Nav Review

Table of Contents

About Nav

Owning a small business can be a tough ship to steer. Compared to chains and corporations, sole proprietorships have unlimited financial liability and limited capital.

While it’s easy to get caught up in the complications of your lifelong dream to run your own shop, let’s not forget that there are businesses out there that are designed to support you. This is where Nav comes in.

This online service works to link store owners with the best credit cards and loans to ensure peace of mind. It’s worth noting that Nav isn’t a bank. It’s actually a financial management app you can use instead of dealing with messy paperwork.

Boasting over 10.3k Instagram followers and features in magazines such as Yahoo Finance, it seems that Nav is a top choice among entrepreneurs.

Are you looking to open your dream bakery or arts and crafts store? If so, perhaps this app can be of some help. Stay tuned, as in this Nav review, I’ll take an in-depth look at the brand, its services, customer ratings, and more to help you decide if they’re worth checking out.

Nav exists to “reduce the death of small businesses.” It’s a tough world out there, and nobody knows it better than serial entrepreneur Levi King. Over the past 20 years, he has established over 7 sole proprietorships.

King was well versed in the difficulties of making it on his own, which served as the initial inspiration to found his 8th brand. Thus, Nav was officially born in 2012.

With the help of co-founder C. Vance Hanson, Nav works to find the best solutions for financially challenged business owners. The company is currently headquartered in Draper, Utah.

Before I kickstart my Nav review, let’s go over some highlights.

Highlights

- Convenient way to find credit cards, insurance plans, and loans for small business owners

- Helps to make it easier to run your business

- Mobile app for on-the-go checking

- Lots of resources concerning financial management

- Easy to sign up

- Positive customer reviews

While overcoming difficulties is imperative in achieving a thick skin when surviving entrepreneurship, it doesn’t mean that it’s a solo endeavor. Nav is here to help, as this financial management app pairs you with the best loans, credit cards, and accounting solutions to help make sure your brand stays afloat.

So, how does it work? To keep things straightforward, I’ll feature some of their services and programs next in my Nav review.

Nav Business Credit Review

Whether you’re sourcing ingredients for your bakery or purchasing products for your family-owned convenience store, getting a credit card is an important way to reduce financial stress. Plus, it’s a more organized way to keep track of your monthly or yearly business expenses.

If you’re uncertain of what banking company to choose from, Nav makes it easy. Depending on your current credit score, they will match you with the best credit card plan for you. Options range from Bank of America, American Express, and the GM Business Card.

It’s worth mentioning that Nav offers resources on why it’s important to sign up for a credit card and how to get started.

