Kubera Review

Table of Contents

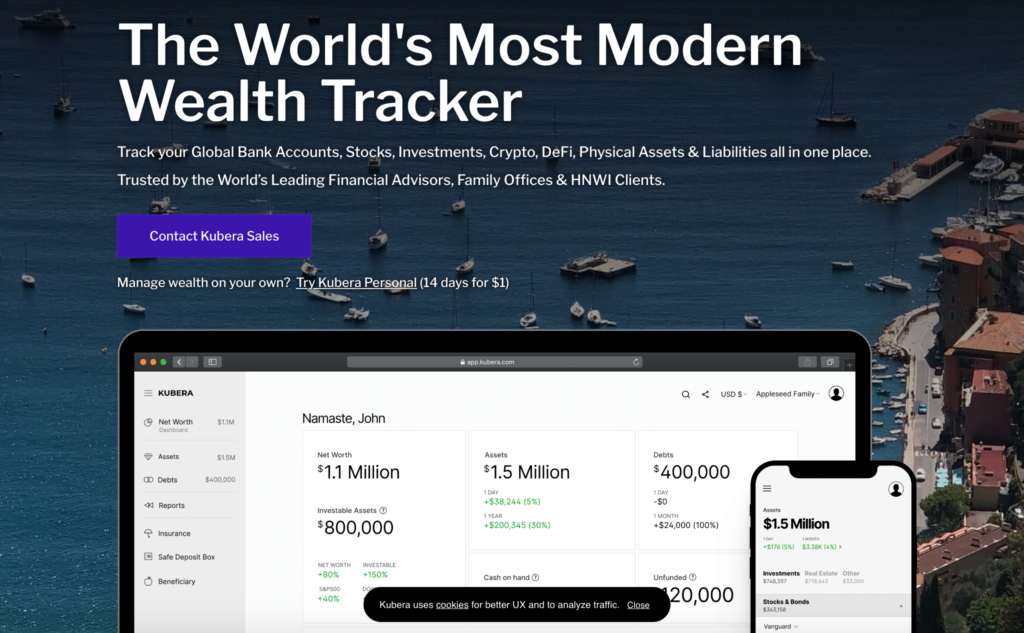

About Kubera

Amid bill payments, transfers, and loans, it can be hard to feel like a wealthy tycoon these days. But don’t underestimate your earnings. If you’re looking for a convenient, organized way to manage your money and stocks, perhaps it’s time to add Kubera as an important bookmark.

This program allows you to connect your bank and brokerage accounts, crypto wallets, stock holdings, and more. You can also track NFTs, which are all the rage these days.

While Kubera is relatively new to the stock and crypto industry, they’ve gained an impressive amount of publicity for their services. The brand has been featured in media outlets such as Forbes and The Economic Times.

Not keen on tracking your earnings and expenses manually? If so, maybe it’s time to switch to a virtual organizer. Stay tuned, as in my Kubera review, I’ll take an in-depth look at the brand, its services, customer ratings, promotions, and more to help you decide if they’re worth checking out.

Overview of Kubera

Surprisingly enough, Kubera was created in a moment of terror. Rohit Nadhani was caught in a riptide during his trip to Costa Rica. He was thankfully rescued, but that brief moment of horror prompted him to review his assets as a sort of will and testament.

After compiling a comprehensive list on Google Sheets with his wife, Nadhani believed there must be a better way to keep track of his resources.

This inevitably led to the establishment of Kubera in 2019. Headquartered in California, this monetary management software is headed by founders Nadhani, Manoj Marathayil, and Umesh Gopinath.

This online program is committed to organizing profits and expenses in a well-designed manner. Before I kickstart my Kubera review, let’s go over some highlights.

Highlights

- A central hub to review assets, debts, and investments

- Tracks bank accounts, crypto wallets, stock holdings, and more

- Services are protected with bank-level security

- Available as a mobile app

- Positive customer reviews

You’re a seasoned go-getter. You’re the type of person that has their foot in several doors of opportunity. But such a busy lifestyle demands some sort of organization.

