Hargreaves Lansdown Review

Table of Contents

About Hargreaves Lansdown

We all have the same 24 hours in a day. We may look at different screens and watches, but at the end of the day, we’re all watching the same little hand overtake the same big hand. That’s how particularly ambitious people justify using every hour of the day to make money. Each second you’re not making money is a second you’re losing money, so they say.

I doubt that the associates at Hargreaves Lansdown, the UK’s top-rated private investing platform, would echo those sentiments aloud, but it’s not like those folks are wrong. But rather than juicing yourself to the gills with energy drinks and working around the clock, why don’t you let some of your money grow over time by investing it with Hargreaves Lansdown?

They were named the best online stockbroker of 2022 in the ADVFN Financial Awards along with winning a gold medal in customer experience from Times Money Mentor. That customer popularity is also evident by their large follower count on Facebook, which numbers more than 45k. Additionally, they have droves of positive customer testimonials on various websites.

In my Hargreaves Lansdown review, I will provide you with the information you need to make an informed decision about whether or not the brand is right for you. You’ll learn about their history, what they offer, what they cover, what their fees are like, what customers say about them, and more.

Overview of Hargreaves Lansdown

Many people find it difficult to start investing because of a lack of knowledge. Simply put, people don’t know how to invest and who they should invest with, myself included. I’d love to put away some of the money I’m not currently using and watch it grow over time, but I have no clue where to start.

That’s where Hargreaves Lansdown comes in as they know there are people like me, folks who want to invest but don’t want to get burned by a bad investment. So they built a system that helps beginners.

But they don’t try to rope in folks who never had an interest in investing. Instead, they cater to people who have always wanted to dip their toes in the investing waters but never learned how to swim. Additionally, they provide avenues in which experienced investors can stay in the game.

Their diverse strategies come from a long history of investing. They first established themselves in 1981. Bristol, UK friends Peter Hargreaves and Stephen Lansdown founded the company from their bedroom. Over time, they sharpened their approach and streamlined it. The crux is that they help people hold multiple account types in one area.

I’ll go into the details of how their system works after running you through the highlights section of my Hargreaves Lansdown review.

Highlights

- UK’s #1 investment platform for private investors

- Live market updates

- The company can invest for you

- Tax-free investment accounts

- Thousands of positive customer reviews on multiple websites

- Trusted by 1.6m investors

- No account opening fees

- No charge for buying and selling funds

In my Hargreaves Lansdown review, I will break down the three primary investment strategies they provide to users.

Hargreaves Lansdown Services Review

The main service Hargreaves Lansdown offers is a universal hub for your money. Through them, you can store your pensions, savings, ISAs, and investments all in one location. It removes the need for the headache process of constantly balancing books and excel spreadsheets as the company will keep all that messy info in one place.

Hargreaves Lansdown positions itself as a great place for you to store your money. But beyond that, they take huge steps towards financial expansion with their roster of services that can help your money grow over time.

Their retirement program is one such service. It provides you with a pension that you can access at any time. You can either allow your money to stay safe with income for life or treat it like an investing account.

Hargreaves Lansdown’s retirement plans are not subject to UK tax or capital income tax, so they’re intelligent caches for money that you don’t need at the moment.

Speaking of investing, I couldn’t continue with my Hargreaves Lansdown review without mentioning what makes the company such a great investment service. They are, after all, the number one broker in the United Kingdom.

They offer you plenty of options when it comes to investing, meaning that you can put your money towards:

- UK Shares

- International Shares

- Investment Trusts

- Exchange-Traded Funds

- Bonds

- IPOs

Hargreaves Lansdown also has in-depth investing tutorials that you can access for free. These blogs cover topics like:

- Rules of thumb when it comes to investing.

- Building your portfolio.

- The relationship between risks and investing.

- How to build good investing habits.

- The benefits of diversifying your investments.

The sheer number of funds that you can select from is another asset that Hargreaves Lansdown purports. They hold access to over 3,000 funds that you can choose from when it comes to buying or selling.

Hargreaves Lansdown’s exchange rates are also great, meaning that you may retain more money with them if you travel than you would if you used another financial service.

