Chip Review

Table of Contents

About Chip

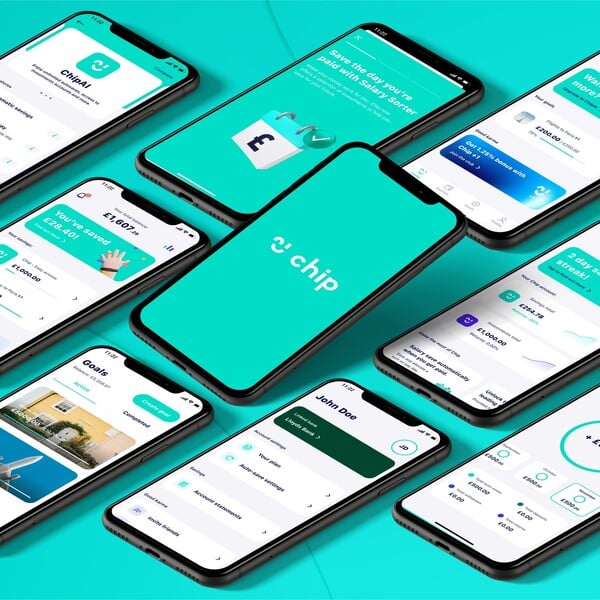

Investing and saving are rarely so simple. On the contrary, it involves calculation, planning, and patience. While it’s up to you to implement these three techniques, Chip can lend a helping hand in terms of organization. This mobile app allows users to view assets, funds and accounts in real-time while on the go.

Since its 2016 debut, Chip has carved itself a place in the financial industry. The brand currently boasts an impressive 13.6K following on Instagram. Oh, and did I also mention that they’ve won a couple of awards for their services? Chip was voted the Best Finance App of 2022 by the British Bank Awards.

In need of a reliable way to measure your wealth? If so, perhaps this brand can be of some help. Keep reading this Chip review as I take an in-depth look at the company, its products, customer ratings, and more to help you decide if they’re worth checking out.

Overview of Chip

Chip is a brand that likes to get to the point. There’s no backstory or ground-breaking realization tied to the company’s history, at least not at the moment.

Founded by Simon Rabin and Alex Latham in 2016, this ‘fintech challenger’ first started off doing auto-savings back in its heyday. Now, it assists thousands of clients in investments and savings. Chip has reportedly helped over 500k users.

It’s worth noting that Chip is currently a work in progress. The brand is looking to implement more features in its program, including DeFi and crypto.

Before I push further in this Chip review, let’s go over some initial highlights.

Highlights

- Considered a convenient hub to view investments and savings

- Offers a wide selection of funds to choose from

- Available to download on the App Store and Google Play

- Affordable

- Positive customer reviews

From the get-go, terms like investment, banking, and cryptocurrency typically denote feelings of confusion and boredom. That isn’t solely the case with Chip, as they manage to make savings and funds look exciting.

The brand’s website features flashy imagery, easy-to-read text, and information relayed in a conversational tone. Basically, Chip is the type of company you’d nonchalantly talk about during a casual dinner.

If you require an uncomplicated way to view your assets, Chip has you covered. I’ll be sure to discuss their services, memberships, and pricing next in this Chip review.

Chip App Review

Chip works harder, so you don’t have to. It’s considered a great app if you’re constantly on the go, as all of its services and programs are designed to work on mobile devices. Chip allows its users to create an organized profile of their assets, whether that be funds, investments, crypto, or current savings.

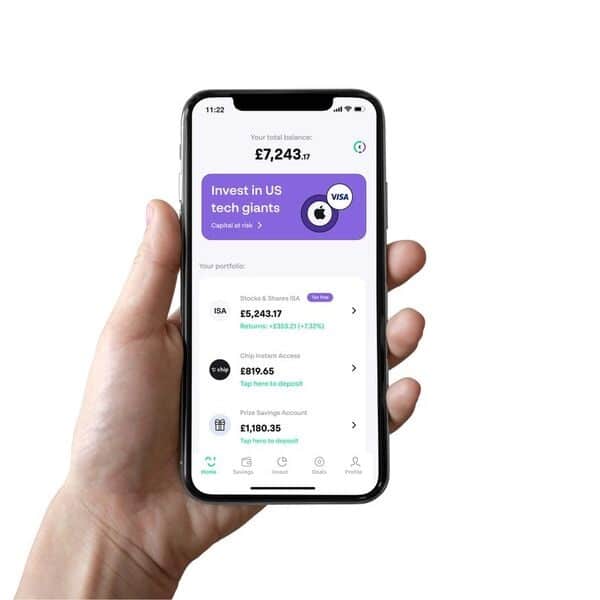

If you’re just getting started, I recommend opting for Chip’s basic plan. It’s completely free to use and includes two types of accounts: general investment and access to leading savings. Other key benefits feature Chip instant access and FTSE 100 index fund.

