Borrowell Review

Table of Contents

About Borrowell

A fear of finances sits in the chests of people of all ages with money and credit being one of the biggest battles to conquer. Reduce the anxiety and stress and learn to breathe easy with the assistance and education of Borrowell.

Providing users with a variety of credit-oriented services, this business is all about growth, prosperity, and success for their customers, wanting the world to wake up and learn just how they can make money work for them.

Partnered with dozens of financial institutions and brokers, this business has managed numerous connections to favor their clients’ growth.

Despite only having nearly 3,500 followers on Instagram, their feature articles in CBC, The Globe and Mail, Financial Post, Toronto Star, and more speak to the popularity of this name.

In my Borrowell review, I’ll break down the business into their core pieces to help readers understand exactly what they can do for you. From products and services to reputation and more, I’m here to determine whether this one is worth the time.

Overview of Borrowell

Founded in 2014, Borrowell came to Canada with a vision of financial management and understanding. Created by Andrew Graham and Eva Wong, this Toronto company wants success for all, breaking down money management into reasonable pieces.

Understanding that finances tend to be one of the more mysterious areas in life, Borrowell came to light with the goal of educating the public on how to manage money, credit, and loans.

Using digital tools to personalize the process, this business is all about comparing and matching options to guide the user through each possibility to see why certain selections are more suitable than others.

Providing all users with a free credit score and monitoring, Borrowell takes advantage of their partnerships across the country.

From working alongside Equifax in scoring and a variety of banks and brokers for cards and loans, Borrowell understands what each partner brings to their business and how to use them for the customer’s best interests.

Customers have access to guidance at all times through the AI Credit Coach, Molly. Accessing personal information to provide tips on improving credit scores and savings, all recommendations and tricks provided revolve around personal experience with spending.

Trusted by millions of Canadians, this brand has a lot going for them in reputation alone. Their services stand strong in providing customers with a safe space to grow and learn – and those are only the start of the benefits this business offers.

Check out some of these other top highlights I’ve compiled for this Borrowell review:

Highlights

- Wide range of financial services including monitoring

- Free credit score

- Personalized matching program

- Mentors and guides for mortgages and loans

- Partnered with a myriad of financial institutions and brokers

- Thousands of positive ratings online

- AI-powered credit coach

Borrowell Review

I can’t really present a Borrowell review without taking a glance at the products themselves. Taking a quick look at the best benefits and services offered by this brand, we wanted to really highlight all that this company can do for their users.

