Starling Bank Review

Table of Contents

About Starling Bank

If you’re well familiar with established institutions like Wells Fargo and JPMorgan, there’s a good chance that Starling Bank should trigger some head scratches. They’re considered a niche alternative on Wall Street, but they’re quickly transforming into a viable option, given the number of positive reviews online.

Modernized in offered solutions, Starling Bank utilizes contemporary methods through its digital platform. Their services are considered a breath of fresh air if you’re tired of the stiff regulations and requirements that most financial institutions call for. Boasting over 38.9k followers, Starling Bank is definitely a favorite amongst the emerging generation.

Looking to switch banks? If so, perhaps this institution can be the change you need. Keep reading, as in this Starling Bank review, I’ll provide a comprehensive look at the brand, its services, customer ratings, promotions, and more to help you decide if they’re worth checking out.

Overview of Starling Bank

It’s no secret that Wall Street prefers traditional solutions. The financial industry is often seen as archaic, unwilling to change, and stationary in innovation. Unfortunately, that mindset has rubbed off on some of its customers. This problematic trend didn’t go totally unnoticed, as founder Anne Boden believed that there was a better way to bank in the twentieth century.

In 2014, Boden launched Starling Bank in the heart of London, England. Considered a modernized alternative to banking, the brand utilizes technology and digital innovation to pioneer a better form of convenience and accessibility for its customers.

Before I kickstart this Starling Bank review, let’s go over some initial highlights.

Highlights

- Offers several accounts tailored to different demographics and needs

- Provides a mobile app for customers to download

- Has 24/7 customer support

- Application requires a small amount of time

- Positive reviews

Banking shouldn’t be so stress-inducing. That said, it doesn’t help that the financial industry loves to throw us into a state of confusion by hurling numbers, deadlines, and carved-in-stone requirements to ensure a ‘seamless’ experience. If you want to cut yourself some slack, Starling is here to help. Their services are tailored to meet your every need, minus any hair-pulling.

If you’re prepping for a bank breakup, there’s a good chance that Starling can act as the perfect bf (bank friend). I’ll provide a brief rundown of their plans, accounts, and features next in this Starling Bank review.

Starling Bank Account Review

Most financial institutions fail to realize that the ‘ideal’ customer isn’t just one demographic. Banking involves multiple walks of life, ranging from the debt-heavy university student to the summer job pre-teen. Thankfully, Starling recognizes that financial responsibility doesn’t start at age 30.

Currently, they offer four different accounts for clients to choose from: Personal, Joint, Euro, Starling Kite, and Teen. All five plans differ in terms of available features, bonuses, and fees. For instance, personal accounts provide instant notifications, categorized spending insights, zero overseas payments, international transfers, and more.

The Starling Kite plan, on the other hand, is catered towards 6 to 16-year-olds. Priced at £2 per month, parents are considered the primary account holder, which is covered by FSCS protection. Considered a great way to teach kids about the importance of budgeting, it’s definitely a more modernized solution compared to monthly cash allowances.

For a full list of details concerning Starling bank accounts, I highly recommend visiting their website for more information.

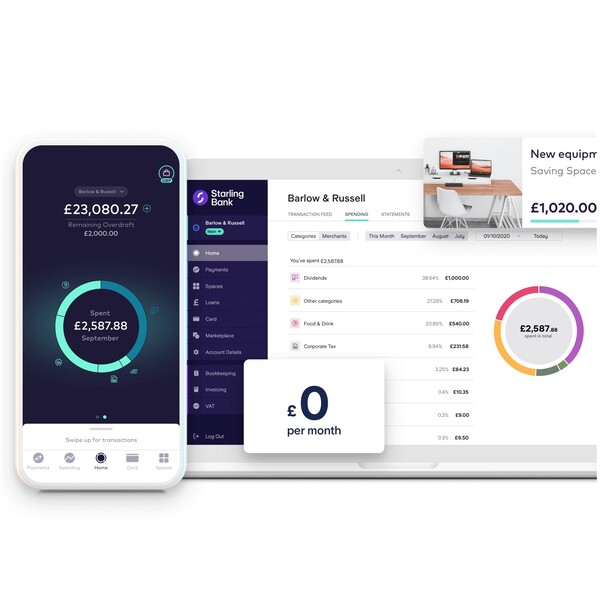

Starling Business Account Review

Through careful planning and patience, a small idea can quickly turn into an established business. If you’re knee-deep in orders, procurement duties, and packaging, chances are that you’re in desperate need of a business account.