Nav Loans Marketplace Review

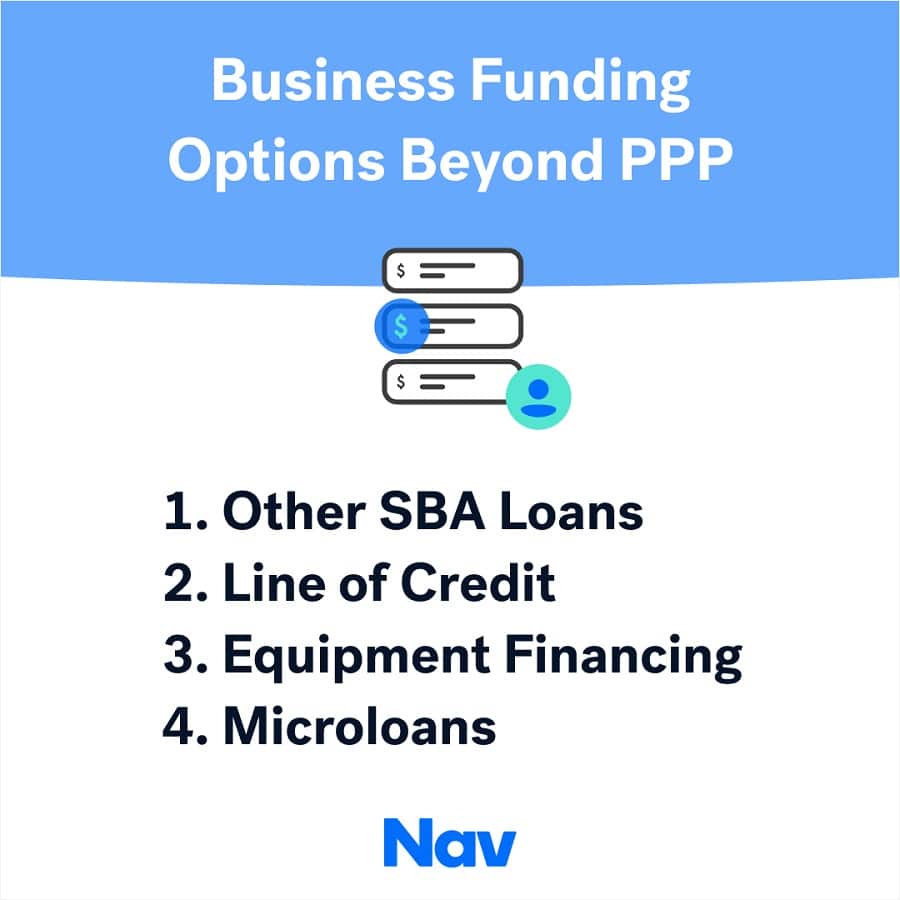

Small dreams often need big investments. That’s why most entrepreneurs look into getting a loan to start their businesses. Fortunately, Nav offers several options for members to choose from.

Organized by loan amount, APR, financing type, and annual revenue, plans include cash advances by Credibly, Kapitus, Kabbage, and RF Rapid Finance.

If you’re unsure where to start, Nav provides a convenient graph comparing different types of loans. Varieties include merchant cash advances, business lines of credit, equity crowdfunding, and more.

Nav will walk you through the pros and cons associated with each option. Plus, you can always consult their resource center found on the app.

How Does Nav Work?

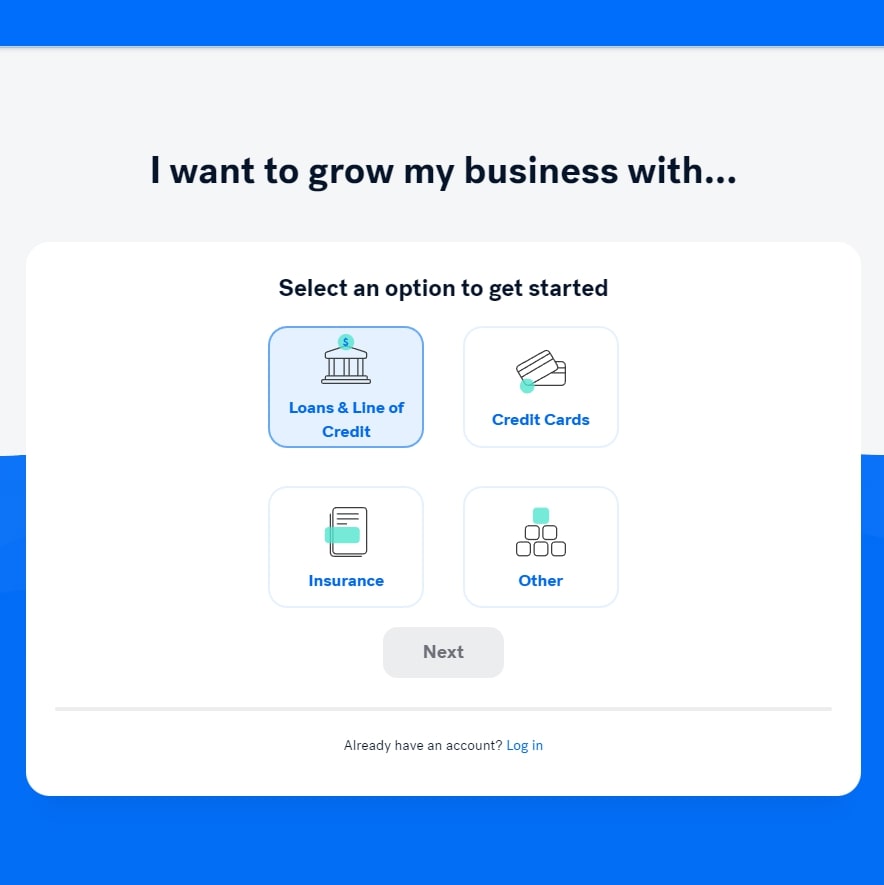

As this service is only available for U.S.-based customers, if you live in the United States, I’ll provide a quick overview of the sign-up process. To begin, customers must click on Get Started located on the top right-hand corner of the front page.