Hargreaves Lansdown App Review

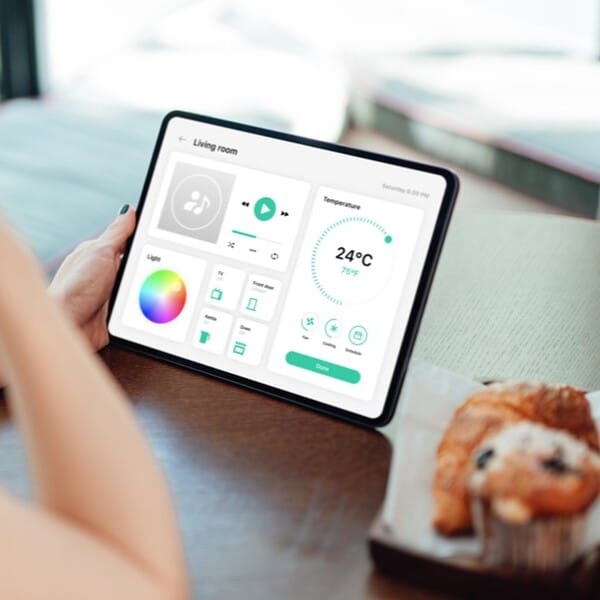

Seeing how Hargreaves Lansdown is a legacy company it may be surprising to see how much thought and consideration they put into their mobile apps. However, those efforts seemingly paid off.

As one user said: “This is a really great app. They really did think about the user experience as the flow is intuitive and presentation/visualizations make sense. Highly recommended for others starting out in investment. I’ve used this app for years and it works well.”

Their app is available on both the Google Play Store and App Store and seemingly runs well according to customers. You’ll see their exact customer scores later in my Hargreaves Lansdown review, but all you really need to know is that all the services I laid out are accessible through the app.

How Does Hargreaves Lansdown Work?

Investing with Hargreaves Lansdown is as simple as clicking a mouse. The company simplifies the process as much as you’d like. You can allow them to handle the investing work for you by selecting one of the portfolios they assembled based on your information.

However, if you want to take a more hands-on approach, then Hargreaves Lansdown provides you with that opportunity too.

And if you think investing is easy with Hargreaves Lansdown, then you’re going to lose your wig when you see how simple it is to sell shares! All you need to do is choose the shares you want and then confirm the trade.

Hargreaves Lansdown will do all the work associated with prices and transfers. The only thing you need to do is sit back and wait for the money to enter your account.

But let’s go back to how you’d set up that account. You may think that it’s a can full of worms when in reality it’s pretty straightforward. The process can be completed through the company’s website and Hargreaves Lansdown’s employees can guide you toward the proper account for your needs.

Hargreaves Lansdown Fees

Here’s a piece of good news, there are no inactivity fees with a Hargreaves Lansdown investment account. There are also no start-up fees, meaning you can open an account virtually for free.

The main way that the company figures out your fees are by checking whether or not you have funds or shares in your accounts. If you have shares then there are no charges. However, you’ll receive charges based on the value of your funds.

If you possess less than £250,000 in funds then you’ll receive a 0.45% charge. Funds valued between £250,000 and £1 million come with a 0.25% charge. Finally, funds that sit between £1 million and £2 million will be charged at 0.1%. Once you hold over £2 million in funds then you won’t be charged anything.

Now while Hargreaves Lansdown doesn’t charge you for buying or selling funds, they do charge for the number of deals. It’s a bit of a workaround in all honesty. Here are the charges they assign per deal:

- 0 to 9 deals in the previous month: £12 per deal

- 10 to 19 deals in the previous month: £9 per deal

- More than 20 deals in the past month: £6 per deal

Hargreaves Lansdown Account Types

What attracts Hargreaves Lansdown to potential investors and customers is the wealth of account types they offer. Obviously, I don’t mean wealth in that they literally provide you with money, but that they have multiple diverse account types, each of which is best suited to a particular need.

Their accounts include:

- Stocks and Shares ISA: a tax-free account in which you can save up to £20,000.

- Fund and Share Account: a limitless account with a £1 opening fee that prioritizes effortless and hassle-free trading.

- Self-Invested Personal Pension: a tax-free growth account with no UK tax or investment income. Contributions can reach up to £40,000 per year.

- Lifetime ISA: a good account for growing small investments, you’ll receive a 25% government bonus on any contributions made to this account.

- Active Savings: the most hands-off account as you can match rates and savings from different banks. It’s taxed as savings interest.

- Junior SIPP: an account you can create for your child to help them when they reach adulthood. You’ll receive a 20% tax boost from the government with this account, experience tax-free growth, and no UK taxes on investment income.

- Junior Stocks and Shares ISA: an account for children under the age of 18 that anyone with authorization can contribute to. It has a maximum limit of £9,000 and tax-free withdrawals.