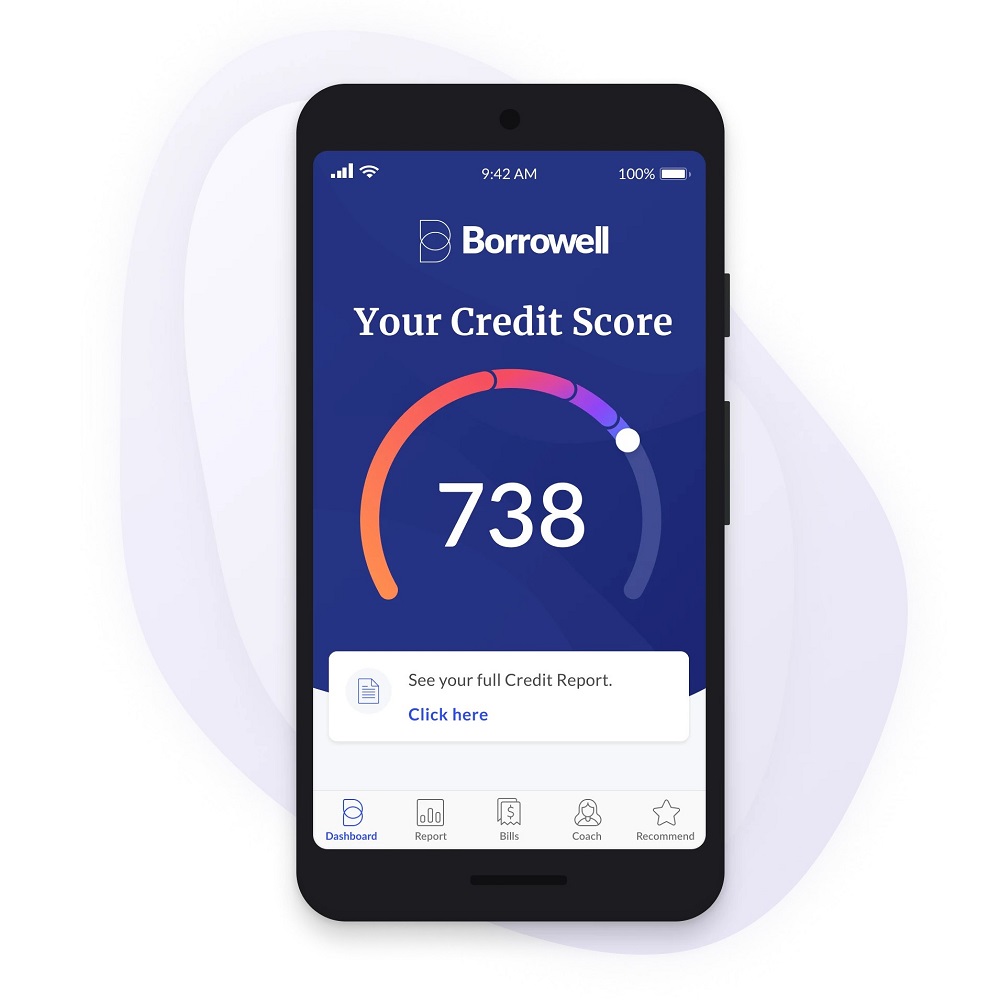

Borrowell Free Credit Score Review

Remove the plaguing stress of credit with the easy assistance of the Borrowell Free Credit Score.

We all know the fear of credit scores. Taught that checking scores actually lowers them leads to a world of anxiety building up around a ball of the unknown.

Many larger purchases and life choices depend on that score, it leaves the popular struggling, just waiting to hear back on rejection from having too low a score.

Luckily, Borrowell offers a solution to the chaos. Working alongside Equifax to provide free and quick credit scores, this app also allows for constant surveillance.

Clients can receive weekly updates on their score and its changes over time, monitoring the range without affecting the overall number to leave things ready for any big incoming purchase or card upgrade.

As stated in the name, this service is available for no cost. Easy to take advantage of in no time at all.

Borrowell Free Bill Tracking Review

The madness of life can get to us in no time. Between shuffling work, school, family, friends, and other commitments, it’s easy to forget about the important things. That’s why the Borrowell Free Bill Tracking exists.

Customers can use this function to track up to 15 bills on their phones. Monitoring companies, costs, and dates, this service allows clients a simple reminder to get those bills paid on time.

Nothing overdue or turned off due to a forgetful memory – just an easy way to stay on top of your finances.

Connected to any bank app, this function works alongside past payments to predict the future. Forecasting future bills and costs, it notes payment patterns and highlights upcoming payments for the user.

From the predicted costs, this app can then estimate bank balance after payments to show customers what they can expect available to them in the future.

All of this at the touch of a button for no cost – sounds like a deal to us.

Borrowell Credit Cards Review

Looking to branch out to a new credit card? The selection process can be a difficult one without the help of Borrowell Credit Cards.

Let’s admit it – there’s a lot of variety out there for credit cards now. It’s no longer just about the money, but now it’s also about the perks.

What can each credit card do for you? Borrowell wants the best for their users and that means helping them find the right card with all the best features.

Partnered with BMO, Scotiabank, CapitalOne, and more, this service takes an in-depth look into users’ credit histories to isolate spending and payment habits.

From there, they offer profiles and recommendations for over 60 different credit cards, highlighting ones that will assist the lives and spending of clients. Compare the perks of each card through the Borrowell profiles and then apply to the one that fits.