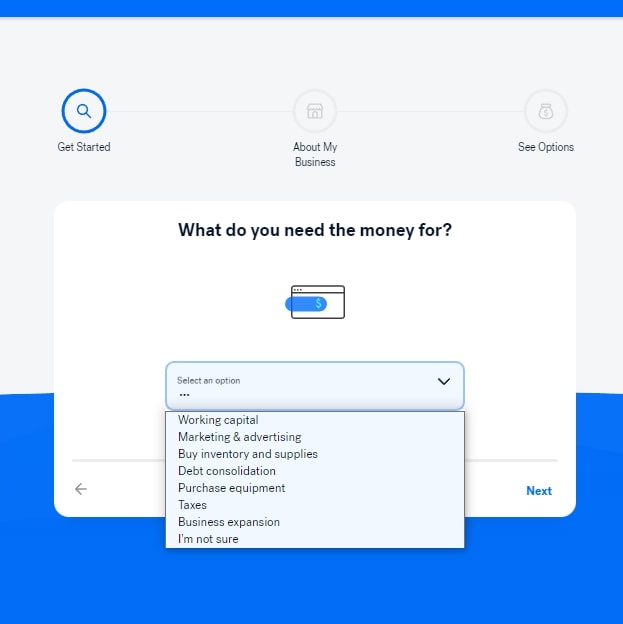

After, you’ll be redirected to the registration page, where you must select one of the four available options. For the purposes of my Nav review, let’s click on Loans & Lines of Credit and see where that takes us.

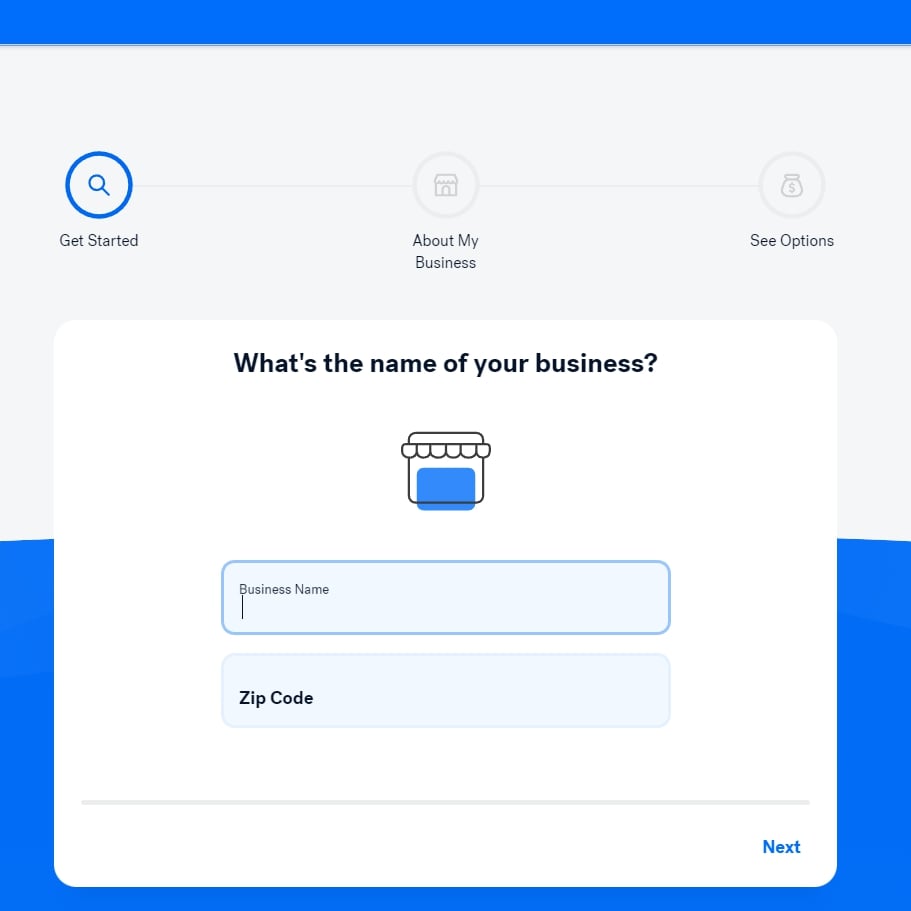

Now it’s time to provide the name of your company and your zip code.