Those familiar with the brand’s services can upgrade to their monthly plan for only $5 per term. This option comes with several additional programs, including stocks and shares ISA and unlimited withdrawals.

It’s worth mentioning that Chip is only available for American customers. Fingers crossed that they’ll make their services available to other countries in the future.

Chip Financial Review

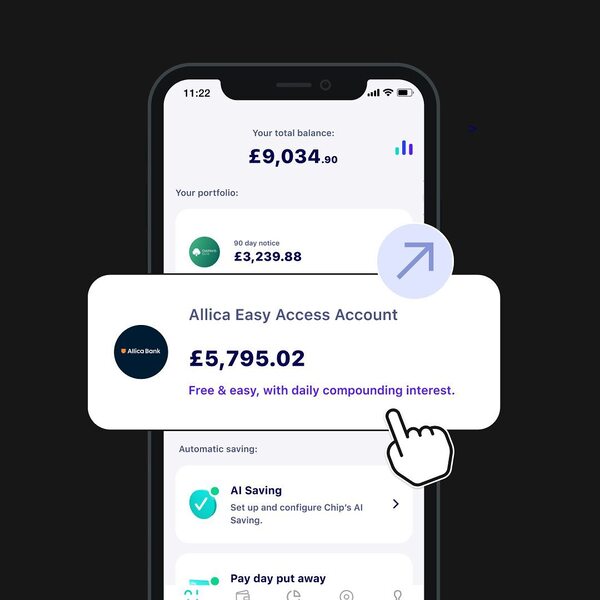

Chip offers two types of services: investments and savings. The latter option is recommended for those who want to build on their current wealth, as the brand offers several avenues to increase savings, ranging from wine to art.

Additionally, clients can partake in funds as Chip offers zero platform fees and hands-free investing. Themed funds include FTSE 100, healthcare innovations, and clean energy. In the near future, Chip looks to add alternative assets as a way to ‘spice’ things up. You can look forward to investing in luxury items such as Rolex watches and Ferraris.

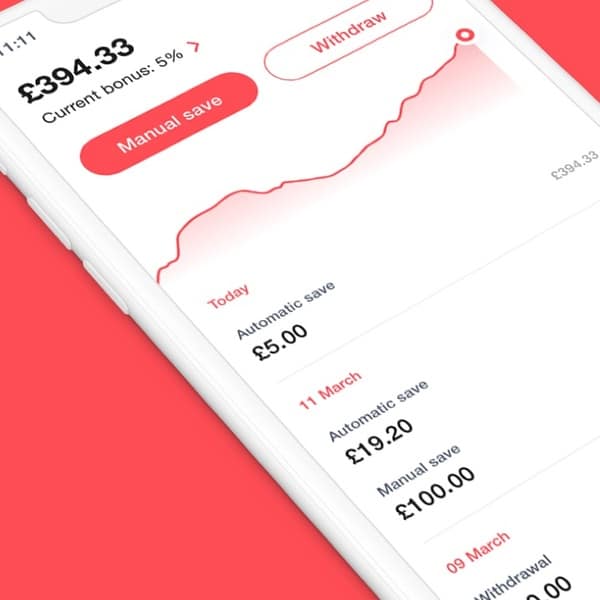

For savings, Chip users can withdraw money and manage their spending habits. The brand prides itself in being FSCS-covered, which works to protect your personal information. Offered with competitive rates, Chip is a hard option to pass up if you value convenience.

The company currently offers four types of accounts to choose from: Instant Access, Prize Savings, Easy Access, and 90-Day Notice.

How Does Chip Work?

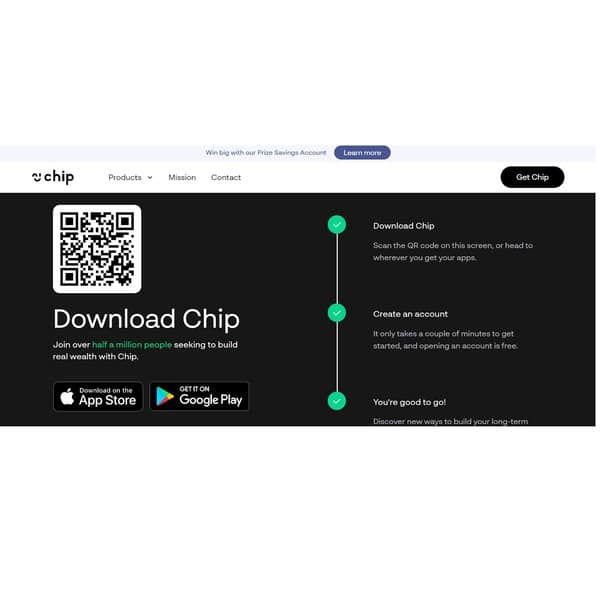

Made some space on your phone? If so, I’ll provide a quick rundown on how to download the app in this Chip review. You can either scan the QR code on their website or search Chip Financial on Google Play or the App Store to get started.