Less stress, more money – all for free.

Borrowell Personal Loans Review

Life is expensive. There’s no getting around it. Sometimes we all need a helping hand and that’s why we turn to Borrowell Personal Loans to help get the right foot forward.

I’ll put it out there – Borrowell doesn’t provide the loan itself. If anything, this brand provides a matching service.

Through the free credit check for all users, Borrowell can notify clients of their chances of loan approval to simplify and speed up the process. Reducing application and notification time, this business reveals the odds in minutes.

Providing access to over 50 financial partners across the country, Borrowell searches through all available matches to offer customers a listing of loans that may fit the user, their history, and their needs.

Compare providers and interest rates, check tailored loan options, and search through loan types to narrow down the offers.

Despite what society may suggest, loans are within reach, especially with the assistance of this free service.

Borrowell Mortgages Review

Moving up in life sometimes does mean moving out…and into a new home. Homeownership may not be for everyone, but it should be available to anyone with the help of Borrowell Mortgages.

Loans and mortgages often sit as one of the most terrifying experiences of homeownership. Grappled by the fear of rejection and high interest rates, it’s easy to be overwhelmed in no time, drowning in numbers and payments.

Once the credit score is in place with this business, they’re able to make more personalized recommendations on finances – that includes mortgages.

By answering a few questions, this app builds an individual profile and matches the best rates and results from over 50 lenders.

Work through the app alone or take time to discuss options with a mortgage master available from Borrowell who will guide users through options and steps to find manageable solutions.

Take advantage of this service for no additional cost.

Borrowell Banking Review

I understand that those reading this Borrowell review likely have bank accounts firmly in place already – most people do in this day and age. However, that doesn’t always mean the best option is in use. Make full use of money with the Banking function of this app.

Borrowell Banking uses the information customers provide to take a look at spending and saving history. Not all banks are born equal – some offer distinct benefits to different groups of people.

Whether a saving student or a secure senior, there should be an advantage to the bank you choose. Working with a number of banking partners, Borrowell makes it easy to compare and contrast the pros and cons of each financial institution, making it clear cut who offers the most for each individual.

Taking note of limited-time offers and promotions, Borrowell doubles up in highlighting the best features of each business. We’re trusting them with our money – we should get more than account fees in recognition.

From TFSAs to checking account limits, there are a variety of elements at play when choosing a bank to do business with. That’s why Borrowell lays it all out in the open for an honest selection of the best and brightest.

Start the search for no cost.

Borrowell Insurance Review

One of the last, but ever-important, financial elements to consider in this Borrowell review is Insurance.

From lives to cars to homes and more, there’s a lot in this life to insure in preparation for the worst. High ratings can often slow the process with many paying the bare minimum to have at least some form of protection, but how do we know that’s the best choice?

Borrowell Insurance works with a number of providers to find the best fit for each customer. Whether home, auto, or anything else, this company compares brokers to find a financial match for each user.

Assisted through monitoring their credit score, individuals can access lower interest rates and premiums for better prices and products.

Start prepping for the worst in life with this brand for free.

Who Is Borrowell For?

I’ll acknowledge it – financial planning and monitoring don’t appeal to everyone. There’s a confusion of numbers, services, and more, all of which can easily overwhelm individuals who are new to the world of finances. I know this one won’t be for everyone.

However, I would say that those who are looking to learn, understand, or manage their finances will find Borrowell to be a dream. Not only offering free credit scores and tracking, but the beauty of this brand also comes in their matching programs.

Finding mortgages, loans, banks, credit cards, and more that match spending and saving habits ease the strain of the world of money to make things quick and easy to understand.

Borrowell Reviews: What Do Customers Think?

I want to be honest in this Borrowell review and that means working alongside those with firsthand experience of the brand and their services. I decided to turn to the world of online ratings to provide a better picture of this company’s users and reputation.