Those involved in stocks, investments, and other number-crunching avenues can use Kubera as their personal virtual assistant. This online portfolio manages and tracks your monetary moves, so you don’t have to.

Looking to graduate from Google Sheets? If so, perhaps this management tool can be the update you need. I’ll provide a quick overview of their services in the next section of my Kubera review.

Kubera Affiliate Program Review

At the time of writing, Kubera doesn’t offer an affiliate program. It’s relatively new to the industry, so it’s possible that they might launch one in the future.

They do, however, provide referrals. Their policy doesn’t run like a traditional reward system, as customers must simply keep using Kubera to be considered. To reap the benefits, recommend the service to your friends, family, and colleagues.

If you’ve successfully convinced someone you know to use Kubera, the brand will reward you with $100 of discount credits, which you can use towards your subscription.

Kubera App Review

There are moments when checking your Kubera profile is vital. Sometimes it’s an incurable itch like Instagram scrolling. Other times, incoming news concerning stock rises and failing NFTs prompts you to quickly review your assets.

Nevertheless, Kubera offers a handy mobile app for customers to download. It’s worth noting that this application cannot be downloaded on Google Play or the App Store.

Instead, you’ll need to visit app.Kubera.com online. Once you’ve landed on the page, click the share button to add the profile to your home screen. From there, you’ll be able to easily access your portfolio whenever you wish.

Kubera’s management tool includes several useful features, which are organized into distinct categories such as net worth, assets, debts, insurance, safe deposit box, and beneficiary.

How Does Kubera Work?