Case in point, Starling offers services for brands. Free to use, this FSCS-protected plan involves automated business spending categorization, free ATM withdrawals, zero overseas fees, and other noteworthy pros.

If you want to upgrade your plan, Starling offers three paid alternatives to choose from. This includes the Business Toolkit, the Euro Business Account, and the US Dollar Business Account. Dissimilar in provided features, I’ll be sure to discuss their monthly fees next up in this Starling Bank review.

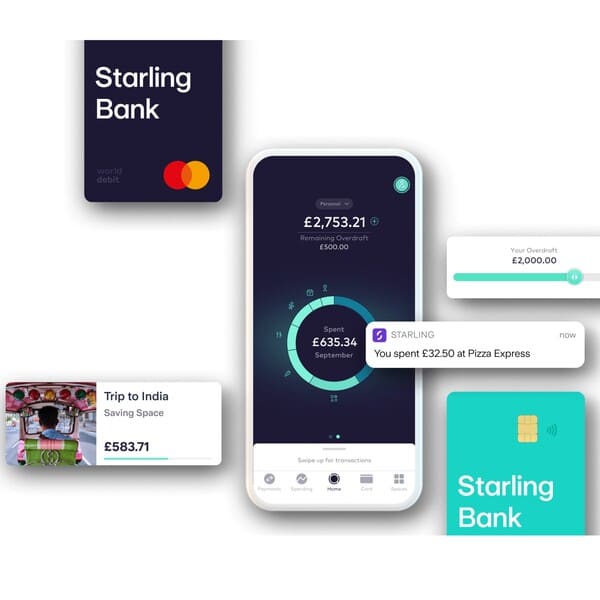

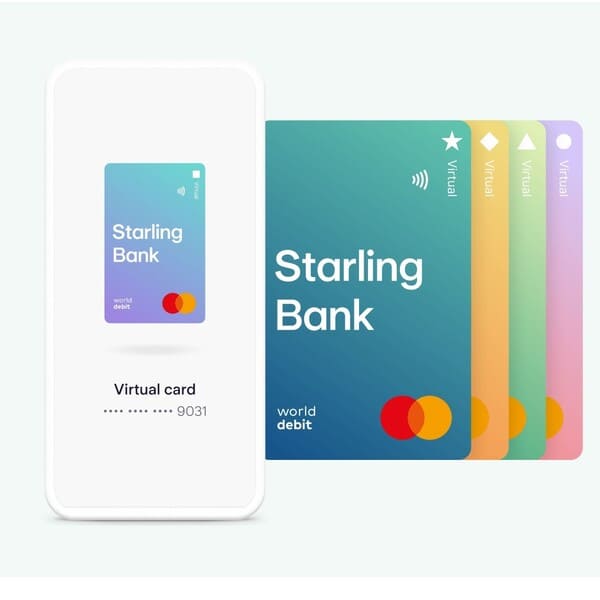

Starling Bank Card

Aesthetics are usually the last thing that you’d prioritize when it comes to banking, but can I just briefly talk about the Starling card? Vibrant in turquoise blue, it definitely packs some glamor in every tap, insert, and swipe.

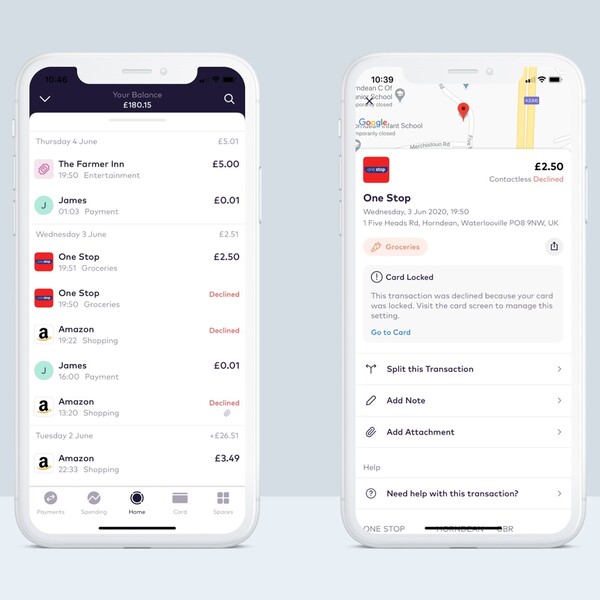

Aside from design, using your Starling bank card comes with a long list of pros. Clients can look forward to zero monthly fees, automatic locking security, and instant transfers.