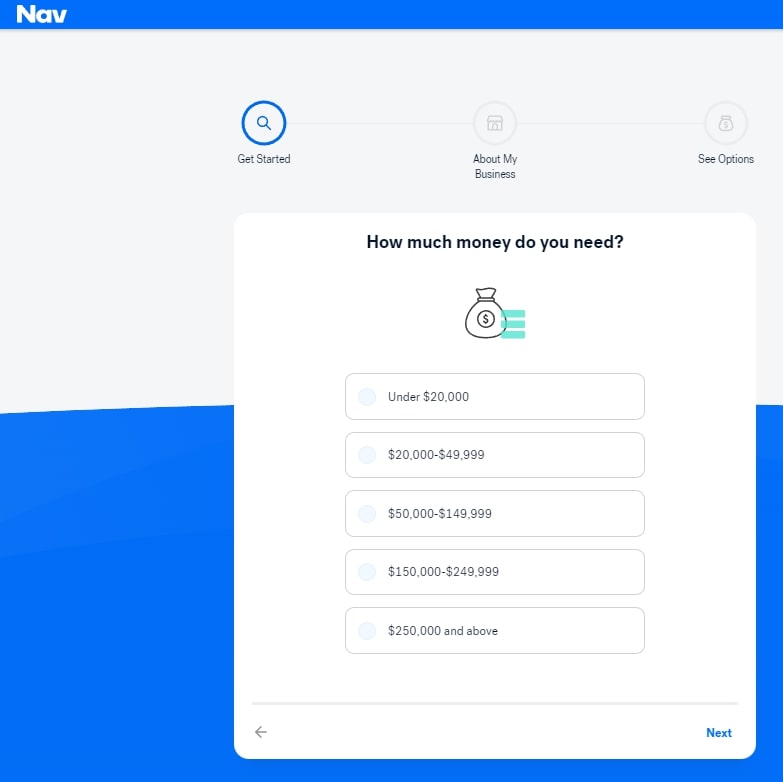

Once you input your information, Nav will ask more specific questions about your business. This may include questions about how much money you need, when you launched your brand, and what you need the loan for.

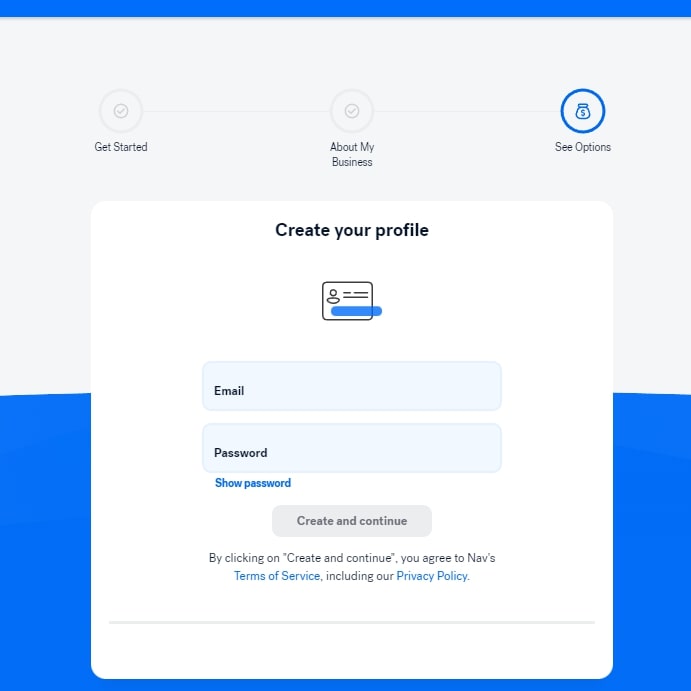

The next step is to share some basic info. This includes sharing your name, credit score, and phone number.

Lastly, customers will need to create a profile to review their options. From there, it’s smooth sailing.

How To Use Nav

A good business owner should be on top of their yearly expenses. While most are used to occasional PC-checking, having a mobile app that keeps track of every dollar spent is a much easier alternative.

Once you’ve created your Nav account, the brand will link you with the best options to ensure your business stays in tip-top shape. Members can either use the app to view their ongoing financial history or utilize the brand’s resource center for questions related to banking solutions.

Nav’s pick of recommended credit cards, loans, and insurance plans is determined by the information you share on your profile. Lenders will review details about your credit score, how much money you require, and how you plan on spending the cash advances. Once your request has been approved, the lender will provide the loan needed.

Nav Features

So, what makes Nav a groundbreaking app? If you aren’t keen on making more space on your phone, I’ll go over some revolutionary features that customers can enjoy:

- Financial History: business data, expense reports, and transactions are all made available on the Nav app.

- Financing Options: Nav offers 160+ financing plans, lenders, and credit cards for all types of businesses.

- Cash Flow Insights: these are personalized insights to ensure continued financial health.

- Wide List of Business Services: programs include insurance, payroll services, accounting solutions, and business grants.

- Resource Center: available to all customers who have questions related to financial management.