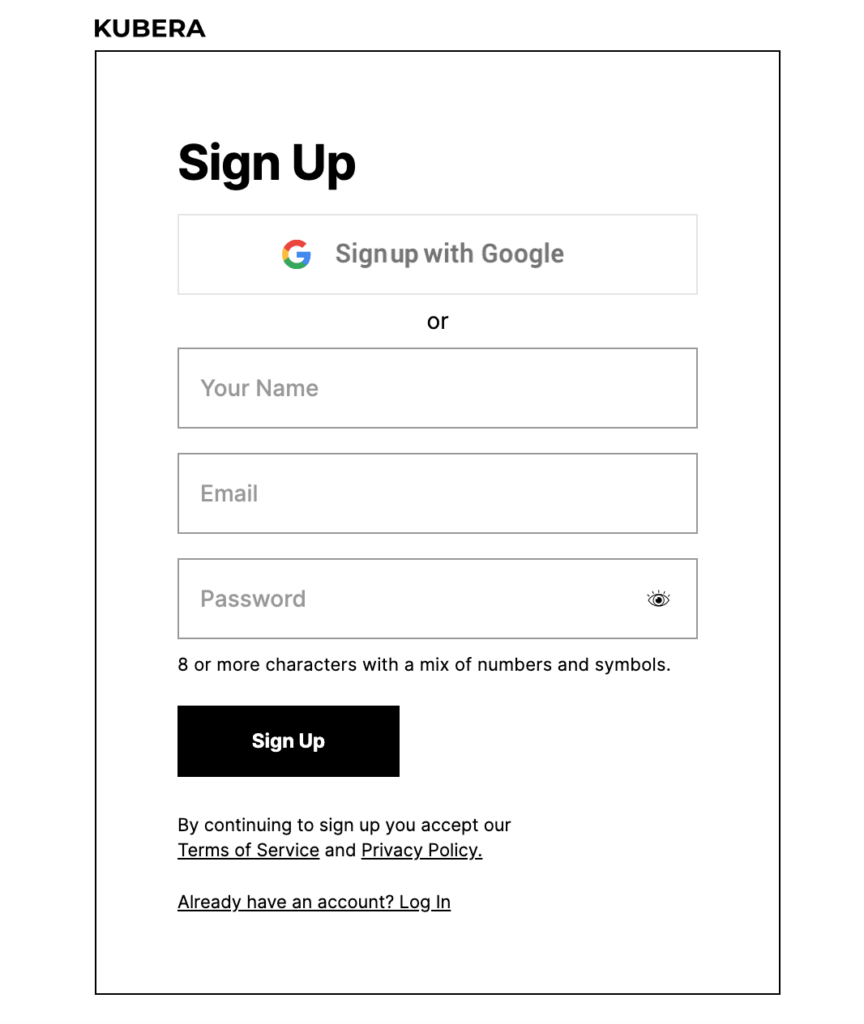

So, how do you sign up for a Kubera account? It’s actually pretty straightforward. If you need a quick step-by-step, I’ll provide a brief rundown in this section of my Kubera review.

First, you need to click the “sign up” button located in the top right-hand corner of the screen.

Once you’ve clicked on the link, you’ll be redirected to a sign-up page. You’ll need to input your email address and create a password. After completing this step, the brand will send you a confirmation email with a verification link in its description.

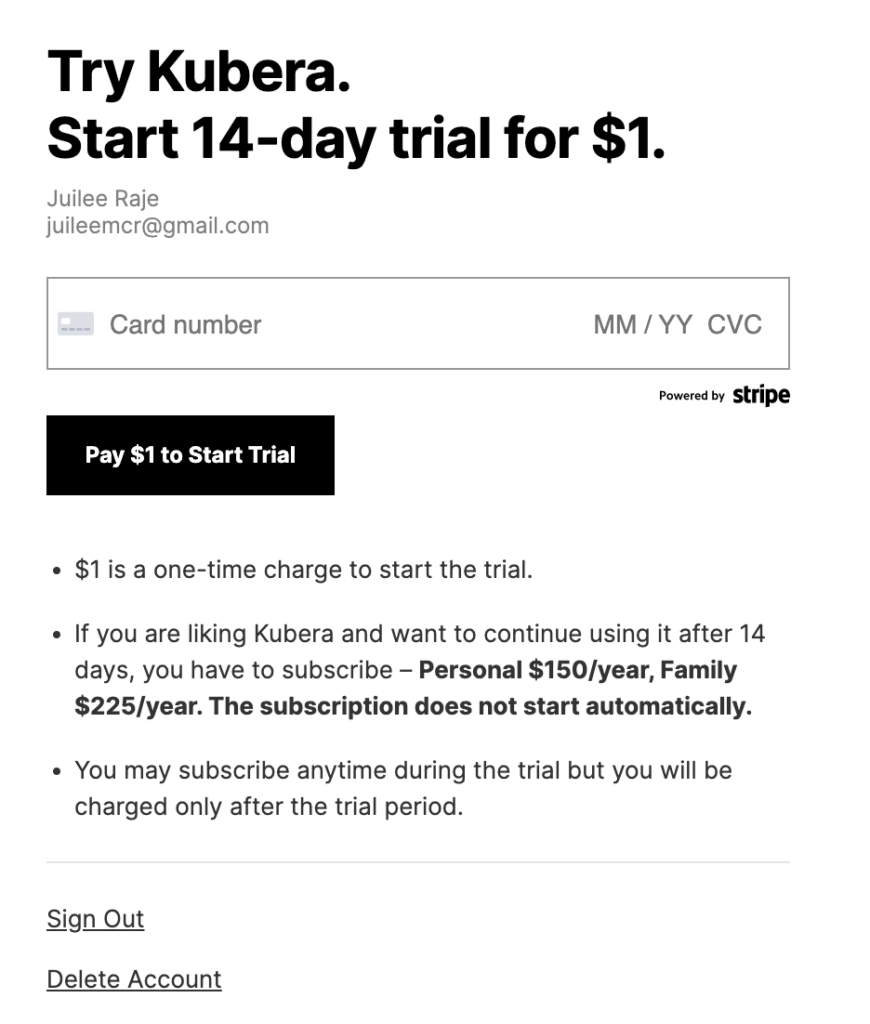

Next, you’ll get a pop-up in front of your actual account screen. To proceed, you’ll need to sign up for a 14-day free trial for just $1. After that period, you’ll need to pay the set fee to continue using Kubera.