It’s worth mentioning that Starling partners with local post offices for deposits and withdrawals. In terms of acceptance, any establishment that offers Mastercard as a viable form of payment will also take Starling as well.

Starling Bank App Review

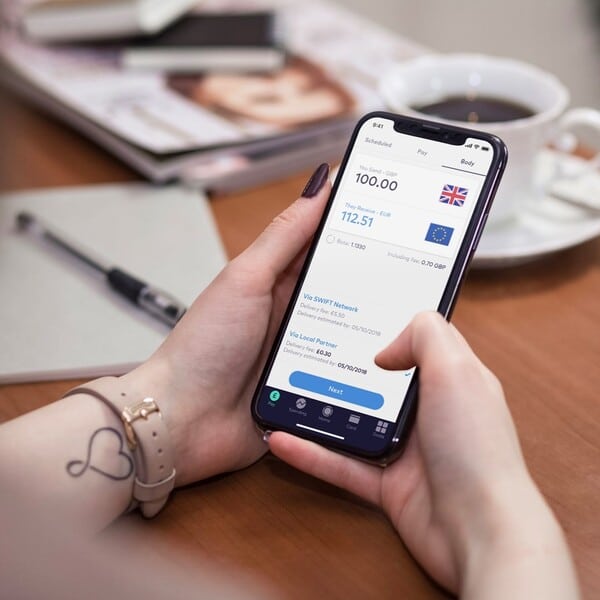

We currently live in the digital age. With that in mind, it seems outdated to settle for a financial institution that doesn’t offer mobile banking. If the current situation calls for a quick overview of your savings, Starling provides a handy app for customers to use.

By downloading the application, clients can initiate transfers, make bill payments, and manage their accounts. They can also look forward to 24/7 customer service in case they require further assistance.

Budgeting has never been this easy, as users can easily keep track of their spendings and earnings. The Starling Bank bank account app is completely free to download, as it is currently available on Google Play and the App Store.

How Does Starling Bank Work?

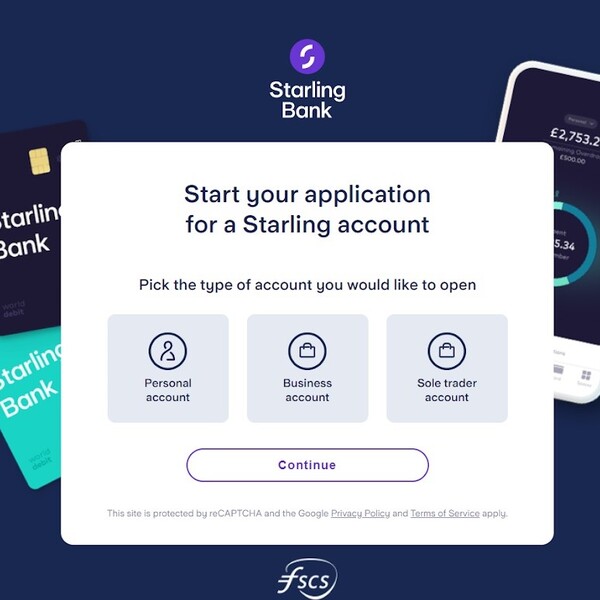

To sign up for an account, simply click the ‘get started’ button on the top right-hand corner of starlingbank.com.

This will automatically redirect you to their application page, where you must select what type of account you’re looking to open. For the purposes of this Starling Bank review, I’ll go over the step-by-step procedure for personal accounts.

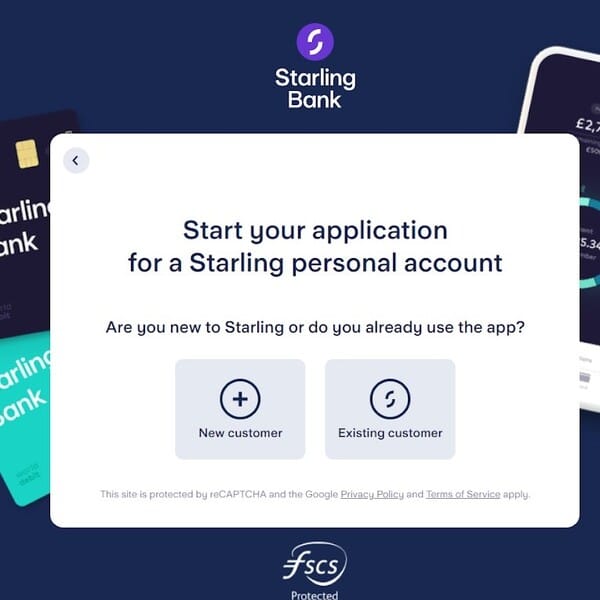

Afterward, you can either choose to proceed as a new customer or an existing user. For now, I’ll continue with the latter option.