According to the Borrowell review section of their own site, this brand provides “Excellent service” with customers ready to “recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purposes.”

The limited posts on this section speak to a unified perspective of wholly satisfied customers. I wasn’t crazy about the lack of free ratings here, so I quickly searched elsewhere to find less biased and controlled visions of the business.

Our first stop was Google Reviews where this company sits with 4.4/5 stars based on over 625 ratings.

I’ll say that just a quick glance over these ratings showcases customers’ contentment with the app as “Borrowell keeps you updated and offers many recommendations & tips no matter the situation you’re in.”

Offering a myriad of services to all customers for no cost, this business is “really helpful for those who want to celebrate the small increases in their credit score as they build or rebuild their credit.”

The fear of the unknown often compounds with credit scores as the knowledge of them lowers with each glimpse. They’re a bit like Pandora’s Jar – I want to open things up to really take a look, but doing so unleashes a world of chaos.

That’s why the simplicity of Borrowell’s monitoring system allows customers to breathe easy knowing that the numbers are being tracked.

Easy to use, this site finds most business through its app with the Google Play Store placement earning them 4.6/5 stars based on over 9,745 ratings and the Apple Store earning 4.8/5 stars based on over 17.7k ratings.

With over 25k downloads to their name, this business catered to the world of technology by making everything accessible through a single app.

By providing a free credit check and constant monitoring, this company eases the minds of any further purchases or loans.

One Borrowell review noted that they “installed Borrowell a couple of years ago. I absolutely love the app, it updates weekly or you can look at it anytime you want to see where your credit score is at. it also lets you know what your chances are of getting other cards, mortgage, car, etc..”

Providing users with a better idea of their loan, mortgage, and insurance options, this app makes the odds a lot less scary.

This app offers customers “so much comfort in their suggested credit card options” by really breaking down spending and saving habits in a way that customers can visualize and understand.

I do have to note that some customers have complained of witnessing their credit score going down each week, however, Borrowell claims to have no responsibility regarding the score as it comes from partnering brand Equifax.

For the most part, this app seems to make things easy to monitor and track in all financial elements.

Is Borrowell Legit?

From what I’ve read for this Borrowell review, it seems like this business is completely legitimate. There are some complaints scattered across the web regarding services, however, the people have spoken.

Every brand will have some customer complaints – the important part to note is the thousands of happy and satisfied customers who found success through this monitoring and managing.

Is Borrowell Worth It?

I’m going to go ahead and give this brand two thumbs up. I understand that not everyone wants such heavy monitoring of their finances and that’s fine too!

However, for those who want to keep track of purchases, and credit scores, and find the best financial institutions to suit their needs, Borrowell offers a great, simple solution.

From credit cards and scores to matching loans and mortgages, there’s a lot to discover with this business.

I’d happily give the brand a green light and I hope this app will continue to help people understand and track their spending for a stronger financial future.

Borrowell Promotions & Discounts

At the time of writing this Borrowell review, there are no ongoing promotions or discounts.

Where to Buy Borrowell

We’d recommend starting from home base by registering through borrowell.com, but this brand is also available through Google Play and the Apple Store.

FAQ

Who owns Borrowell?

Borrowell is owned and operated by the founder Andrew Graham.

What is Borrowell’s Privacy Policy?

We understand that privacy is always a concern. This brand collects information from the following sources:

- the user via third parties

- use of services

- directly from the client themselves

This information does not get shared with third parties for any alternative purposes without the consent of the individual.

What is Borrowell’s Refund Policy?

Should something not work out, Borrowell allows cancellation at any time in the process. All customers have to do is:

- Unsubscribe within the app

- Confirm cancelation

- Uninstall the app

All cancellations will be in effect at the end of the subscription period. No refunds will be provided for any purchases made in the app.

How to Contact Borrowell

I hope you enjoyed this Borrowell review! The brand allows and encourages communication—reach out through the online contact form and someone will be in touch as soon as possible.

Check out similar brands you might like:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review