It’s worth noting that financial advisors, portfolio managers, and other related positions can request a demo. In that case, you can click the link “white-label Kubera for Institutions” which is located at the bottom of the website.

Kubera Fees

Unlike virtual journals which are typically free to use, Kubera isn’t a free service. You’ll need to pay for a membership to access all of their features.

For financial advisors and small businesses, professional accounts cost $150 per month. For personal accounts, Kubera costs $150 annually. As I mentioned, the brand offers a 14-day trial for just $1. It’s a great way to test Kubera to see if it works for you.

Who Is Kubera For?

Kubera is great for people who want to easily track all of their assets. This includes investments, bank accounts, debts, stocks, and other monetary resources.

Given the cost of the brand’s services, Kubera is catered to high-net-worth individuals, financial advisors, and businesses.

Kubera Reviews: What Do Customers Think?

Kubera values convenience, but do they actually provide it? According to several happy customers, it seems that Kubera passes the vibe check. The brand hasn’t published customer testimonials on its official page, but I did find several critiques elsewhere. To kickstart this segment of my Kubera review, I’ll share some average scores:

- Reviews.io: 444 reviews with 4.7/5 stars

- Investor Junkie: 4/5 stars

- Credit Donkey: 4.3/5 stars

Customers appeared to be happy with Kubera and how helpful it is in tracking finances and investments, Most users loved that the service was organized and easy to use.

One customer on Reviews.io said: “Best platform I’ve used to track net worth. Simple to use and reliable. Support is incredibly responsive to questions. One simple fee and I don’t get inundated with financial planners looking to manage my portfolio. Highly recommend.”

Investor Junkie wrote: “With Kubera, you get a seamless, premium net worth tracking tool. You have to pay for the luxury, but for more complicated portfolios, the annual price could be worth it.”

Independent blogs such as Credit Donkey were quick to appreciate specific Kubera features including its currency conversion calculator:

“For maximum convenience, Kubera connects to thousands of banks, brokerages, and exchanges to make syncing all your accounts easy. A nice perk for crypto is that Kubera converts their value into your native currency, so you can quickly see how a single Bitcoin or £1,000 GBP affects your net worth in USD.”

Professionally run and organized, Kubera should be considered a long-term investment for accomplished entrepreneurs and businessmen. Before I give out my full recommendations, I thought it best to go over a few negative complaints I found to complete my Kubera review.

Is Kubera Legit?

In terms of negative Kubera reviews, some users found their services too expensive. A few members weren’t impressed with the brand’s features and level of customer service.

That said, you can relax knowing that the amount of negative critiques is quite small compared to the positive ones published online.

Is Kubera Worth It?

It’s worth reiterating that Kubera caters to a specific audience. People who juggle multiple investments, accounts, and investments may find the brand’s services helpful in organizing their workspace.

But if you only have a few “pots boiling,” it’s probably best to stick to simpler online portfolios to help save some money. I can confidently recommend this company to accomplished entrepreneurs and businesses.

Kubera Promotions & Discounts

Aside from the brand’s referral program, I didn’t find any promotions or discounts worth including at the time of writing my Kubera review.

How To Get Started On Kubera

To create an account, you can visit kubera.com to get started. You can also access the Kubera app by clicking app.Kubera.com.

FAQ

Who owns Kubera?

Kubera is owned by founders Rohit Nadhani, Manoj Marathayil, and Umesh Gopinath.

What is Kubera’s Privacy Policy?

According to their website: “personal data of Kubera users is collected and retained for the purposes of providing the user with a modern-day wealth tracker.”

How is Kubera’s Customer Service?

I haven’t uncovered much information concerning Kubera’s customer service. Although, the reviews I did find were generally positive.

How to Contact Kubera

For any questions or concerns unrelated to my Kubera review, you can contact the brand directly through:

- Email: [email protected]

- Filling out the contact form online

Next, check out some related reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review