- Cash ISA: a no-frills account that comes without tax on withdrawals and can save up to £20,000 per year.

That’s a daunting number of accounts. If you feel like you’re unsure which one is the best for you then I can empathize. Thankfully, Hargreaves Lansdown has a crack team of financial advisors that can steer you towards the proper account for your goals.

Additionally, there’s a handy drop-down menu that filters through Hargreaves Lansdown’s account to tailor them to your requirements.

Who Is Hargreaves Lansdown For?

There are plenty of people who would likely enjoy what Hargreaves Lansdown offers. I’m specifically thinking of those who want to set up multiple investment accounts as the company’s premise is based on balancing those accounts with simplicity.

Hargreaves Lansdown Reviews: What Do Customers Think?

To give you an idea of what people thought about Hargreaves Lansdown, I journeyed into some of the most perilous places on the internet: customer review sections. Normally, this would fill me with dread in the face of enraged keyboard warriors, but most people were kind in their Hargreaves Lansdown reviews.

To prove that, I’ve put together a list of some of the brand’s average scores:

- App Store: 4.7/5 stars, 45k reviews

- Smart Money People: 4.5/5 stars, 65 reviews

- Trust Pilot: 4.3/5 stars, 7k reviews

- Google Play Store: 4.1/5 stars, 11k reviews

- Reviews.io: 3.3/5 stars, 9 reviews

Many Hargreaves Lansdown reviews came from long-time clients. Their dedication came from the brand’s professionalism, specifically their customer service. Hargreaves Lansdown members were routinely described as being a pleasure to work with, such as in this buyer’s review:

“I have been a client of HL for many years. I have always found them to be friendly and professional. The website is very easy to use and the telephone contact is easy and the staff are very helpful. The probate changes were done effectively and at speed.”

Customers also enjoyed how Hargreaves Lansdown streamlined the investment process. They could see breakdowns and analyses of top funds and specific areas from the HL landing page that only presented the most vital information. The website and apps were both easy to navigate in users’ eyes, which was another reason why many people stuck with the service.

On top of that, buyers appreciated how simple it was to register and start investing. Hargreaves Lansdown’s setup helped them see which companies and brands would be the wisest to invest in, reducing the stress of the act. People also didn’t have to deal with complex paperwork or long email chains.

This is what another customer wrote in their Hargreaves Lansdown review: “Easy to access online or contact direct, always very helpful, and never any pressure sales. Keeps you informed through emails and explains clearly and possible pitfalls. A few very good services.”

Another user summed up their experience by saying that while the brand is a great platform, it’s arguably more beneficial for those who already have a bit of basic investing knowledge. Here’s their justification as to why:

“A good company to arrange stock market trades. The website is quite good, and solid, but there are a lot better websites out there for comparing stocks. Best in my experience to ignore their tips as you will often be steered towards the better commission options for HL.”

They concluded by saying: “So bottom line ok for dealing, not the cheapest! In line with most of these money houses they are there to max out their revenue stream so maybe take any steers/ recommendations with a pinch of salt.”

Sadly, there were some complaints I found while reading Hargreaves Lansdown reviews. They centered on the app, which is to be expected as those are often subject to disruptions and bugs. They spoke about problems with functionality, slow loading times, and not storing their information.

Is Hargreaves Lansdown Legit?

Besides the complaints about the app, I couldn’t find enough dirt about Hargreaves Lansdown to make me consider them sketchy.

Is Hargreaves Lansdown Worth It?

Since you don’t need to pay any fees to open an account, and the company has such stellar financial advice, I’d recommend at least checking them out. If you’re even a bit curious about investing then you’d likely find something that interests you.

Hargreaves Lansdown Promotions & Discounts

There were no promotions running at the time of writing this review.

How To Get Started on Hargreaves Lansdown

You can either make an account on the brand’s website, www.hl.co.uk., or through their app which is available on the App Store and the Google Play Store.

FAQ

Who owns Hargreaves Lansdown?

I’m not sure who owns Hargreaves Lansdown currently as Peter Hargreaves sold his shares in 2021.

What is Hargreaves Lansdown’s Privacy Policy?

They use your information to protect you from fraud. If you want to read the full privacy policy then you can access it on the company’s website.

What is Hargreaves Lansdown’s Cancellation Policy?

There are no cancellation or transfer charges if you want to move your money over to a different provider.

How to Contact Hargreaves Lansdown

You can fill out a contact form on their website, or by calling one of the phone numbers directly associated with your problem. You can find all that information here.

Next, check out some related articles you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review