Starling will require some personal information for new users. This includes your name and phone number. It’s worth reiterating that Starling Bank is only available to UK-based customers, as they won’t accept any international numbers. For those who’ve downloaded the app, the sign-up process is relatively the same.

Starling Bank Fees

So, how much does Starling Bank charge for setting up an account? It really depends on what plan you opt for. To keep things short and sweet, I’ll provide a brief summary of all of their available programs:

- Personal and joint accounts: no fee

- Teen account: no fee

- Starling Kite: £2 per month

- Euro personal accounts: no fee

Business accounts

- The Business Toolkit: £7 per month, including VAT

- The Euro Business Account: £2 per month

- The US Dollar Business Account: £5 per month

Who Is Starling Bank For?

Starling Bank is an excellent alternative for those who value convenience and accessibility when it comes to financing.

A company that offers multiple different accounts to choose from (more specifically, Starling Kite and the Teen plan) is very telling, as it shows the brand’s inclusivity and willingness to provide services for other demographics. Plus, there are no tacked-on fees for many of their available accounts, which is definitely something to consider if you’re tight on money.

Starling Bank Reviews: What Do Customers Think?

Leaving Wells Fargo for Starling Bank should trigger some anxiety. Is it worth trying out a new company for a financial institution that’s well-established? According to hundreds of happy customers, it’s definitely worth the switchover. There’s an overwhelmingly positive response attributed to this brand.

To kick this section of this Starling Bank review off, let’s go over some initial ratings:

- Trustpilot: 32.6k reviews with 4.3/5 stars

- Facebook: 718 reviews with 2.4/5 stars

- Smart Money People: 25.6k reviews with 5/5 stars

Easy to use and professional in customer service, Starling appears to be deserving of its 5-star status. A majority of its users stated that it was seamless transferring funds and depositing money. The sign-up process was also relatively simple.

“I opened a Starling account to reduce charges whilst overseas. The opening of the account couldn’t have been easier and the use of the account whilst overseas is also first class. The account also lets you deposit cheques up to a certain amount without the need to visit a bank,” one Trustpilot user wrote.

“The banks services are very easy to use and provide me, as a sole trader, with everything I require to operate successfully. The log on process is quick but gives me confidence that the banks security systems are very robust,” one reviewer shared on Trustpilot.

Some customers were quick to praise specific programs and plans. For example, the Starling Kite account was reportedly useful in teaching kids the value of budgeting.

“Easy to use child’s space. Child loves the card and app, and the sheer independence of it all. Really valued the explanation about data management and privacy. Well considered tools,” one customer wrote on Smart Money People.

Based on the vast amount of positive Starling Bank reviews, there seems to be little risk involved in switching providers.

Is Starling Bank Worth It?

It’s normal to be a little apprehensive when it comes to switching banks, but Starling offers a spick-and-span repertoire. After a quick rundown of its website, it’s apparent that this brand is committed to giving its users a hassle-free banking experience.

If you’re in need of a more convenient and accessible way to manage your finances, I can confidently wrap up this Starling Bank review by recommending this company.

Starling Bank Promotions & Discounts

As of lately, I found no promotions or discounts to include in this Starling Bank review.

How To Get Started On Starling Bank

Looking to start a Starling Bank business account? If so, you can head over to starlingbank.com to set up an account. You can also download their mobile app on the App Store and Google Play.

FAQ

Who owns Starling Bank?

Starling Bank is owned by founder Anne Boden.

What is Starling Bank’s Privacy Policy?

To conclude this Starling Bank review, I thought it best to go over the brand’s privacy policy.

According to their website, “we use your information in order to carry out our operation as a bank and provide banking and financial products and services, to make sure we do not breach any contracts, to keep Starling and you secure, to give people information about products and services and to comply with the law.”

How is Starling Bank’s Customer Service?

Across Trustpilot and Smart Money People, most reviewers agree that Starling provides excellent customer service.

How to Contact Starling Bank

For inquiries unrelated to this Starling Bank review, you can contact the brand through:

- Email: [email protected]

- Mailing address:

5th Floor, London Fruit and Wool Exchange,

1 Duval Square, London,

E1 6PW

Next, check out some similar reviews you might find useful:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review