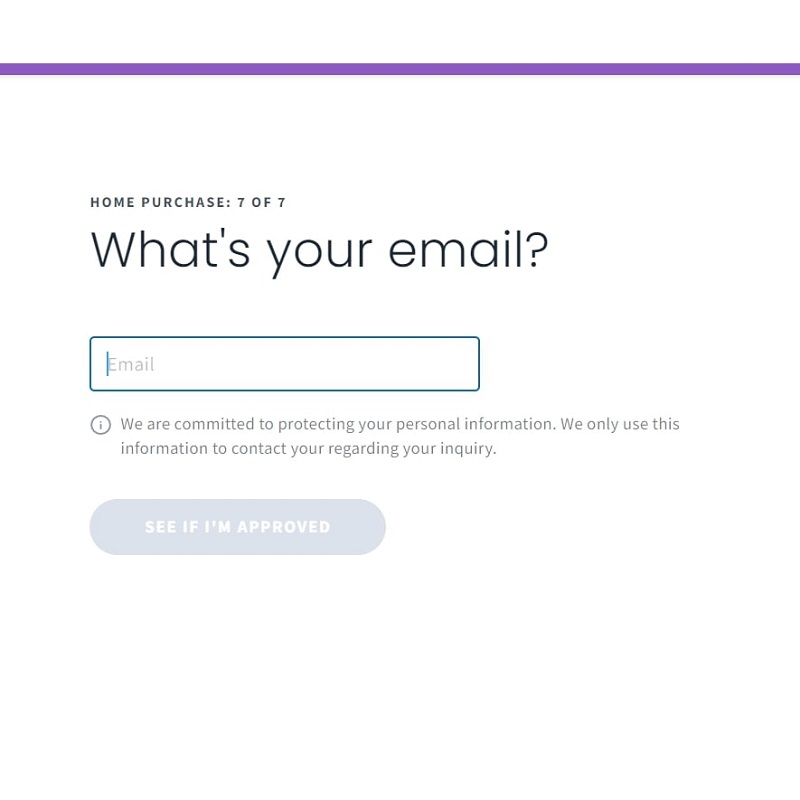

Lastly, it’s time to provide your phone number and email address. LoanDepot Mortgage will assign you to a loan officer to help guide you through the next steps.

As I mentioned, HELOCs work a bit differently. To apply for this option, revisit the brand’s main page and click on the “apply now” button again. This time, click on the HELOC box.

This will redirect you to an online form, where you will be required to fill out some specific information concerning your property, place of employment, government documents, and other necessary details.

LoanDepot Mortgage Fees

Like most mortgage lenders, there’s no standard fee. It’s a case-by-case basis, as it really depends on the property value, how much you’re willing to pay on a periodic basis, and your credit score. LoanDepot Mortgage offers a handy home loan and refinancing calculator on their website if you’re not ready to fill out an application just yet.

Who Is LoanDepot Mortgage For?

I think it goes without saying that LoanDepot Mortgage is for anyone looking to buy a house. It’s a great online service to use if you value efficiency and convenience, as signing up is relatively easy. It’s best to have a good credit score to help ensure that your application is improved.

LoanDepot Mortgage Reviews: What Do Customers Think?

Mortgages can be messy and anxiety-inducing, but it seems that most customers reported a positive experience with LoanDepot Mortgage. The company has yet to publish testimonials on its official website, so I thought to include some outside sources to beef up my LoanDepot Mortgage review. This includes sites like:

- The Better Business Bureau: 3.8k reviews with 4.05/5 stars

- Credit Karma: 1.5k reviews with 3.7/5 stars

- Consumer Affairs: 603 reviews with 4/5 stars

Helpful, communicative, and reportedly professional, LoanDepot Mortgage customer service was praised highly by thousands of homeowners. Others shared success stories of refinancing their loan and settling on a mortgage plan that they agreed with.

One customer on Consumer Affairs wrote: “Their digital platform is very user-friendly. They keep me informed of changes in the mortgage industry. I receive sufficient notice of changes to my account. They keep me informed of their latest financial products. Their mortgage approval process was very smooth and timely.”

Some clients stated that LoanDepot Mortgage was efficient and timely in processing applications, like this user on BBB:

“This was the best experience I have had with any type of loan. I was able to contact my agent either by phone or text and he responded immediately. He worked hard and fast and I was able to close faster than I ever expected. I recommend going with them and will be sending my family and friends.”

In another positive review, one client was particularly impressed with how patient and informational LoanDepot Mortgage representatives were in explaining the process for new applicants. “Everyone has a lot of patience explaining things to me as this process is new to me. Things seem to flow seamlessly, and they notify me as they need to.”

Considered a reputable company when it comes to mortgages, LoanDepot should definitely earn a spot in your list of considerable brands. That said, I did come across a few customer complaints that are worth including in my LoanDepot Mortgage review. I’ll cover those in the next segment.

Is LoanDepot Mortgage Legit?

There are a few negative LoanDepot Mortgage reviews published online. Most of these deal with issues concerning payments and customer service. Given that there are only a few of these types of complaints, you can take care knowing that LDM is still a legitimate brand.

Is LoanDepot Mortgage Worth It?

I can wholeheartedly rate this brand with two thumbs up in this LoanDepot Mortgage review. The brand manages to make refinancing, HELOCs, and mortgages easy for new-time customers, which is partially thanks to its Mello software.

Comprehensive in available resources and neatly organized when it comes to the application process, LDM is definitely worth checking out if you’re looking to buy a new home.

LoanDepot Mortgage Promotions & Discounts

At the time of writing my LoanDepot Mortgage review, I didn’t find any promotions or discounts to include.

How To Get Started On LoanDepot Mortgage

To fill out an application, you can visit loandepot.com to get started. You can also download the mobile app on the App Store or Google Play.

FAQ

Who owns LoanDepot Mortgage?

LoanDepot Mortgage is owned by founder Anthony Hsieh.

What is LoanDepot Mortgage’s Privacy Policy?

According to their website, here is the brand’s privacy policy: “We collect information about you to help us serve your financial needs, to provide you with quality products and services, and to fulfill legal and regulatory requirements.”

How is LoanDepot Mortgage’s Customer Service?

Reviewers on BBB and Consumer Affairs reported that LoanDepot Mortgage’s customer service was generally helpful in answering questions and addressing concerns.

How to Contact LoanDepot Mortgage

For any questions unrelated to my LoanDepot Mortgage review, you can contact the brand through:

- Phone: (888) 337-6888 ext. 6789

- Email: [email protected]

- Fill out a contact form

Their customer service team is available weekdays from 10:00 am to 9:00 pm EST.

Check out some of our recently published articles:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review