Nav Fees

Nav offers two plans for customers to choose from. Members can either select the Business Boost program, which is $50 per month, or opt for the Business Basic plan, which is completely free to use. To keep things simple, I’ll outline the features associated with each option to help readers make a more informed decision:

Business Basic

- $0 per month

- Includes business and personal credit accounts

- One-on-one meetings with credit and lending experts

- Actionable cash flow insights and alerts

Business Boost

- $50 per month

- Includes all the features provided in the Business Basic plan

- $1 million identity theft protection

- Identity restoration services

- Follow up on 5 businesses’ credit reports

- Lost wallet replacement

- Simple quarterly billing option

- Tradeline reporting for business credit support

Who Is Nav For?

Nav exists for committed entrepreneurs. This financial management app is designed to take away some of the stress associated with running a business, as it works to keep track of your expenses, loans, and credit history. Plus, Nav is a great starting point if you’re unfamiliar with the world of business banking.

Nav Reviews: What Do Customers Think?

Financing your small business is no walk in the park. You need all the help you can get. With that in mind, can Nav truly be a light in the dark? According to several 5-star Nav reviews, it seems like this app is a nifty asset for entrepreneurs. Here are some of my findings:

- Nav.com: 739 reviews with 4.3/5 stars

- Trustpilot: 210 reviews with 4.5/5 stars

- Consumer Affairs: 10 votes with 3.5/5 stars

Nav’s painless sign-up process is attracting hundreds of small business owners. Praised for its convenience and support, the brand’s app is definitely a hit. Take it from two customers who left rave Nav reviews:

“Nav made the entire process of procuring an American Express Business Card painless. I greatly appreciate utilizing Nav to increase my Company’s viability,” one customer wrote on their website.

“Thanks to NAV for giving great recommendations on products and because of those great recommendations I was able to secure not one but two business credit cards” another reviewer detailed.

Websites such as Trustpilot and Consumer Affairs featured glimmering testimonials concerning the brand’s level of customer service and independent blogs, such as Business.org, also had a favorable critique of the brand as well. There, the reviewer was quick to point out certain features, including Nav business credit monitoring services and personalized financing matches:

“Nav tackles business financing from several different angles. It offers small-business loans, credit cards, credit monitoring, and more ― all personalized just for your business. Put simply, rather than address just one piece of the financing puzzle, Nav takes a holistic approach to business funding.”

For the amount of support that you get, it seems that Nav is something worth considering if you’re looking to establish your own business. That said, I did uncover some negative comments worth discussing in the next section of my Nav review.

Is Nav Legit?

In terms of negative Nav reviews, there are a few Trustpilot users who noted issues with the brand’s customer service that was reportedly unhelpful in offering solutions and recommendations.

Independent blogs, such as Business.org, weren’t a fan of the company’s website, as it looked disorganized and confusing. Aside from this, I didn’t find any red flags worth including in my Nav review.

Is Nav Worth It?

If you’re looking to hit the ground running, Nav is a good place to start. They pair business owners with the best recommendations about credit cards, insurance plans, loans, and more.

Considering the vast amount of praise towards their level of customer service, it’s quite apparent that the company doesn’t leave you hanging. Convenient and easy to use, I can confidently recommend their services.

Nav Promotions & Discounts

At the time of writing, I didn’t find any promotions or discounts to include in my Nav review.

How To Sign Up on Nav

Looking to launch your small business? If so, you can head over to Nav.com. You can also sign up by downloading the app on Google Play or the App Store.

FAQ

Who owns Nav?

Nav is owned by founder Levi King.

What is Nav Credit Monitoring?

Nav Credit Monitoring works to ensure that you have good business credit. Maintaining a decent score can help you get funding and increased capital.

Does Nav Credit Monitoring offer identity protection?

Only Nav’s premium plan offers identity protection.

How does Nav help build business credit?

It’s worth reiterating that Nav isn’t a financial institution. If you’re concerned about building credit, they offer a wide list of resources to help you do just that.

Is Nav credit accurate?

According to several sources, Nav credit is quite accurate. I highly recommend consulting with a brand representative if you have any concerns about your current finances.

What is Nav’s Privacy Policy?

Nav’s Privacy Policy states that they “may use personal information collected about you to provide you with products, services or information that you request.”

What is Nav’s Cancellation Policy?

If you wish to cancel your Nav plan, you must contact the brand’s customer service directly.

How to Contact Nav

For any questions or concerns unrelated to my Nav review, you can contact the brand through:

- Email: [email protected]

- Filling out the contact form on their website

- Using the chat function online

- Visiting one of their home offices in California, Utah, or Pennsylvania

Next, check out some similar reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review