After downloading the app, you’ll need to create a profile in order to start using their services. This includes any personal information, such as your email address and your name. Once this step is complete, it’s time to pick a plan. Customers can either opt for the basic membership—which is free to use—or sign up for one of their paid subscriptions.

Which Banks Does Chip Work With?

I can happily report in this Chip review that they support several banks. This includes financial institutions such as Starling, TSB, Nationwide, Halifax, and more. Customers should know that this only covers companies operating within the United Kingdom.

How Much Does Chip cost?

This wouldn’t be a complete Chip review without going over their memberships. The basic plan is completely free to use. That said, it only offers a limited amount of benefits.

If you want access to all of their features and services, the ChipX plan only costs $5 per month. This subscription offers several pros, such as admittance to additional funds, 0% platform fees, and recurring saves.

Who Is Chip For?

Simply put, Chip is catered to financial geeks. It’s considered a great mobile app for those who constantly check their bank accounts and are obsessed with investing funds. Affordable to use, Chip manages to implement a level of convenience and organization into the messy world of financing.

Chip Reviews: What Do Customers Think?

Any brand that’s involved in money is bound to entail some skepticism. This especially bodes true for new brands, as they have yet to build an esteemed reputation compared to established companies. So far, Chip seems to be on the right path, as I found hundreds of positive critiques online. I’ll be sure to share my findings down below for this Chip review.

- The App Store: 13.2k reviews with 4.5/5 stars

- Trustpilot: 1,060 reviews with 3.9/5 stars

- Smart Money People: 7,101 reviews with 4.9/5 stars

Considered a convenient way to manage your assets, customers appear to be happy in using the Chip app. Users are quick to commend specific features, such as level selection on auto-saving. Others praised the quality of the brand’s customer service, as they were reportedly helpful in addressing online complaints.

“I can change the level of my auto saving from low to high (5 levels) depending on how broke I am! I can pause saving if I need to, or withdraw any amount (instant access). I can set goals and work towards them which I love. My work is seasonal and I’ve managed to save enough to get me through the winter,” one customer wrote on the App Store.

“I have banked with Chip for approximately a year and recently had cause to contact them over a small issue. I have found them to be very friendly, courteous and knowledgeable. The wording of the e-mails was easy to understand and concise,” one user wrote on Trustpilot.

Some users were impressed with how beginner-friendly the Chip app was. “I love Chip, this app allows me to save without thinking about it, allows me to increase or decrease savings. You can set up Payday savings, earn interest on your savings & even split your savings into different goals. Without this app I’d have no savings,” one reviewer detailed on Smart Money People.

The Chip reviews speak for themselves. Easy to use and excellent for tracking finances, it’s definitely worth considering if you’re a number cruncher. That said, I did come across a few online complaints worth including in this Chip review. I’ll be sure to discuss this in detail in the following segment.

Is Chip Legit?

There are a few comments on the App Store and Trustpilot concerning poor customer service and app glitches. Fortunately, the amount of negative reviews is quite small compared to positive ones online.

Is Chip Worth It?

There’s no risk associated with Chip. Stress-free, organized, and beginner-free, this mobile app can help track your savings and investments while on the go. Plus, it’s relatively affordable, so you don’t have to worry about not using the program on your off days.

The only major complaint I have in this Chip review is its availability. Fingers crossed that they’ll open up their services outside of the United Kingdom.

Chip Promotions & Discounts

Let’s conclude this Chip review with some highlights, shall we? For instance, the brand is currently giving away a £10,000 deposit reward if you have at least £100 in your Prize Savings Account.

How To Get Started on Chip

To sign up for an account, simply head over to getchip.uk to scan the QR code provided on their website. You can also visit the App Store and Google Play to download the program.

FAQ

Who owns Chip?

Chip Financial is currently owned by founders Simon Rabin and Alex Latham.

What is Chip’s Privacy Policy?

To complete this Chip review, I thought it best to go over the brand’s privacy policy. According to their website, “Chip needs to collect information from our users in order to provide the best possible service and to fulfil our legal and regulatory obligations.”

What is Chip’s Cancellation Policy?

Chip implements an autosave feature within its program. It is generated between 9:00 am and charged at 3:00 pm. If you want to cancel any transfers or withdrawals, you must do so within this allotted window.

How to Contact Chip

For inquiries unrelated to my Chip review, you can contact the brand through email at [email protected] or by using the chat function on their website.

Check out some related reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review